By Adam Pagnucco.

Few industries are more prominent in any local economy than the real estate industry. Consider everything this industry does. Realtors help residents buy and sell homes. Homebuilders expand the housing supply. Commercial developers build and operate office, retail and industrial properties used by employers. The construction industry provides middle class jobs to skilled trade workers. And so many other jobs in engineering, architecture, law, property management and more depend on real estate.

And yet consider the totality of what the county has passed in the last two months.

A 4.7 percent property tax hike.

A double-digit recordation tax hike.

A huge increase in impact taxes.

And a tough rent control law that has already caused multiple apartment developers to stop new projects in the county.

This comes on top of a slew of other new laws and regulations including multiple laws to regulate employment of building service employees, a new law on radon testing, a new law on building energy performance standards and a new all-electric building law that delegates writing of regulations to County Executive Marc Elrich, who has built his political career on opposing development.

One of the principal flaws of policy making in MoCo government is that individual policies are considered in isolation from each other. Fiscal and economic impact statements are applied to single bills by themselves. There is no framework for analyzing the cumulative impact of many bills – and taxes – all passing at the same time. But when any one industry is hit with as many things faced by the real estate industry right now, that cumulative impact is what matters. What are the various players in one of our most important industries currently thinking about this county?

I have previously written about some of the challenges faced by the county’s real estate industry, including declining inventory of homes for sale, cost-push inflation in rental properties and disparate rates of home ownership. Let’s add two more issues to the headache list.

Office Vacancy

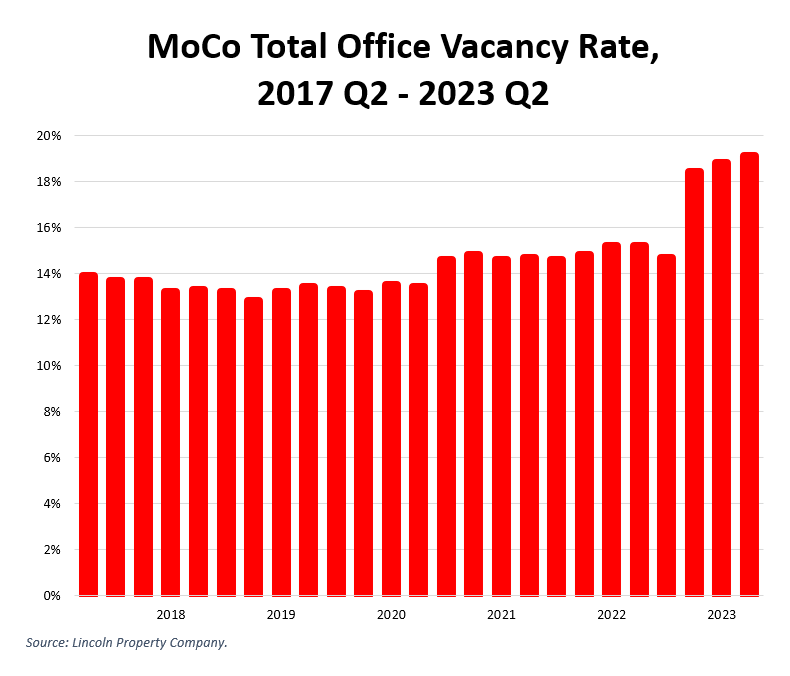

Lincoln Property Company, one of the region’s biggest commercial real estate firms, releases regular reports on office vacancy rates. The chart below shows the total office vacancy rate in Montgomery County since 2017’s second quarter.

The chart demonstrates what every office property owner knows: vacancy climbed during the COVID pandemic and it has not yet recovered. Lincoln Property’s last three reports show an alarming spike in vacancy to 19.1%, up six points from five years ago. This is going to affect property valuations and therefore the county’s property tax receipts.

Construction Employment

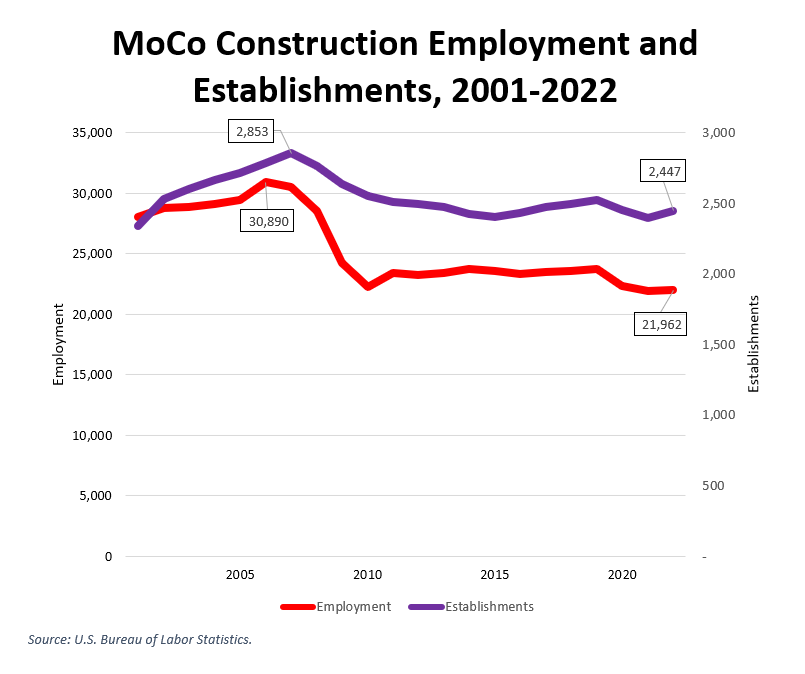

It’s easy for politicians and activists to demonize “evil developers,” but the fact is that the real estate industry directly supports the construction industry. The chart below from the U.S. Bureau of Labor Statistics shows what has happened to employment and the number of establishments in Montgomery County’s construction industry since 2001.

The sad fact is that the county’s construction industry has never recovered from the Great Recession. Establishment count is down 14% since its pre-recession peak. Employment is down an astounding 29%. These aren’t evil developers, folks – these are carpenters, laborers, electricians, plumbers, operating engineers and other skilled trades workers who are the backbone of the private sector middle class. Increasingly, these workers can’t find work in this county. What will happen to them if Takoma Park-style rent control stops homebuilding?

Damaging the housing supply, as rent control laws do, will have a worrisome impact on housing availability and affordability. Of equal concern is the impact of the above measures on the commercial sector. One of the primary differentiators in the property tax base between Montgomery County and the rest of Maryland is our commercial tax base, especially in the I-270/MD-355 corridor. Our county depends on this base to pay its bills. What happens if the combination of immense tax hikes, rent control and other new laws and regulations causes commercial owners to stop development, cash out and/or petition for reassessments at lower values? If enough of that happens, higher rates may not necessarily produce much more in revenue because they will be offset by a lower base. And as the commercial sector recedes, homeowners will be left holding the bag.

Montgomery County’s leaders must step back and evaluate all of these policies together. Yes, the county has serious needs in education and other areas. But if the real estate industry dies and the rest of the economy follows, not only will the schools suffer, so will the rest of us.