By Adam Pagnucco.

Montgomery County’s Delegates have killed a local bill proposed by Delegate David Moon (D-20) that would have eliminated a special tax break for country clubs contained in state law. Seventeen Delegates voted to kill the bill while seven voted in its favor.

Under current state law, the State Department of Assessments and Taxation (SDAT) is permitted to enter into agreements with country clubs possessing golf courses that would set the assessed value of their land at $1,000 per acre. Moon’s bill would have phased out these agreements in Montgomery County subject to approval by voters. The fiscal note on the bill indicated that the state government would have received an extra $1 million a year in tax revenue and the county government would have received an extra $10 million a year once the agreements were ended. Despite the fact that the county just reported a $120 million shortfall, neither the County Executive nor the County Council supported the bill.

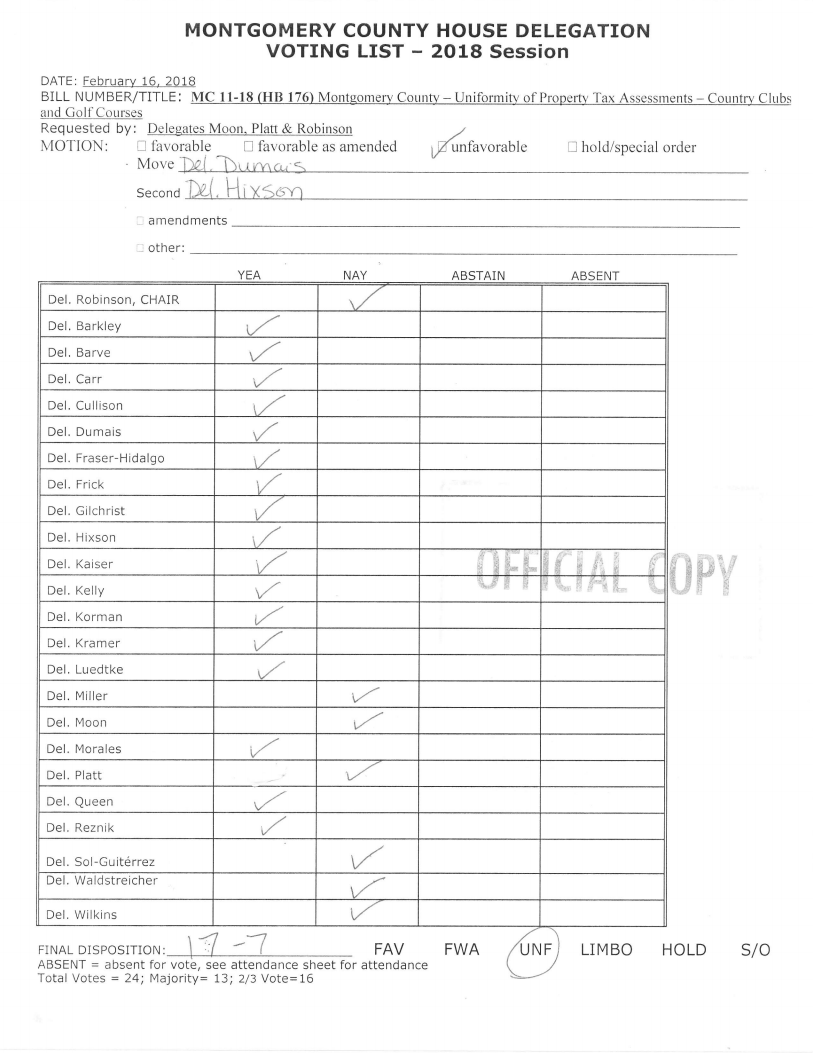

Since it was a local bill, the bill needed to clear Montgomery County’s House delegation before advancing to further votes by the county’s Senators and the full General Assembly. That vote took place this morning. After two unsuccessful attempts were made to amend the bill, Delegate Kathleen Dumais (D-15) made an unfavorable motion on it, which is tantamount to a no vote. Delegate Sheila Hixson (D-20) seconded the motion. Seventeen Delegates voted in favor of that motion and seven voted against. The seven Delegates who voted in support of Moon’s bill were Moon, Ana Sol Gutierrez (D-18), Aruna Miller (D-15), Andrew Platt (D-17), Jeff Waldstreicher (D-18), Shane Robinson (D-39) and Jheanelle Wilkins (D-20). We reprint the vote tally below. In reading it, remember that a “Yea” vote is a vote to kill the bill.