By Adam Pagnucco.

Soaring home prices and rising rents have been themes for Montgomery County’s housing market for several years. A big reason for both is increasingly tight supply of homes for sale relative to demand, conditions creating a classic scenario for rising prices. Today’s post features a few charts demonstrating the challenge in both Montgomery and Prince George’s counties.

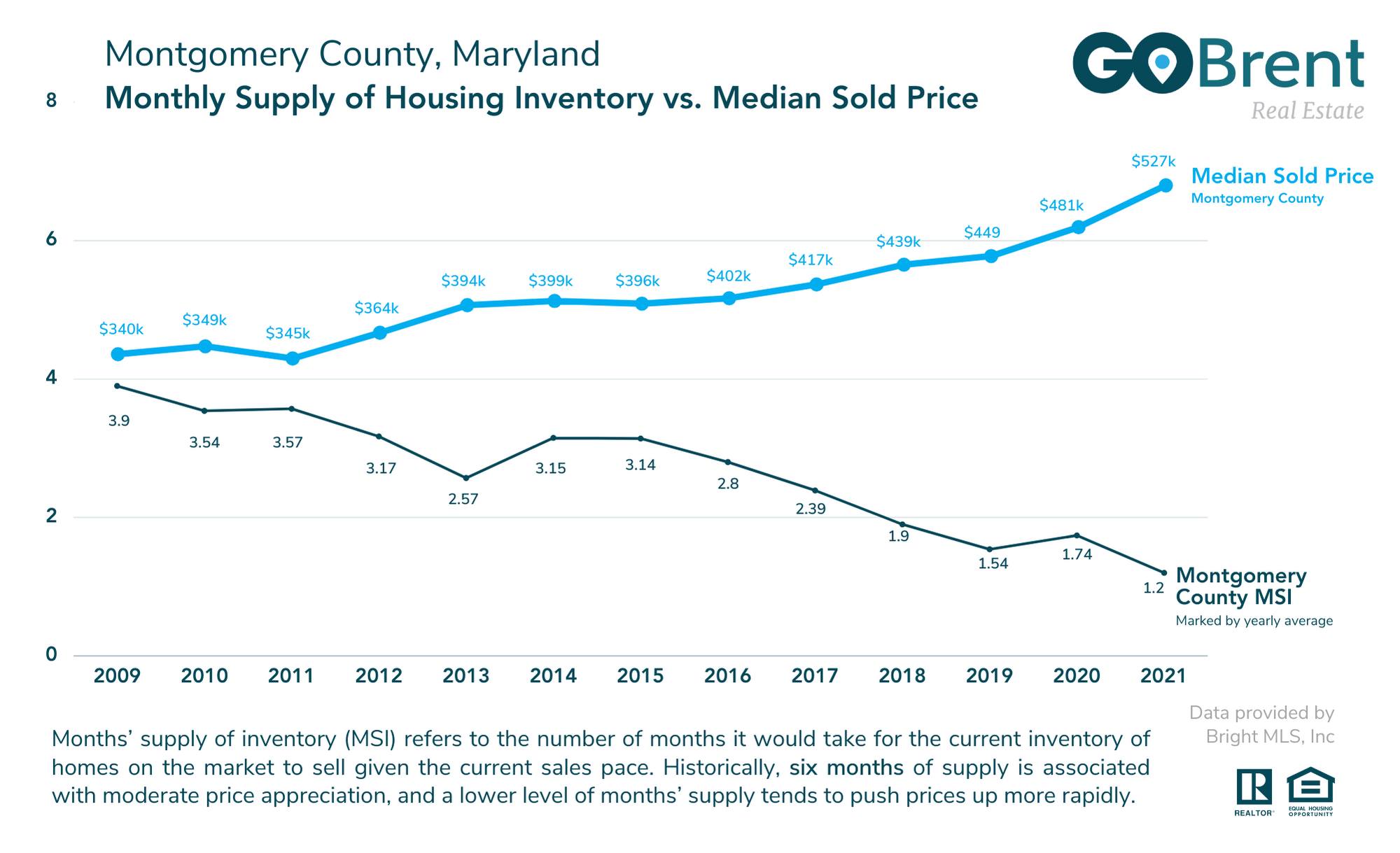

The chart below was produced by real estate agent Liz Brent, who founded the Go Brent brokerage in Silver Spring. It uses multiple listing service data to demonstrate two data series from 2009 through 2021 in Montgomery County. The thick blue line on the top shows annual median sales price of homes in the county. The thin dark line on the bottom shows months’ supply of inventory (MSI), which is the number of months it would take for the current inventory of homes on the market to sell given the current sales pace. MSI is a relative supply measure; the lower it is, the less supply of homes for sale there is relative to the demand for those homes. Low levels of MSI tend to be associated with rising prices as buyers bid up the prices of scarce housing.

Let’s go back to 2009, when the Great Recession was starting to hit the county. Back then, median home price was $340,000 and MSI was 3.9 months. That was a moderately tight housing market. Since then, MSI – the relative supply measure – has fallen steadily while prices have risen. Last year, median price topped a half million dollars and MSI was at a rock-bottom 1.2 months. There simply are not enough homes for sale in the county for everyone who would like to buy them.

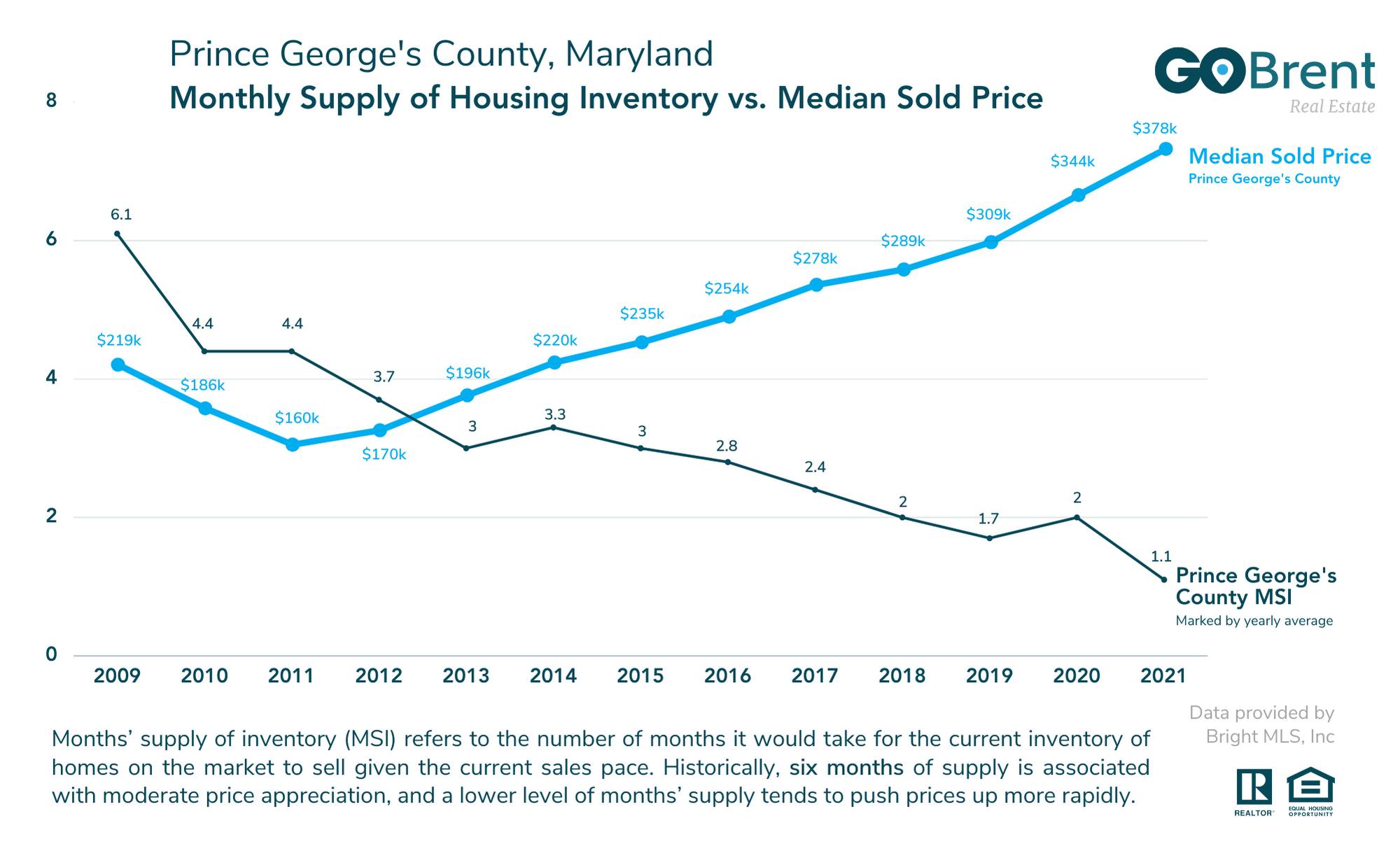

Prince George’s County has seen similar trends, although its median price has risen more while its MSI has fallen farther than Montgomery’s.

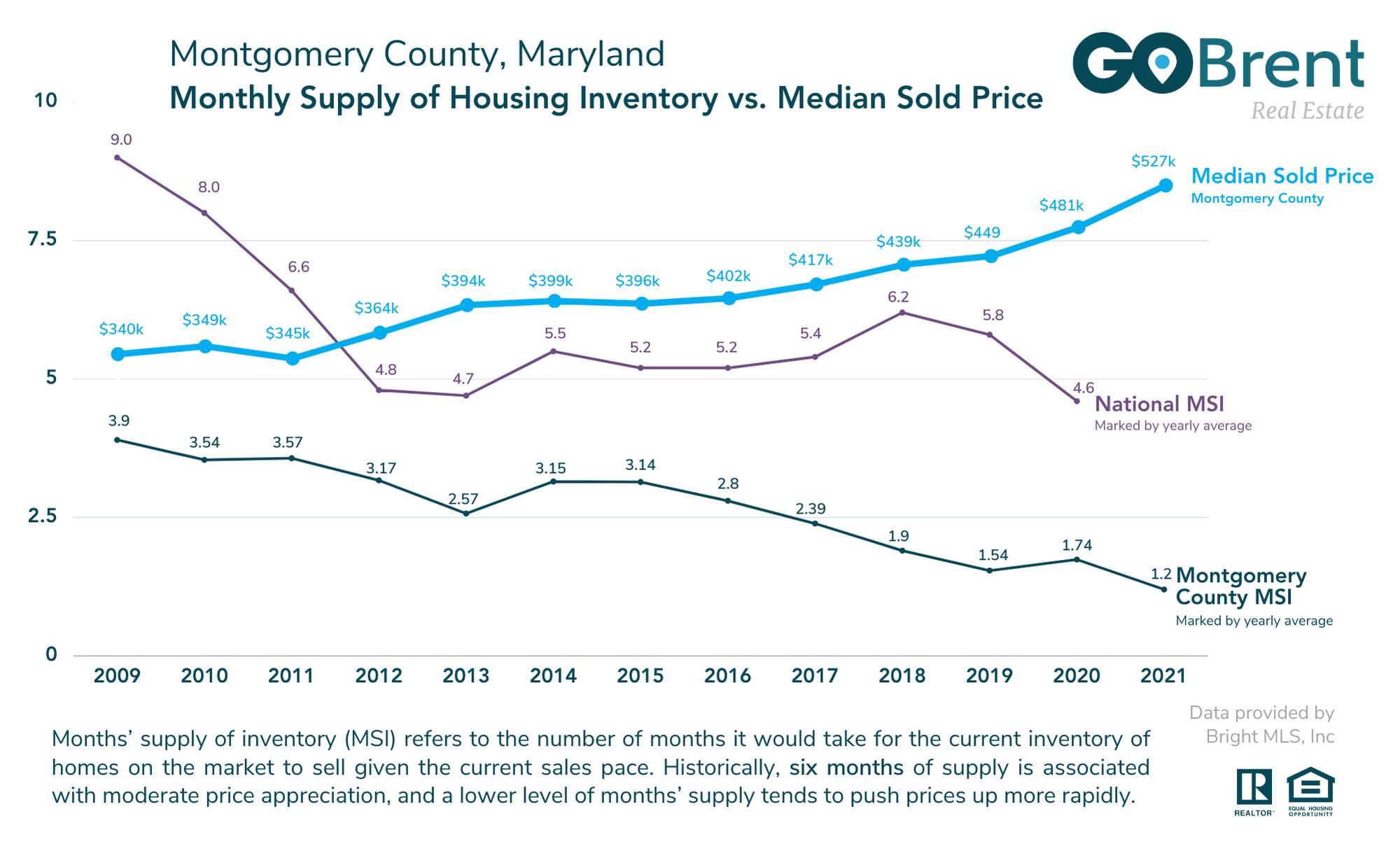

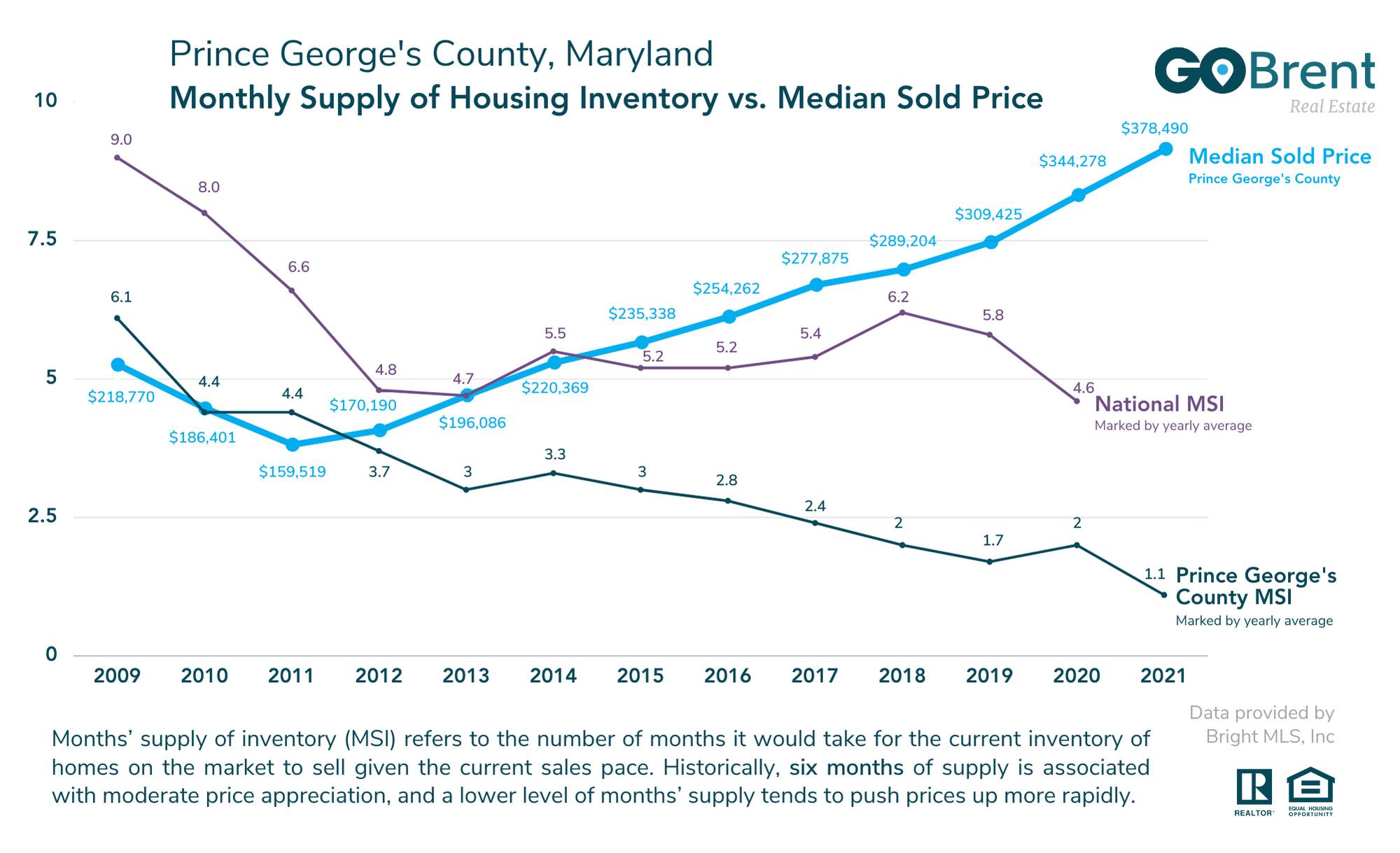

How do Montgomery and Prince George’s compare to national conditions? The two charts below include national MSI lines in purple. Both counties have been well below national months’ supply of inventory for the entire period and were less than half of national MSI in 2020. That means that our housing markets are significantly tighter than national averages.

Tight conditions for homebuyers are no doubt spilling over into the rental market because folks who cannot find homes to buy create extra demand for rental homes, thus pushing up rents. An additional consequence of rising home prices is rising assessments, which push up property tax payments.

Montgomery and Prince George’s counties must both encourage more home construction, and while Liz Brent has not released more charts, I bet the need for more housing applies to the rest of the region as well. The alternative is higher home prices, higher rents and higher tax bills.