By Adam Pagnucco.

The Washington Post and Maryland Matters have reported on the state’s $477 million revenue shortfall. That’s not a great thing for any Marylanders, but what does that mean for MoCo?

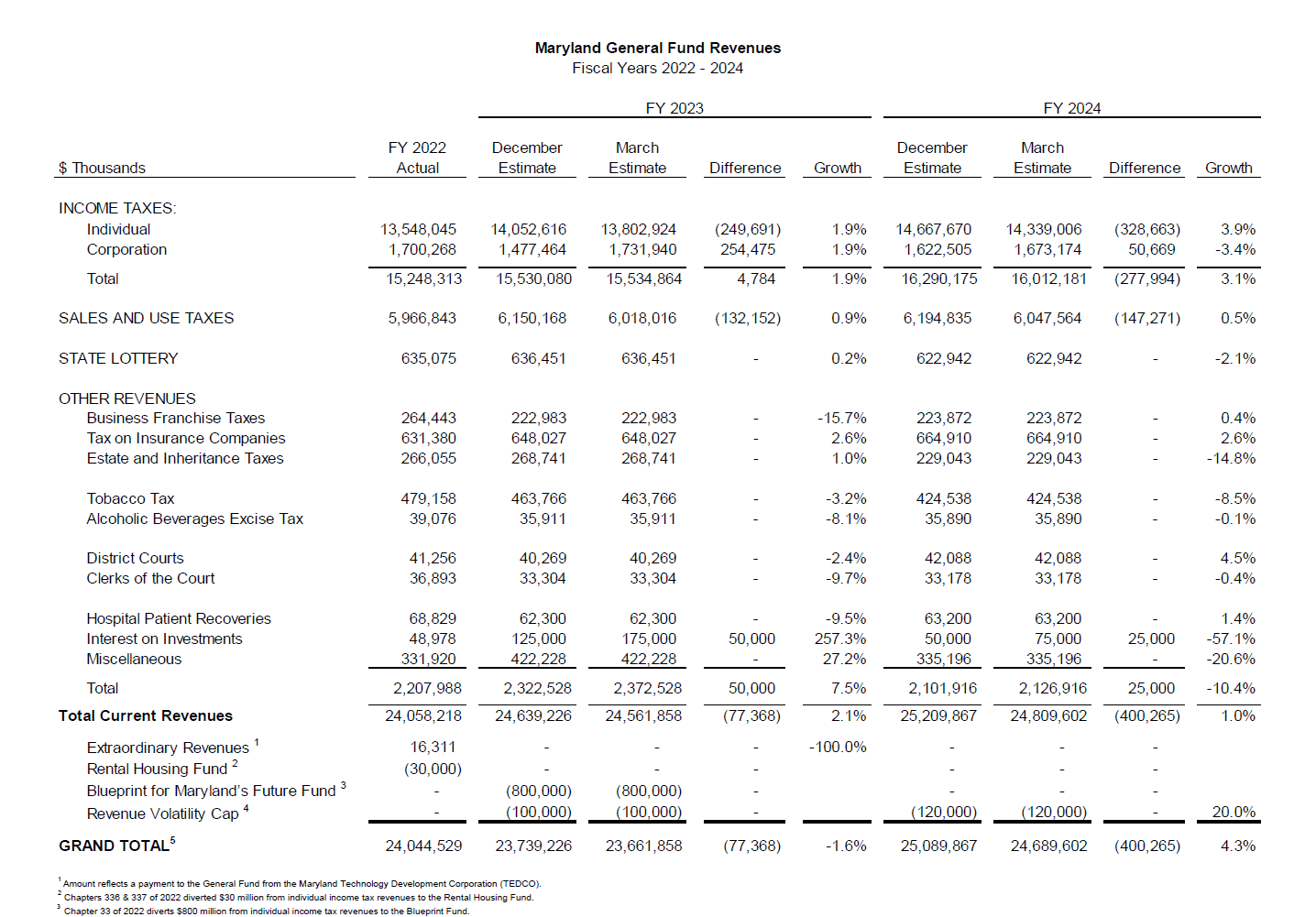

First, let’s understand why the state has seen a shortfall. The table below from a March 9 briefing of the House Ways and Means Committee shows FY22 actuals and FY23-24 estimates for the major revenue categories of the state’s general fund.

Over the last four months, estimates of corporate income taxes have risen by $254 million in FY23 and $51 million in FY24. That’s the good news. The bad news is that estimates of individual income taxes have fallen by $250 million in FY23 and $329 million in FY24. Sales and use tax estimates have also fallen but by smaller amounts.

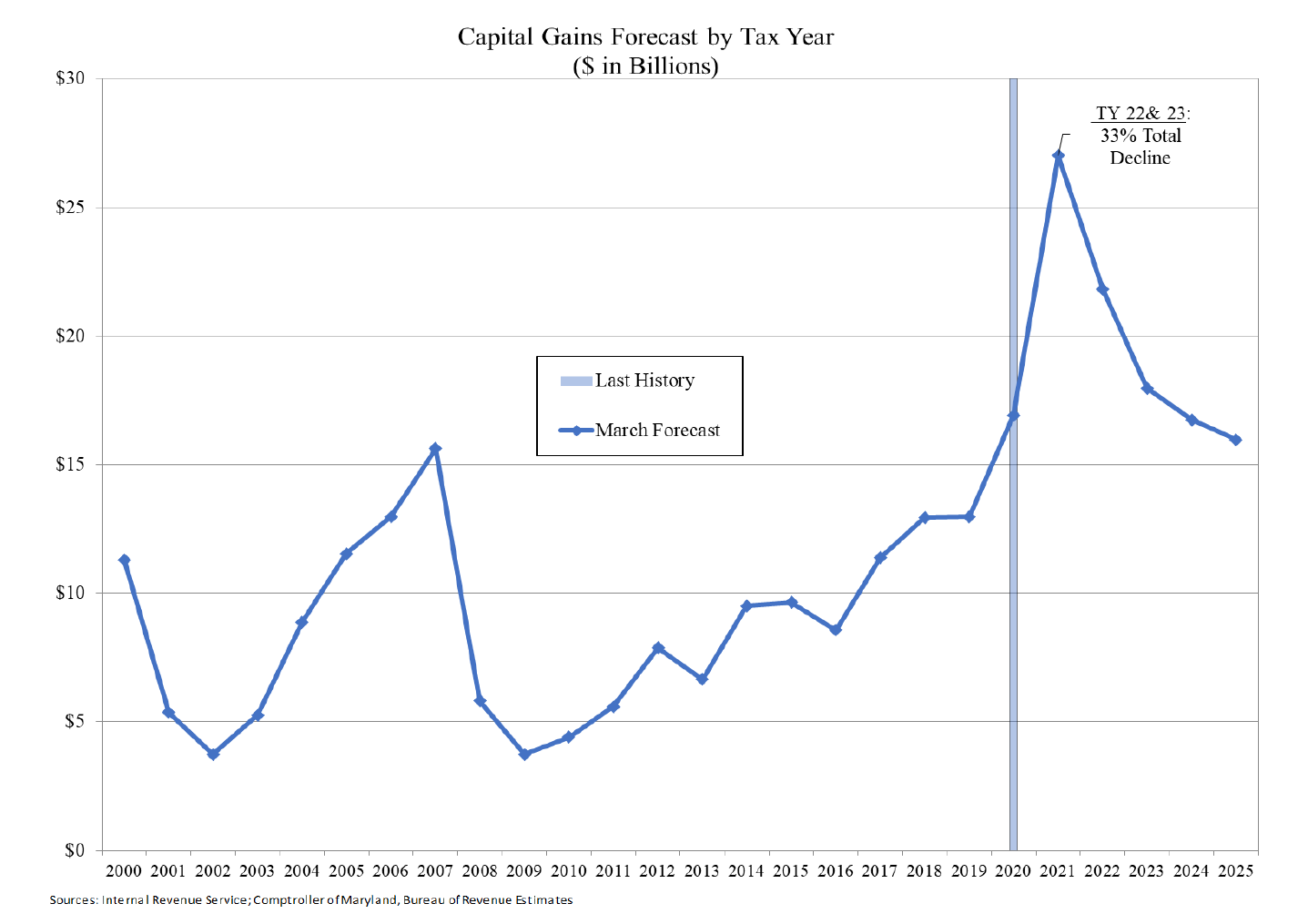

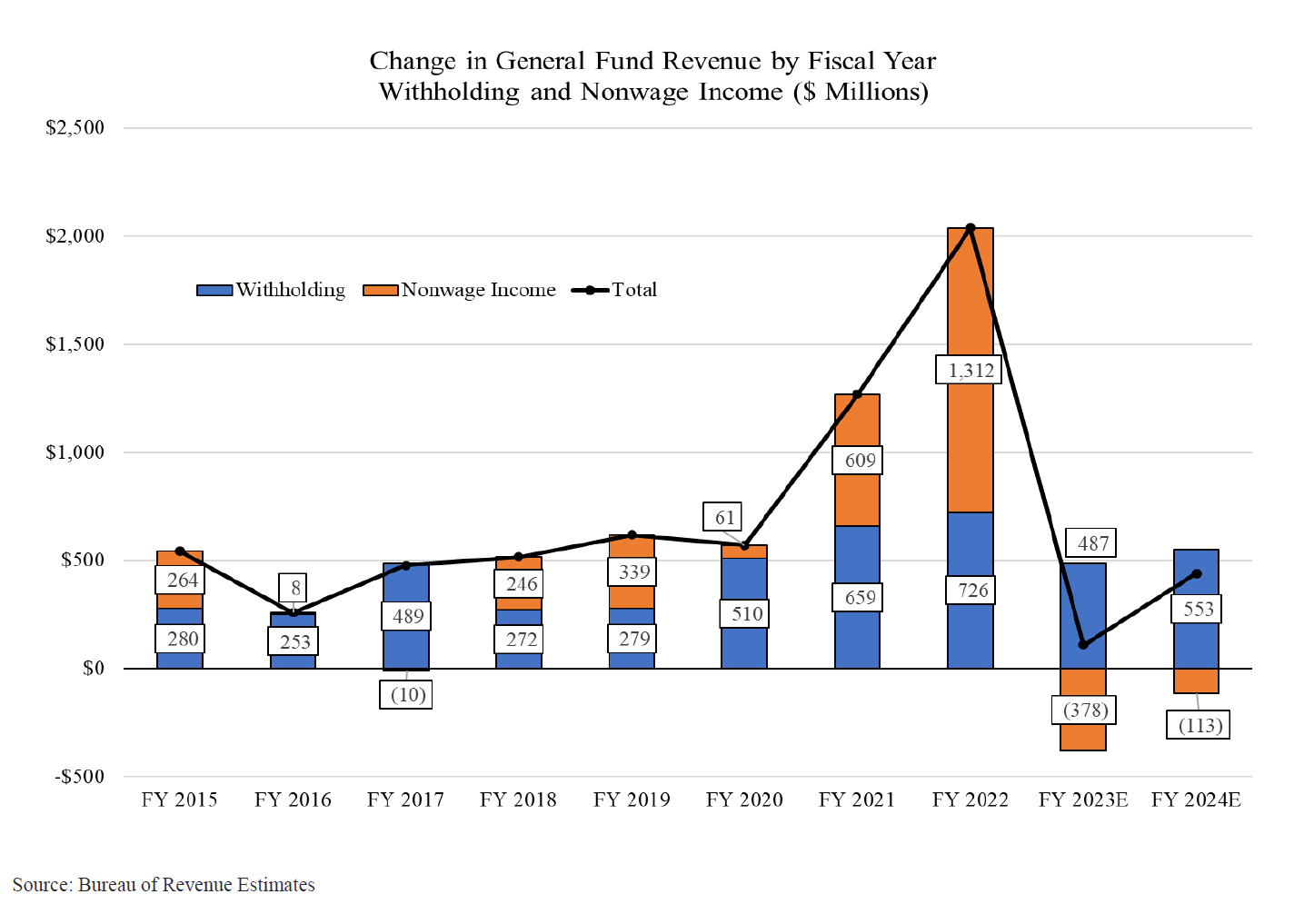

What accounts for the drop in individual income tax estimates? The briefing states that the “March forecast includes greater decreases in nonwage income” and “Estimated payments, which were increasing, had a sharp decline for the 4th quarter of tax year 2022.” The Post attributed these declines to “the state’s non-wage tax revenue from small businesses and the stock market” along with an underperforming economy.

Two more charts from the briefing illustrate these problems. The first shows a sharp decline in capital gains taxes following several years of increases. The second shows that withholding taxes are increasing while nonwage income is falling. Again, the problems are proprietor incomes and the stock market.

MoCo has roughly one-sixth of the state’s population but it’s a bigger player in the revenue categories causing problems for the state. According to the U.S. Bureau of Economic Analysis, Maryland proprietor income in 2021 totaled $27.5 billion. Of that amount, MoCo accounted for $8.3 billion, or nearly a third.

The table below shows various categories of reported income to the Internal Revenue Service in 2020. Look at how MoCo dominates dividends, interest income, business income and capital gains. No other jurisdiction in Maryland comes close to us.

So there is no way that the state could have a problem of this specific nature unless it is also affecting MoCo. That’s our money which is causing headaches for the state budget.

The county’s last fiscal plan was released in December. In terms of revenue, it was a mixed bag. Tax receipts were $292 million above estimate for FY22, which closed last June 30. Tax receipts for FY23 were projected to come in $23 million above estimates. Those two items pushed up reserves beyond 12% of revenues, which is a great thing for the county. BUT there were two danger signs.

First, the county’s profligate use of special appropriations added $62 million in new spending in FY23. Second, FY24 revenue estimates were written down by $100 million.

That was December and the state recorded a shortfall by March. This week, we will learn whether we also had a shortfall and, if so, how that impacts the county executive’s recommended budget. And we will also learn the most important thing of all:

How any shortfall will impact your wallet.