By Adam Pagnucco.

The Republican takeover of the U.S. House of Representatives will have obvious ramifications for national politics and international relations. It may also have consequences for Montgomery County’s budget.

During the pandemic, the county government became more dependent on federal aid, especially on money from the American Rescue Plan Act of 2021. The act was intended to help state and local governments deal with the fiscal consequences of COVID. Its provisions contained money for unemployment benefits, food stamps, earned income tax credits, grants to small businesses, aid to schools and colleges, rental and homeowner assistance, transportation funding, healthcare funding and much more. It was coupled with reimbursements from the Federal Emergency Management Agency for COVID-related costs incurred by state and local governments.

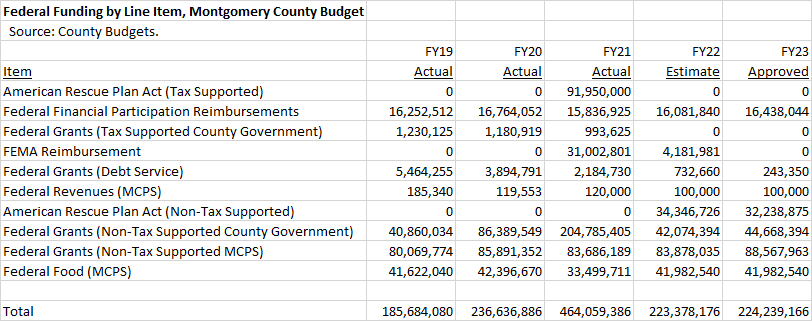

Federal funding is not easily identified in the county budget, but the table below shows a partial tabulation from FY19 through FY23. Note the massive spike in federal assistance to the county in FY21, the worst year of the pandemic, as well as the $38.6 million increase from FY19 (the year before the pandemic) to FY23.

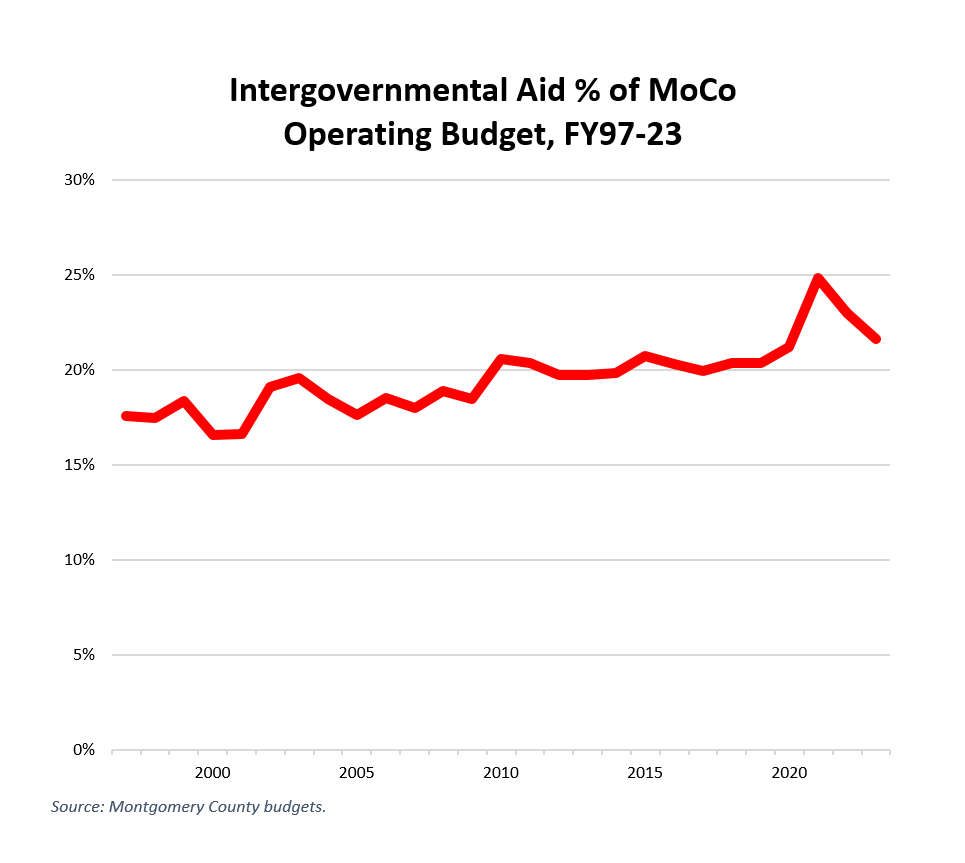

Increased federal money boosted the percentage of the county’s operating revenues coming from intergovernmental aid to previously unseen levels. The chart below shows that percentage from FY97 through FY23. Intergovernmental aid peaked at 24.8% of county revenues in FY21 before falling down to 21.6%, which was higher than the county’s FY19 level of 20.4%.

At the same time that one-time federal money was juicing the county’s budget, the county was adding lots of employees. Between FY19 (the last budget under the previous term) and FY23 (the last budget of the current term), the county government added 621 full-time equivalent (FTE) positions. MCPS, Montgomery College and Park and Planning collectively added 1,565 FTEs resulting in the combined creation of 2,186 new jobs.

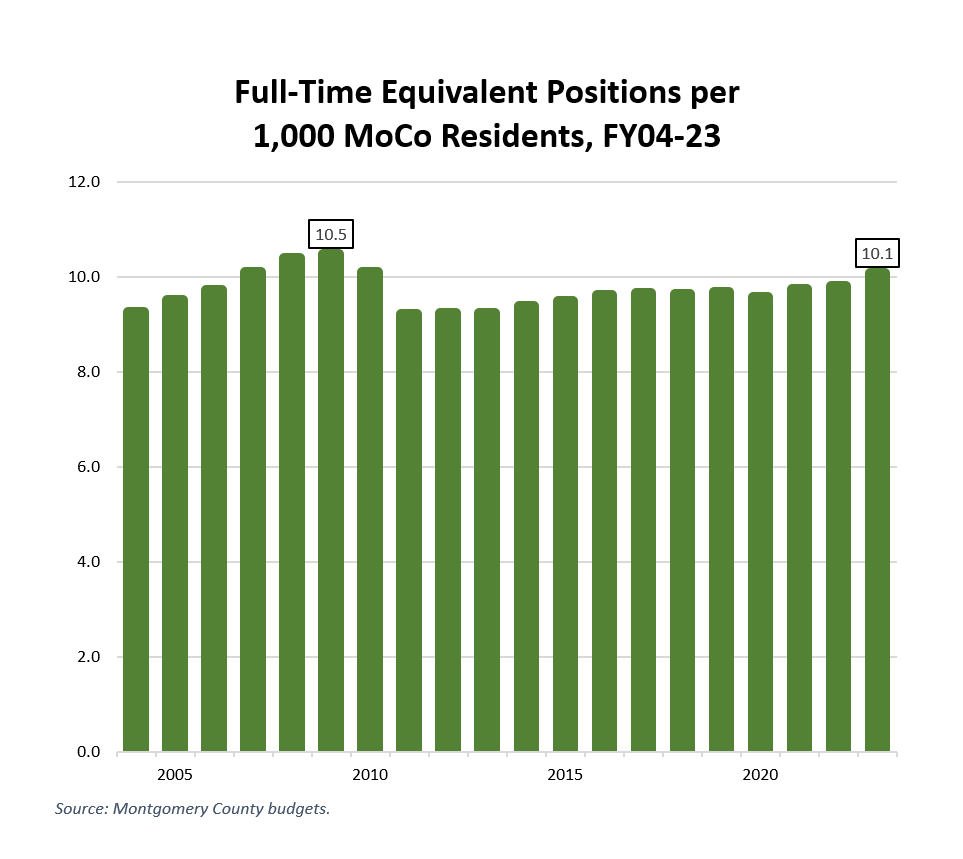

The chart below shows county government FTEs per 1,000 residents from FY04 through FY23. Note that this only includes county government and does not include its affiliated agencies (like MCPS, the college and Park and Planning).

The county’s hiring spree has resulted in 10.1 county employees per thousand residents, which is approaching the pre-Great Recession peak of 10.5. Here is a Captain Obvious statement: the county’s economy is nowhere near as robust as it was before the Great Recession.

It was not supposed to be this way. When County Executive Marc Elrich first ran for executive in 2018, he promised to restructure county government to save money and forgo tax increases. But in his second budget, he nevertheless proposed a tax hike which the county council denied. He then proceeded to create hundreds of new positions anyway – all of them approved by the council – while his much-ballyhooed restructuring effort produced a recommendation to eliminate just 9 positions. That’s right, not 900 positions, not 90 positions – NINE positions.

Here’s a question: how much of the additional federal money was used to support additional spending which will now stop and how much was used to backfill spending the county would have normally incurred? It’s one thing to cut off dedicated spending directly related to COVID. It’s another thing to disentangle a structural issue created by use of one-time revenues to support ongoing spending (like more than 600 new positions). Let’s also note that money is fungible and the county regularly transfers millions of dollars between its funds.

Finally, the county’s fiscal plan update noted greater than expected revenues in FY22 and the strength of the county’s reserves (a one-time resource). But it also drew these comments from council staff.

The update shows reductions in all revenue sources every year from FY24-FY28. FY24 revenues are projected to be approximately $100 million lower than estimated in June.

OMB estimates that the County Government’s FY23 expenditures will be $19.4 million greater than the FY23 approved budget. This estimate is based on the County’s actual expenditures through Quarter 1 of FY23 and are primarily due to expenditures in the Department of Health and Human Services, overtime in Fire and Rescue Services, and higher than anticipated participation in the Working Families Income Supplement.

OMB estimates that the County Government could add approximately $61.8 million in new expenditures in FY23. This estimate is based on the supplemental and special appropriations that have been introduced or acted on since the approved budget in May 2022 and potential snow removal costs.

“Supplemental and special appropriations” are spending items added outside the regular budget, which is supposed to be balanced. Such appropriations have become more common during the pandemic.

A Democratic U.S. House might have helped to keep federal aid flowing, thus making all of the above issues easier to confront. But House Republicans now partially control the nation’s purse strings and the last thing they want is to continue large amounts of federal aid for blue jurisdiction operating budgets. Can the county control its spending to offset likely declines in federal money? And if the county enters a recession (as former county council analyst Jacob Sesker already thinks it has), can the county pay for its hundreds of new positions without a tax hike?