By Adam Pagnucco.

In making the case for his 10 percent property tax hike, County Executive Marc Elrich is claiming that our property tax rate is modest compared to the rest of the region. MoCo 360 found that our property tax rate is below many other nearby jurisdictions. But this data requires context. Property taxes here are moderate because of two primary reasons that the executive does not want to discuss.

First, local governments in Virginia do not charge income taxes. Maryland counties do, and in our state, income taxes tend to be the second-largest locally generated revenue source. To make up for their lack of income taxes, property taxes in Virginia are often higher than in Maryland.

Second, Montgomery County is an outlier on another revenue source: energy taxes. The county imposes a series of taxes “on every person transmitting, distributing, manufacturing, producing, or supplying electricity, gas, steam, coal, fuel oil, or liquefied petroleum gas in the County.” In FY21, the county collected $184 million in energy taxes, its third largest local revenue source behind property and income taxes.

The energy tax is a controversial topic in the business community. During the county government’s financial crisis in 2010, county leaders nearly doubled energy taxes and said the tax hike would sunset in two years. But that promise was broken and roughly three-quarters of the increase was retained. The legacy of those years continues today.

Energy taxes are complicated. Rate structures differ a lot. So do the energy sources that are subject to taxes. Across the region, taxes are levied on electricity, gas, oil, coal, liquefied petroleum, propane and more, with the details differing substantially by locality. This makes a straight rate comparison impossible. Instead, the table below compares energy tax collections in FY21 among many counties in the region.

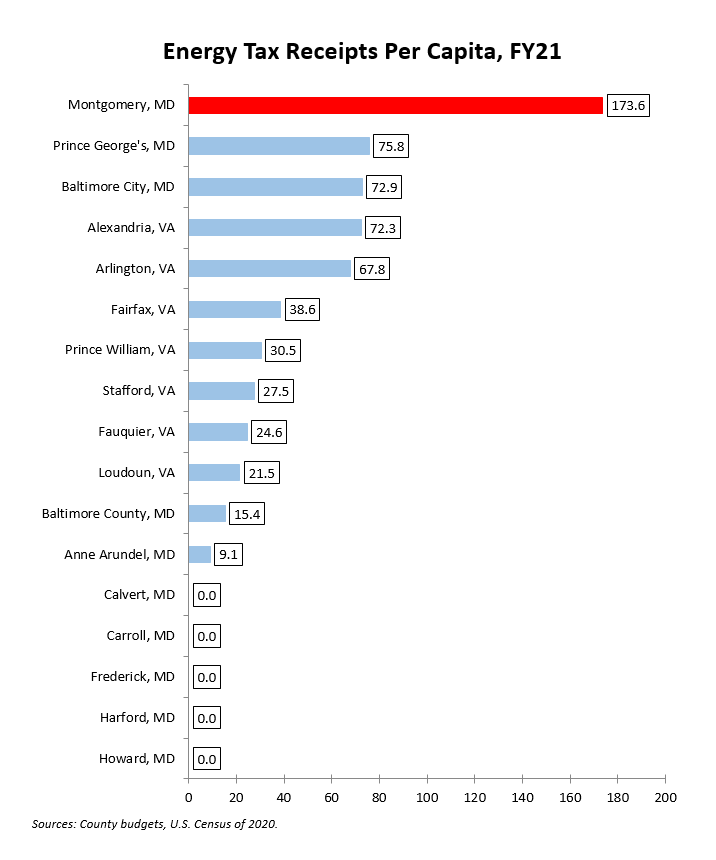

And the chart below summarizes FY21 energy tax receipts per capita.

So what can we tell from this presentation? First, many Maryland counties do not charge energy taxes. Two of them who do not – Frederick and Howard counties – are among our principal competitors.

Second, in per capita terms, none of our neighbors charge anywhere close to us in energy taxes. The only possible exception is D.C., but since their reported tax receipts do not break out charges on phone, TV and radio, their budgetary data is not comparable to ours.

Accordingly, because of our income and energy tax receipts, our tax competitiveness comes from having moderate taxes on property, recordation, transfer, admissions and hotels, all of which are within normal bounds in Maryland. The combination of a ten percent property tax increase and a potentially very large recordation tax increase might have competitive consequences.