By Adam Pagnucco.

County Executive Marc Elrich and the school board are marketing his 10 percent property tax increase on the notion that it is intended to finance higher teacher salaries. Let’s set aside the fact that the actual use of the tax hike is to expand almost all of county government, not just schools. The truth is that MCPS uses budgeted teacher salary money for other purposes almost every year and this practice has been growing over time. This raises the question of how extra funds will generate a positive impact in the classroom.

This series examines the relationship between instructional salaries, transfers of money and fund balance in MCPS’s budget. Regardless of how anyone feels about Elrich’s tax hike, it’s important for the public to have confidence that tax dollars intended for teacher salaries actually go towards teacher salaries. If they don’t, then what is the purpose of taxpayer funding for public schools?

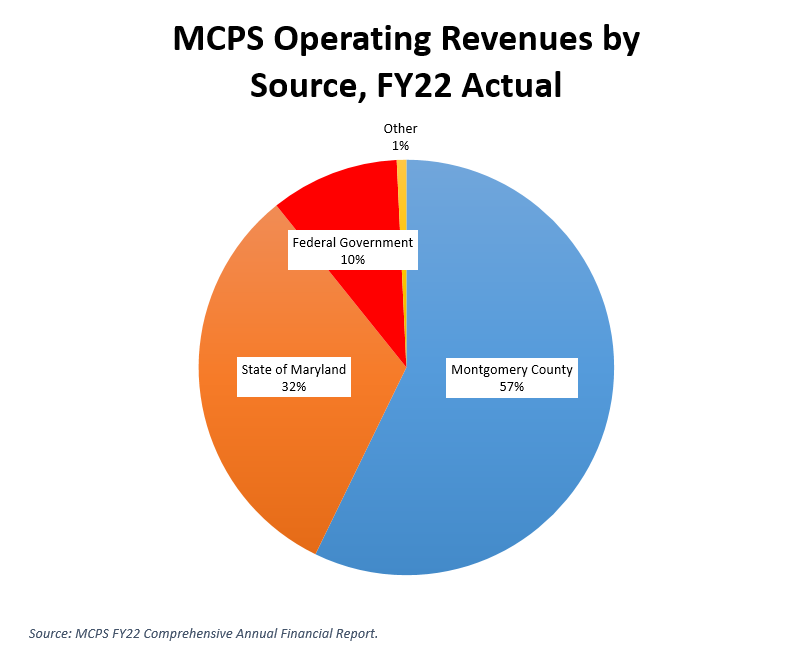

Before getting into the issue directly, let’s understand a few basics about MCPS’s operating budget. Funding for MCPS comes from four principal sources: the county’s contribution, state aid, federal aid and locally generated revenues like fees and meal payments. The chart below shows the distribution of these $2.8 billion in operating revenues for FY22.

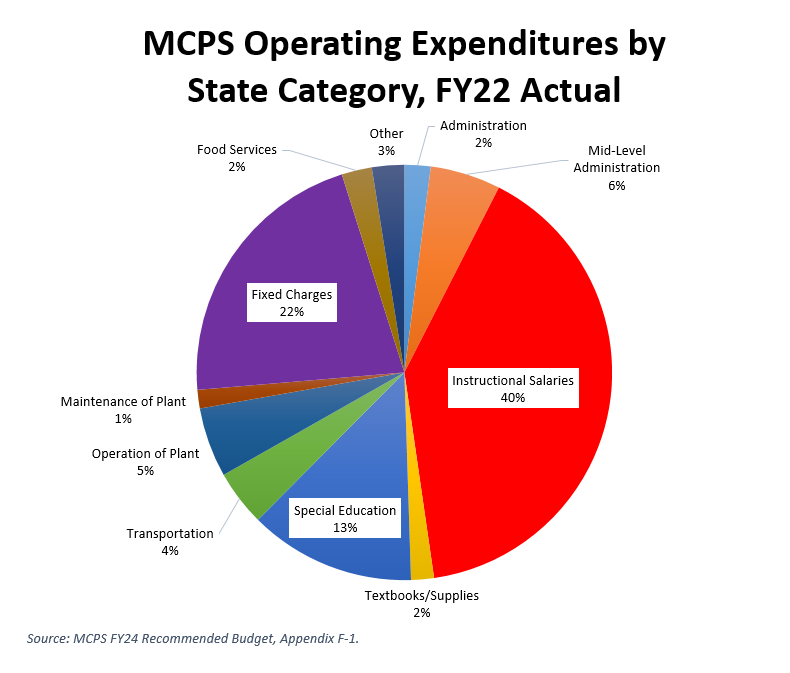

The county council does not have line item authority over MCPS’s operating budget as they do over much of the rest of county government. According to state law, the council appropriates operating funding to MCPS in a series of broad state-defined categories. The largest of these categories are instructional salaries, fixed charges (which mostly contains employee benefits) and special education. The chart below shows the distribution of these operating expenditures for FY22.

MCPS’s budgets are an important source for understanding how the school district spends your money. Equally important are MCPS’s comprehensive annual financial reports (CAFRs), which include both budgeted and actual spending for each fiscal year. Unlike the budgets, CAFRs are standardized financial reports overseen by the Governmental Accounting Standards Board. They enable apples-to-apples comparisons of governmental entities all over the nation – a truly invaluable resource for budgetary dirt diggers.

We shall start digging in Part Two.