By Adam Pagnucco.

Let’s imagine that you are saving for retirement. As you are exploring investment options, you come across a fund that caps its rate of return. You could earn less than the maximum. You could even lose money. But you can never do better than the cap. Furthermore, you don’t even know what the cap is because it changes every year and is totally outside your control. As an alternative, there are MANY other funds you could buy that are similar to this one but have no maximum returns. So would you buy into the fund with the cap?

Of course you wouldn’t! And your decision explains a lot about Takoma Park’s housing market since it has rent control, which functions as a cap on returns from rental real estate. Why on Earth would any developer be crazy enough to build there when there are so many other options in the region without rent control?

Here are three data points showing how bad Takoma Park is at generating new housing.

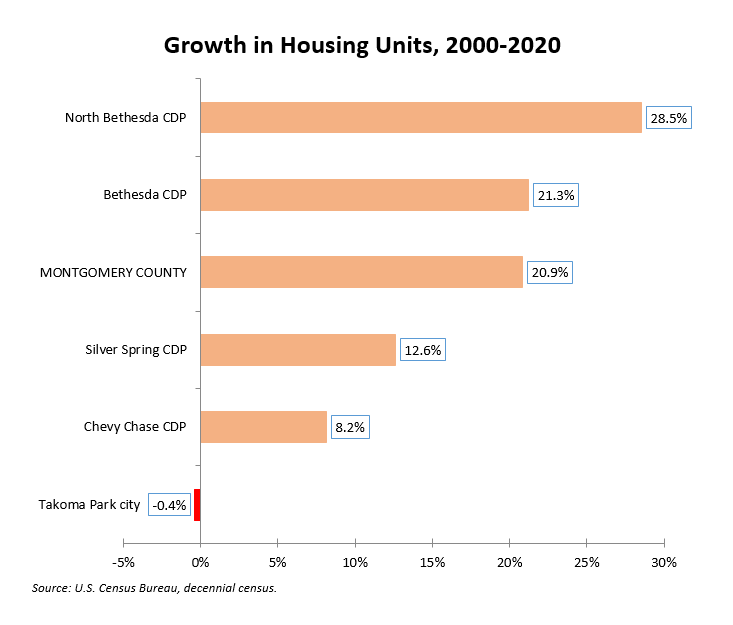

Growth in number of housing units

According to the decennial census, Takoma Park had 7,187 housing units in 2000, 7,162 in 2010 and 7,161 in 2020. That’s a drop of 0.4% in housing units over 20 years. Montgomery County as a whole grew from 334,632 units in 2000 to 375,905 in 2010 and 404,423 in 2020, a growth rate of 21% over 20 years.

Now to be fair, Takoma Park has limited space for housing construction. It’s a dense community that dates back to the late 19th century, making it very unlike high-growth residential areas like Clarksburg and Germantown with lots of developable land. So let’s compare it to its peers. The chart below shows housing unit growth in Takoma Park along with other Downcounty areas with at least 4,000 units since 2000. (CDP indicates an unincorporated area defined as a census-designated place.)

Even in dense, long-developed Downcounty, Takoma Park is an outlier.

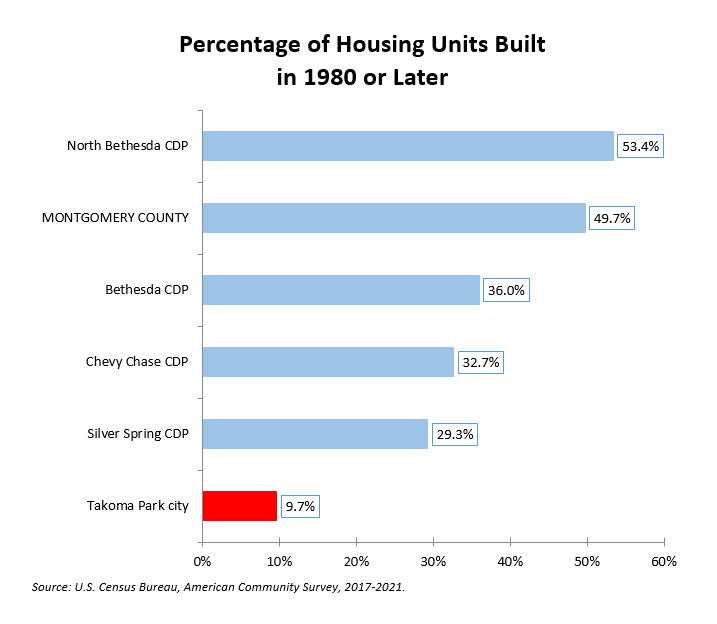

Percent of housing built after 1980

The chart above is insufficient to understand Takoma Park’s housing market for two reasons. First, boundaries of census-designated places and municipalities can and do change. Second, the chart above shows net change, not gross change. It’s possible that Takoma Park could be adding new units that replace old ones, thus giving it a healthier housing market than appears at first glance.

To deal with those issues, let’s evaluate a different metric – the age of housing units, which is measured by the Census Bureau’s American Community Survey (ACS). Takoma Park passed its rent control law in 1981. The ACS groups housing units into age categories by decade, making it possible to calculate the percentage of housing units built in 1980 or later – almost the exact period during which Takoma Park has had rent control. Here is how Takoma Park compares to nearby areas in Downcounty on that measure.

Once again, Takoma Park is an outlier for its lack of residential construction. But believe it or not, the above chart actually understates the case. The ACS 2017-2021 survey tracks 200 municipalities and census-designated places in Maryland with at least 2,000 units. And Takoma Park’s rank among them in percentage of units built in 1980 or later?

197 of 200.

Commercial building permits data

The county’s Data.montgomery site contains a file of commercial building permits dating back to 2000. In Maryland, multi-family residential buildings are classified as commercial structures. Building permits for new multi-unit rental housing in Takoma Park or anywhere else in the county would appear in this file.

As of this writing, the file contains more than 2,000 building permits applying to new multi-family structures with a combined declared valuation of $3.1 billion since 2000. Clarksburg, Germantown and Silver Spring have all seen hundreds of permits and Silver Spring, Bethesda and Rockville have each seen hundreds of millions of dollars in construction. As for Takoma Park, the file contains exactly one new multi-family structure: a 240-square foot deck worth $15,000 built in 2010. Is the deck covered by rent control?

Takoma Park is not an inherently bad place to build rental units. It’s an attractive community with beautiful neighborhoods and a great central commercial district. It has a robust city government with many municipal services. Its kids can go to Montgomery County Public Schools, it’s near a Metro station and it’s close to Downtown Silver Spring and D.C. Its land use approvals are decided by the same Montgomery County Planning Board that has approved thousands of housing units all over the rest of the county. The biggest difference between Takoma Park and other areas in MoCo is its rent control law. And while D.C.’s law exempts units constructed after 1975, Takoma Park’s law covers new rental units beginning five years after they are licensed. Let’s amend that – the law would cover new units if there actually were any new units.

The frozen condition of the city’s housing market is a preview of what would happen to Montgomery County if the rent controllers succeed in turning the county into a larger version of Takoma Park. Here’s the thing, folks – we are not the only option in the region for builders of new rental housing. D.C., Virginia and the exurbs all offer attractive options to developers and tenants alike. And as those places build new communities, they can also increase their jobs base, their entrepreneurial base and their tax base.

So if rent control is not the answer, what is? We will conclude in Part Four.