By Adam Pagnucco.

Back in July, I wrote a post about the county budget titled “Crash!” The post discussed the county’s revenue writedown of $522 million for Fiscal Years 20-22, with more shortfalls to come later. That post was soon followed by another titled “MoCo is Praying for a Federal Bailout,” which described the county’s cream-puff savings plan and desperate desire for more federal money (which so far has not arrived). Three months later, an eye-opening memo from county council staff contains more details of what is becoming one of the most serious budget crises in recent county history.

Consider the following.

CARES Act Funding

The county has received $183 million in federal aid under the Coronavirus Aid, Relief, and Economic Security (CARES) Act. Of that amount, $100.6 million has been used for special appropriations, $82.2 million has been allocated for county operations (some as placeholders) and $10 million has been allocated for municipal and outside agency reimbursements. If the placeholders (totaling $85.9 million) are included, the county will have overspent its CARES Act money by $9.4 million.

COVID Pay

I have previously written that County Executive Marc Elrich agreed to distribute COVID pay of up to $10 per hour at a cost of $3.2 million per pay period indefinitely. According to the council staff, the initial cost estimate was low. The cost is now roughly $4 million per pay period. Through 9/26/20, $49.2 million has been paid out, far in excess of any savings the council achieved through canceling collectively bargained raises. The total cost of the extra pay is projected to total $72 million through the end of the calendar year and approximately $100 million if paid for an entire year.

The executive branch expects to get FEMA reimbursements for most of this pay but that is not assured. Council staff wrote:

Previously, the Executive Branch had indicated that the pay differential would likely be eligible for FEMA reimbursement – meaning that the County might only be required to cover 25% of the total cost. However, the County has yet to apply for or receive FEMA reimbursement for these costs. In preparation for this briefing, the Executive Branch provided the following update on the status of FEMA reimbursement for the pay differential: “These remain pending. There were changes in the FEMA reimbursement guidelines on September 15 and other reimbursement rulings that created significant questions about some personnel cost eligibility. We met with FEMA representatives on Monday, October 5 to clarify some of these questions and are proceeding with data collection for reimbursement. We have added a large number of staff to this effort to address the increasing data collection burden.” Based on the updated guidance from FEMA, even in the best-case scenario, it is likely that the County will need to cover much more than 25% of the total cost of the pay differential.

In other words, who knows whether the feds will come through, leaving the county stuck with tens of millions of dollars in liabilities.

Council staff also compared the extra pay negotiated by Elrich to other jurisdictions. Maximum payouts per pay period are $140 in D.C., $200 in Baltimore City, Baltimore County and Frederick, $250 in Anne Arundel and $350 in Prince George’s. Howard County paid one-time bonuses of $600 to $1,500 and Fairfax County does not have COVID pay at all. MoCo’s maximum payout is $800 per pay period, by far the highest in the region.

Spending from Reserve

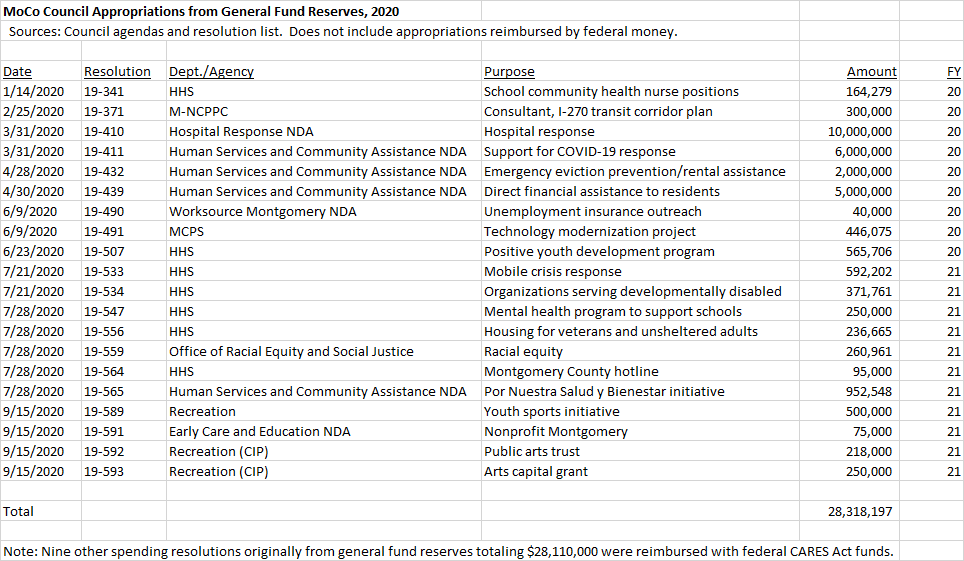

This fact is not contained in the council staff memo but is nonetheless relevant to the county’s budget issues. Since the start of the calendar year, the council has appropriated amounts totaling $28 million from general fund reserves. This does not include another $28 million taken from reserves that were reimbursed with federal CARES Act money.

These appropriations might be understandable if the county had undertaken a deliberate strategy of dipping into its reserves to fight the recession. But no such strategy has been announced. The county has not officially diverged from its policy of setting aside 10% of its revenues into reserves, a policy originally devised ten years ago. What happens if we have a bad winter and the county must dip into reserves some more to pay snow removal costs, a common practice of the past?

During the Great Recession, County Executive Ike Leggett and the council of that era adopted very tough measures combining brutal spending cuts, an energy tax hike and a 10% reserve policy to save the county from financial disaster. Both the county employee unions and the business community were outraged at these tactics but they worked. When Leggett retired, he bequeathed a large reserve, a 96% pension funding ratio and a gold-plated AAA bond rating to his successor.

So far, the actions taken during the current recession bear no resemblance to the prudence of Leggett and the council during the Great Recession. We have seen a nothing-burger savings plan full of lapses, projected overspending of federal money, a new unending liability of COVID pay with no assurance of federal reimbursement, a drawdown of reserves and even hints of another raid on retiree health care money, a practice that has drawn a baleful eye from Wall Street.

The county’s elected officials are united in opposing Question B, the tax cap charter amendment from Robin Ficker that they say would endanger the county’s AAA bond rating. They’re right to oppose Question B. But the actions described above, occurring in the context of a huge revenue writedown, might be at least as big a threat to the bond rating as anything Ficker’s proposal would do. The council must heed the warnings of its staff and get control of the budget.