By Adam Pagnucco.

Rent control supporters frequently allege astronomical rent hikes in making their case for tough legislation such as the Jawando-Mink-Elrich rent control bill. Statements in support of that bill claim that rents are rising by 19%, 30% and even 50%.

Is this true?

The planning department recently sent to the county council a package of rental rate statistics from CoStar, a data company widely used by the real estate industry. It’s important to note that CoStar rent data applies to asking rates of currently available units, not to lease renewals. The slide below summarizes the nature of this data.

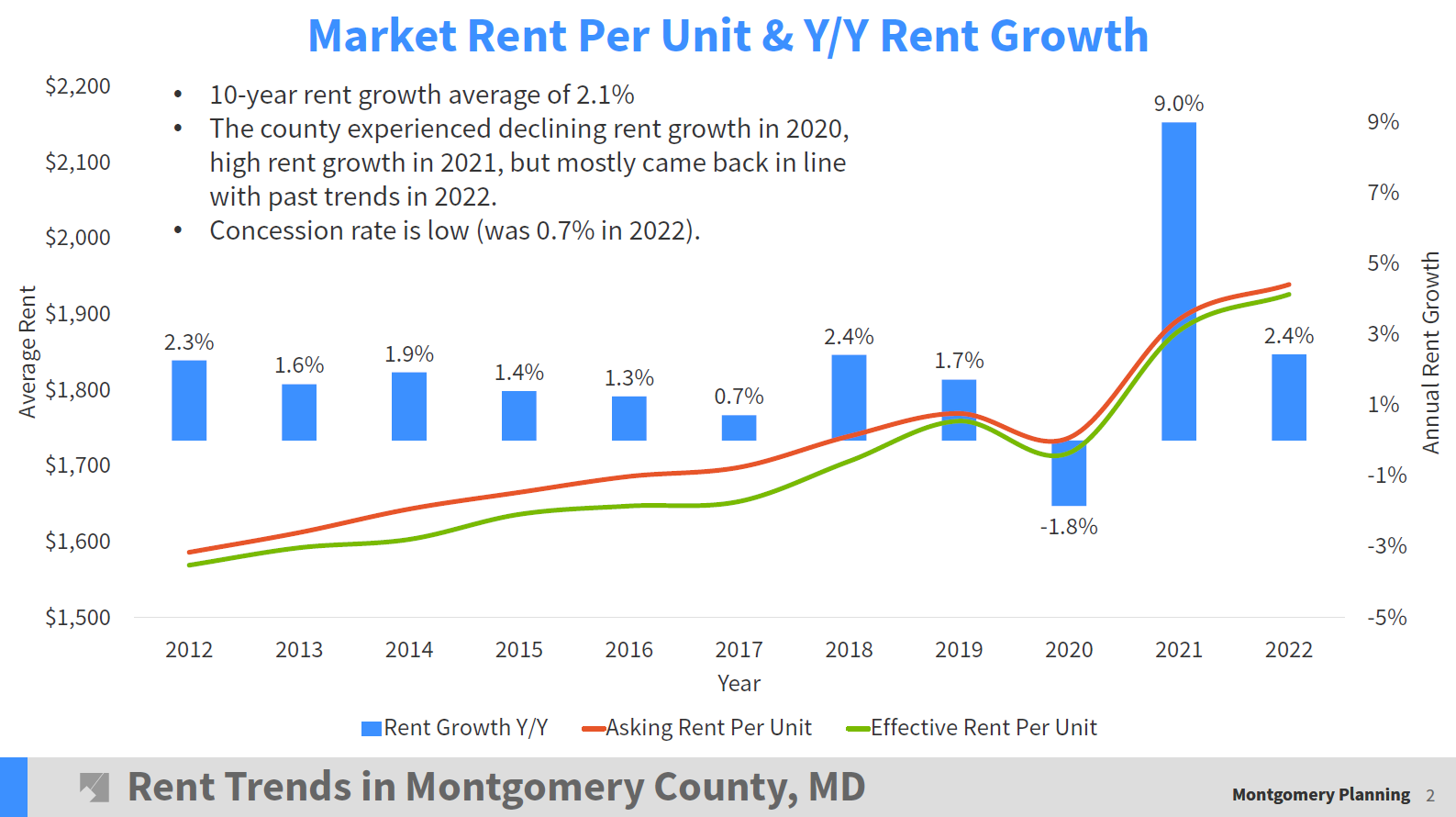

With the above caveats in mind, the planning department found that asking rents for available rental units in the county rose by 9.0% in 2021. This followed 9 years when changes in asking rents ranged between 2.4% and negative 1.8%.

Let’s bear in mind that the county had temporary rent control laws in effect in 2021 that prohibited increases to existing tenants above the county’s voluntary rent guideline, which was then 1.4%. Facing spiking operating costs during the pandemic and barred from significant rent increases on current tenants, it seems that landlords reacted by increasing rents on available units for new tenants. That said, rent increases fell to 2.4% in 2022, which was close to the average of the previous decade.

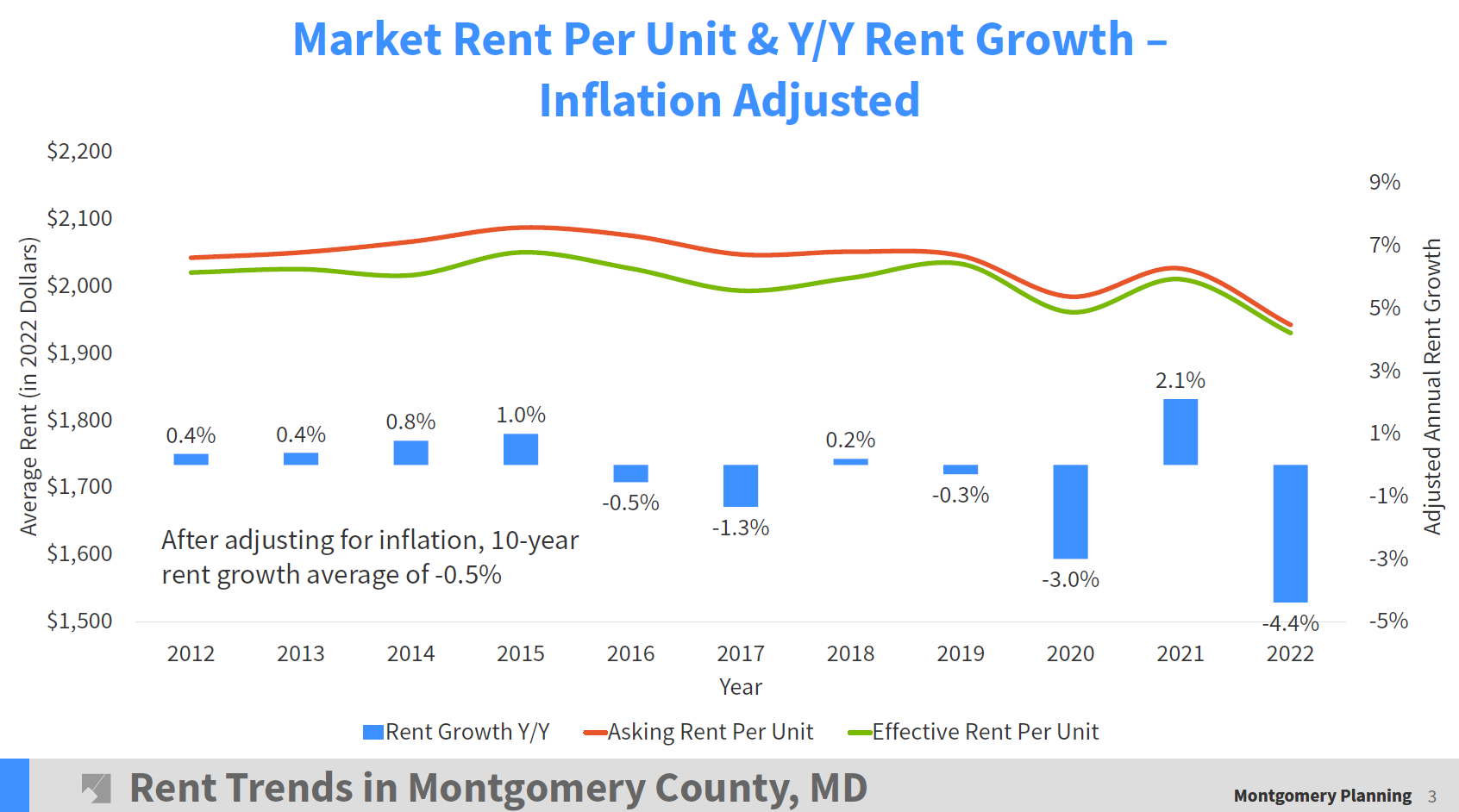

The planning department then provided data adjusting the change in asking rents for inflation.

Now we see what’s really happening in the county’s rental market. In five of the last seven years, asking rental rates did not keep up with inflation. Even in 2021, when the mean nominal increase was 9.0%, the real dollar increase was just 2.1%.

This explains why residential building permits in the county have tanked since the Great Recession. It may not be profitable to build here, especially considering all the new mandates the county has piled onto the housing industry and the three(!) real estate tax hikes – property, vacancy and recordation – now on the table.

So yes, there have been increases in asking rents, though the above data does not address renewals. If there are 30-50% rent increases, they don’t appear to be common across the market. And when rent increases fail to keep pace with inflation, caution is in order when considering imposing new costs on the residential rental market. Takoma Park allows rents to rise up to the rate of inflation and the city has still seen a drop in rental units over the last two decades.

A final note. The slide below shows the county’s vacancy rate, which was rock bottom in 2021 and 2022. This points to the real solution for the county’s housing problems: BUILD MORE UNITS. And then the corollary: make sure they can earn a return or they won’t get built.

You can download the entire presentation from the link below.