By Adam Pagnucco.

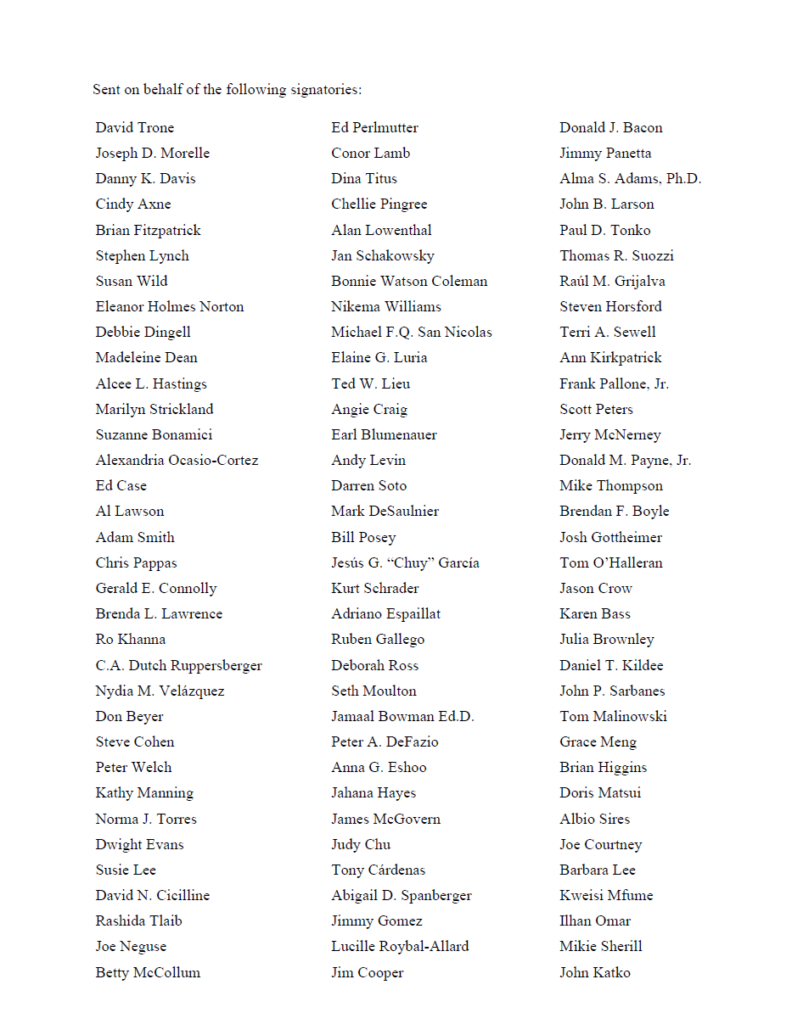

Congressman Jamie Raskin has spearheaded a joint letter from more than 100 members of Congress in both parties asking the IRS to extend its April 15 tax filing deadline. Among the reasons for the request are the agency’s late kickoff for tax filings, a change in the American Rescue Plan Act regarding taxation of unemployment benefits and the fact that the IRS is only answering 1 out of 4 phone calls from taxpayers with questions. The joint letter is reprinted below.

*****

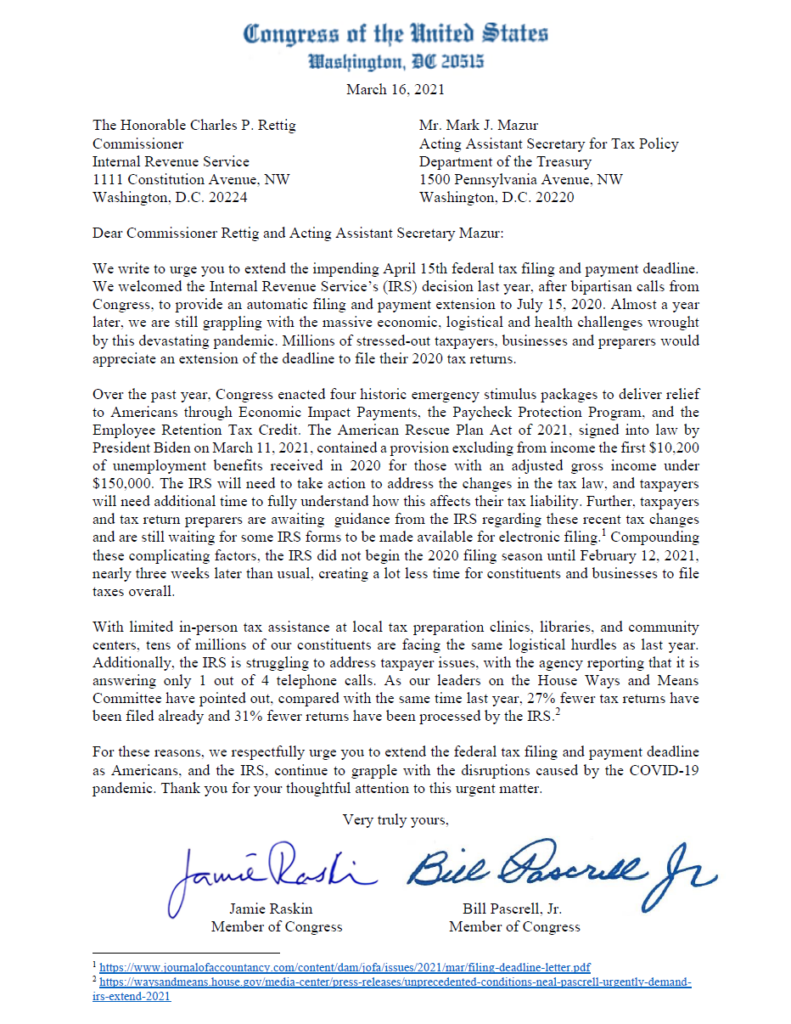

Dear Commissioner Rettig and Acting Assistant Secretary Mazur:

We write to urge you to extend the impending April 15th federal tax filing and payment deadline. We welcomed the Internal Revenue Service’s (IRS) decision last year, after bipartisan calls from Congress, to provide an automatic filing and payment extension to July 15, 2020. Almost a year later, we are still grappling with the massive economic, logistical and health challenges wrought by this devastating pandemic. Millions of stressed-out taxpayers, businesses and preparers would appreciate an extension of the deadline to file their 2020 tax returns.

Over the past year, Congress enacted four historic emergency stimulus packages to deliver relief to Americans through Economic Impact Payments, the Paycheck Protection Program, and the Employee Retention Tax Credit. The American Rescue Plan Act of 2021, signed into law by President Biden on March 11, 2021, contained a provision excluding from income the first $10,200 of unemployment benefits received in 2020 for those with an adjusted gross income under $150,000. The IRS will need to take action to address the changes in the tax law, and taxpayers will need additional time to fully understand how this affects their tax liability. Further, taxpayers and tax return preparers are awaiting guidance from the IRS regarding these recent tax changes and are still waiting for some IRS forms to be made available for electronic filing. Compounding these complicating factors, the IRS did not begin the 2020 filing season until February 12, 2021, nearly three weeks later than usual, creating a lot less time for constituents and businesses to file taxes overall.

With limited in-person tax assistance at local tax preparation clinics, libraries, and community centers, tens of millions of our constituents are facing the same logistical hurdles as last year.

Additionally, the IRS is struggling to address taxpayer issues, with the agency reporting that it is answering only 1 out of 4 telephone calls. As our leaders on the House Ways and Means Committee have pointed out, compared with the same time last year, 27% fewer tax returns have been filed already and 31% fewer returns have been processed by the IRS.

For these reasons, we respectfully urge you to extend the federal tax filing and payment deadline as Americans, and the IRS, continue to grapple with the disruptions caused by the COVID-19 pandemic. Thank you for your thoughtful attention to this urgent matter.