One year ago today, we wrote a post about the sudden halt in pay increases and the sudden rise of furloughs facing Maryland county employees in FY 2010. In the present fiscal year, those circumstances are arguably worse.

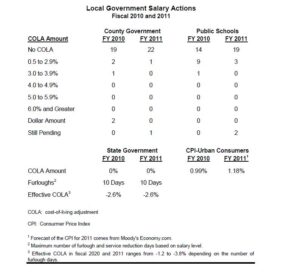

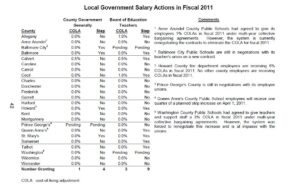

According to this month’s state Spending Affordability Briefing and our research from last year, the number of counties granting cost of living adjustments (COLAs) to non-school employees was 20 in FY 2009, 5 in FY 2010 and 1 this year, with another county decision still pending. The only COLA currently being granted is by Calvert County, which is offering a 0.5% raise. Non-school employees received step increases from 20 counties in FY 2009, 8 counties in FY 2010 and 4 counties in FY 2011.

The number of counties granting COLAs to school employees was 22 in FY 2009, 10 in FY 2010 and 3 this year, with two more county decisions pending. The three counties granting school employees COLAs are Cecil (1.8%), Allegany (1.0%) and Calvert (0.5%). School employees received step increases from 21 counties in FY 2009, 14 counties in FY 2010 and 9 counties in FY 2011.

State employees are getting no COLAs and their furloughs effectively cut their pay by 1.2-3.8%.

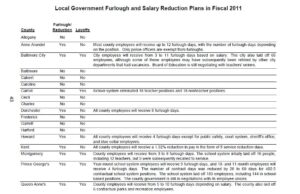

Wage increases are out and furloughs are in. In FY 2009, we know of just one county that furloughed its employees: Prince George’s. In FY 2010, 10 counties had furloughs and 12 had layoffs. In FY 2011, 9 counties had furloughs and 6 had layoffs, with another county considering layoffs. Anne Arundel leads the state in maximum furlough days (12) while Prince George’s leads in layoffs (183 workers in the school system with more to come in the rest of the government).

How will FY 2012 look? Consider the fact that the Governor, the Senate President and the Speaker of the House have said they will close the state’s $1.6 billion general fund deficit without tax increases. Next, consider that federal stimulus money is running out and that aid to local governments constitutes over 40% of state general fund spending. State aid accounts for over a quarter of the counties’ revenues. Five counties (Anne Arundel, Montgomery, Prince George’s, Talbot, and Wicomico) have limitations on their ability to raise property taxes written into their charters. And the state could send a hefty chunk of teacher pension obligations down to the counties. All of these factors hitting at the same time will force the vast majority of the counties to scrutinize their labor costs.

So it’s not over yet.