By Adam Pagnucco.

Ten years ago, White Flint was regarded as the future crown jewel of MoCo. With a shiny new master plan, a tax district for infrastructure and an assortment of regulatory breaks, the area was supposed to create new high-end high-rises combining office, retail and residential uses that would generate billions of dollars in county revenues over coming decades. Everyone who lives here knows that vision is still largely unrealized. And now a new report by county planning staff lays out why.

First, let’s revisit what White Flint was envisioned to become in its 2010 master plan: a smart growth, walkable mecca around a transformed Rockville Pike which would be transit-heavy and pedestrian friendly. The plan required substantial infrastructure investment including streetscaping, a new road network and a bus rapid transit route. Unlike many county master plans, this one had a mechanism for financing infrastructure: a new special taxing district. Properties inside the taxing district would pay into a fund used to pay for the new infrastructure needed to bring the plan to life. In return, impact taxes were set to zero. The council set an infrastructure project list through a resolution and projects in the district were exempted from county traffic reviews. This combination of high density, infrastructure investment and regulatory exemptions was revolutionary for MoCo at the time and still has not been fully replicated. MoCo politicians love to throw around the word “bold” like peanut shells, but White Flint (now marketed as the Pike District) truly deserved the adjective.

So what happened?

In simple terms, the planning staff describes a negative, self-reinforcing feedback loop that has no identifiable end. The loop functions like this. Low levels of development led to low proceeds for the tax district. It was supposed to raise $45 million in its first 10 years but only generated $12-15 million. Low tax district revenues held back the construction of some of the transportation improvements and other infrastructure necessary to make the area more attractive to investment. Developers seeking financing for projects were hindered by the inadequate infrastructure along with the “prominence of underutilized properties.” One of those properties, the mammoth White Flint Mall site, was tied up by years of litigation. The lack of financing, along with construction costs and market conditions, has held back development. And of course the lack of development holds back tax district revenues necessary to pay for infrastructure, so the cycle continues.

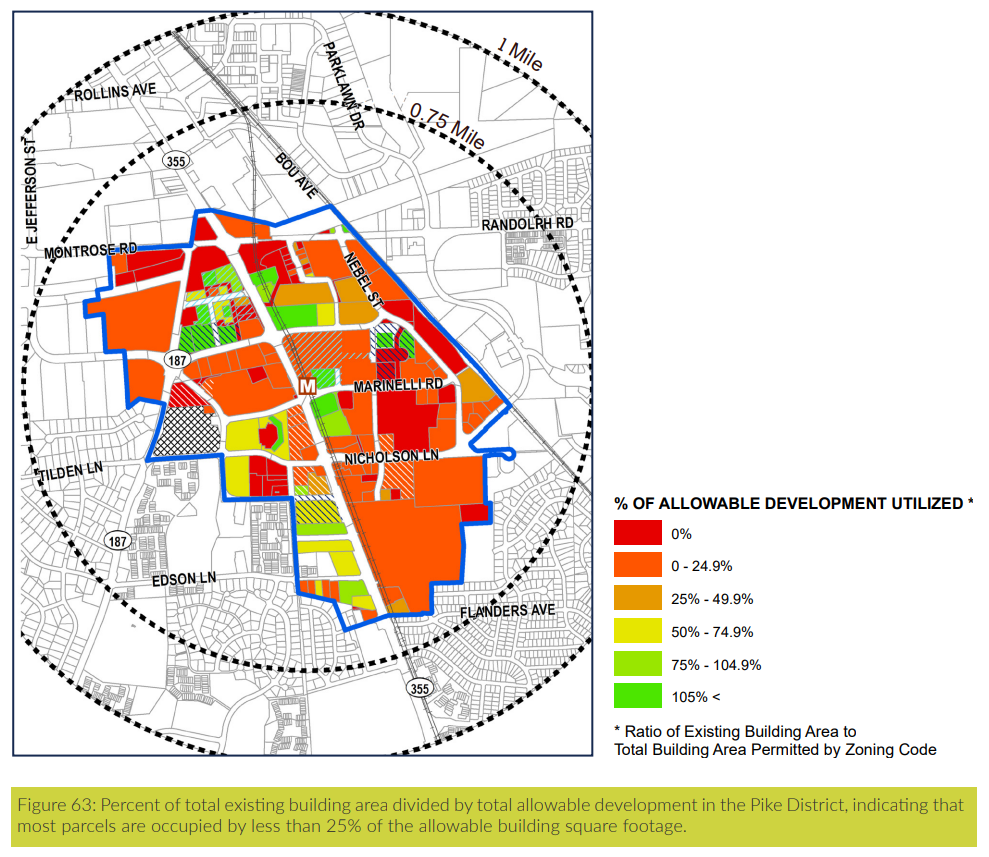

This map from the report shows the vast majority of land in White Flint is underutilized (areas marked in red and orange) relative to its zoning.

The most interesting part of the report summarizes comments from White Flint property owners, who comprise a who’s who list of prominent MoCo developers. First, let’s identify what they don’t complain about. They don’t complain about the plan itself; indeed, they think the area still has potential. They don’t complain about market demographics; they find the wealth and education levels in the area attractive. They don’t intend to sell their existing properties, which generate enough cash to cover operating costs and taxes, but they’re not in a hurry to redevelop them. And not a single one of them complained about taxes or requested a tax abatement.

Here are a few excerpts from the report on their take on White Flint’s problems.

*****

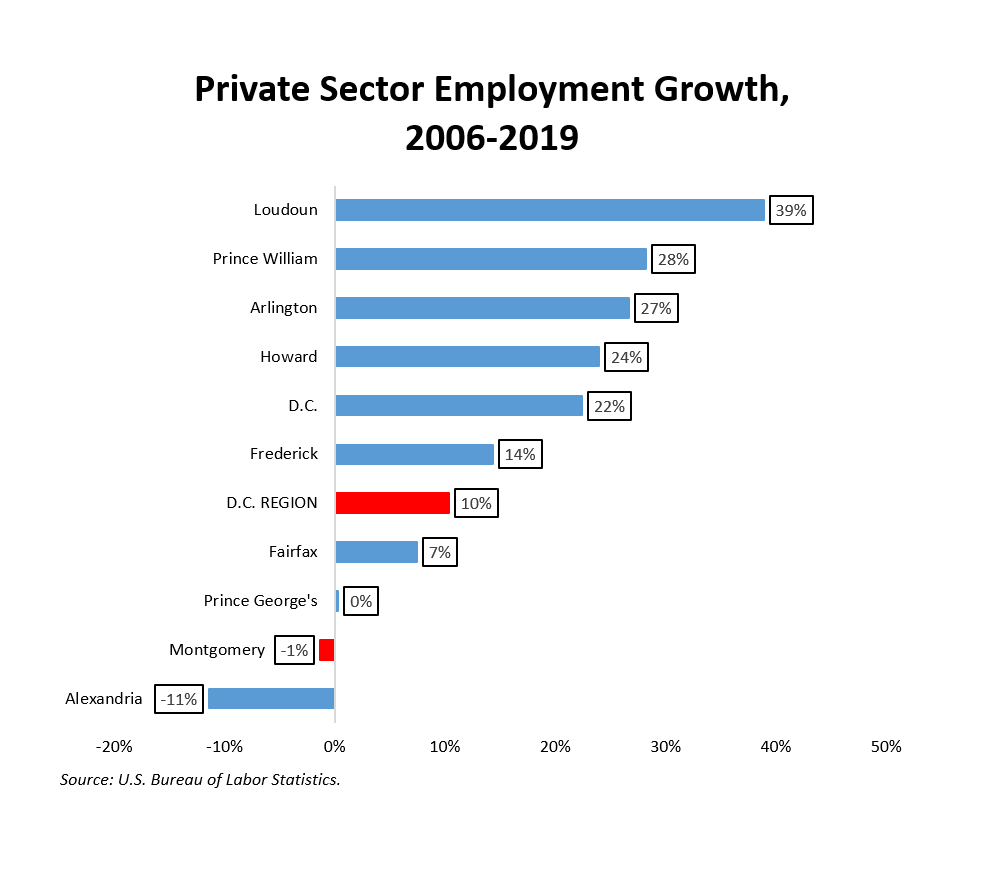

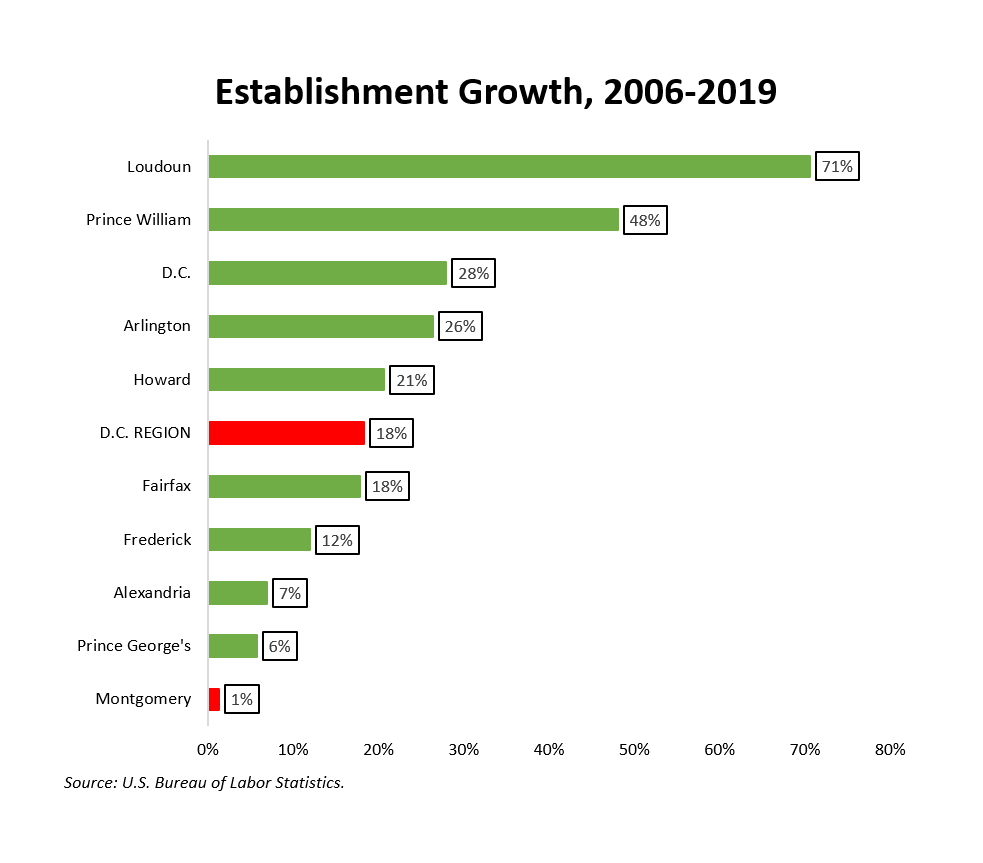

All developers interviewed cited Montgomery County’s limited job growth as a fundamental challenge to continued construction in the Pike District. Low levels of new jobs limit the number of new families seeking to occupy units in the county (household formation), decreasing demand for new development. In addition to limited employment growth, construction costs increased dramatically since 2010, office users occupied less space per employee, and retail demand declined with the rise of online shopping, all factors that continue to reduce demand for or limit the financial feasibility of new development.

Multiple developers noted without providing details that their firm managed to solve issues of high construction costs in other submarkets where there is a higher pace of job growth and household formation, which in turn supports rent growth.

Developers interviewed affirmed that the Pike District is accessible to fewer jobs within a reasonable commute than its peer non-downtown submarkets, and that this reduced access to job centers limits demand for additional multifamily units.

All developers interviewed cited Montgomery County’s limited job growth as a fundamental challenge to continued construction in the Pike District. Low levels of new jobs limit the number of new families seeking to occupy units in the county (household formation), decreasing demand for new development. Developers cited the reduced pace of household formation as a key contributor to stagnant rents, a major concern for the feasibility of future projects.

Several developers independently stated that the attraction of a major employer to the Pike District, such as a life science campus, would significantly increase the feasibility of new multifamily projects.

Developers are not currently willing to build speculative office projects in Montgomery County due to the lack of underlying job growth and the uncertainty about the future of the office sector. Several developers mentioned that they would still consider speculative office construction in Tysons and along the Silver Line corridor, highlighting the continued job growth in Northern Virginia and the contrast with suburban Maryland.

Several interviewees contrasted recent Northern Virginia economic development wins, such as the expansion of Microsoft in Reston, with news that a large distribution center project in Gaithersburg for Amazon is in jeopardy due to delays in the entitlement process. These interviewees stressed that while the number of jobs in these deals is modest, there is a constant drumbeat of positive economic news from Northern Virginia that is unmatched from suburban Maryland.

*****

Let’s boil this down to three words: jobs, Jobs, JOBS. Employment growth was the dominant theme for these developers, but they had a few things to say about business climate and regulations too.

*****

Interviewees related that development projects ultimately deliver equivalent profits as similar projects in neighboring jurisdictions, but that Montgomery County’s reputation as generally “a difficult place to do business” limits developer interest.

Developers agreed that the difficulty of the business environment issue is primarily about perception rather than the ultimate profitability. Interviewees cited as examples a range of policy issues such as a minor energy efficiency tax that Montgomery County leadership presented and implemented as a temporary measure but that never expired.

Multiple interviewees stated that in competitor counties they feel that the entitlement review process is oriented to enabling and facilitating a project, whereas in Montgomery County it feels like an oppositional relationship. Related to this, developers feel the County continually creates new policies and initiatives that adversely affect development, and which ultimately encourages them to focus on assets elsewhere in the region.

*****

The county council and the planning staff are focused on tax abatements as a way to stimulate development, especially housing. But developers in White Flint weren’t complaining about taxes. In fact, tax revenues are NECESSARY to finance infrastructure required to make development happen and function well. It is the absence of tax revenues that resulted in under-financing of infrastructure in White Flint, a key part of the area’s negative feedback loop.

Instead of taxes, the key issue identified by White Flint developers is the absence of job growth, which they believe would stimulate demand for housing and eventually make the economics of housing construction work even with high construction costs. In short: if you want more housing, create more jobs. All of these developers know what we have been saying on Seventh State for years: MoCo has one of the worst records on job growth and business formation of any large jurisdiction in the metro area.

The county’s terrible record on job growth and business formation must be reversed.

All of this points to the need for a strategic decision. MoCo can focus like a laser on job creation, doing everything possible to help entrepreneurs grow their organizations and create employment for residents. If the county does that, the vision of White Flint and other smart growth plans can be realized. Or MoCo can keep handing out tens of millions of dollars in corporate welfare as it has done for decades, thereby depleting its ability to construct infrastructure that facilitates economic growth. Or it can do nothing.

Those are the choices. What will MoCo choose?