By Adam Pagnucco.

As the county council begins its debate about whether to scrap the tip credit for minimum wage, here are four facts about restaurants that must be part of the discussion.

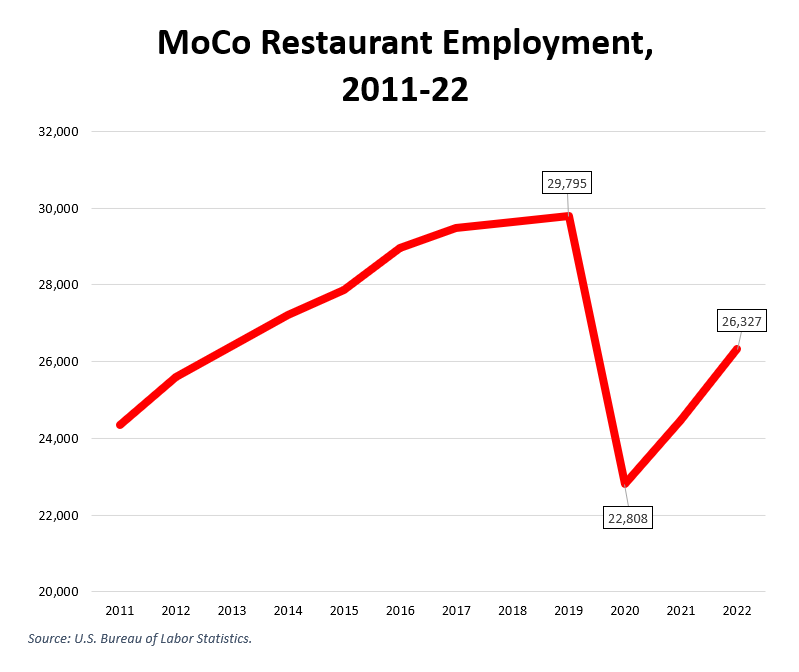

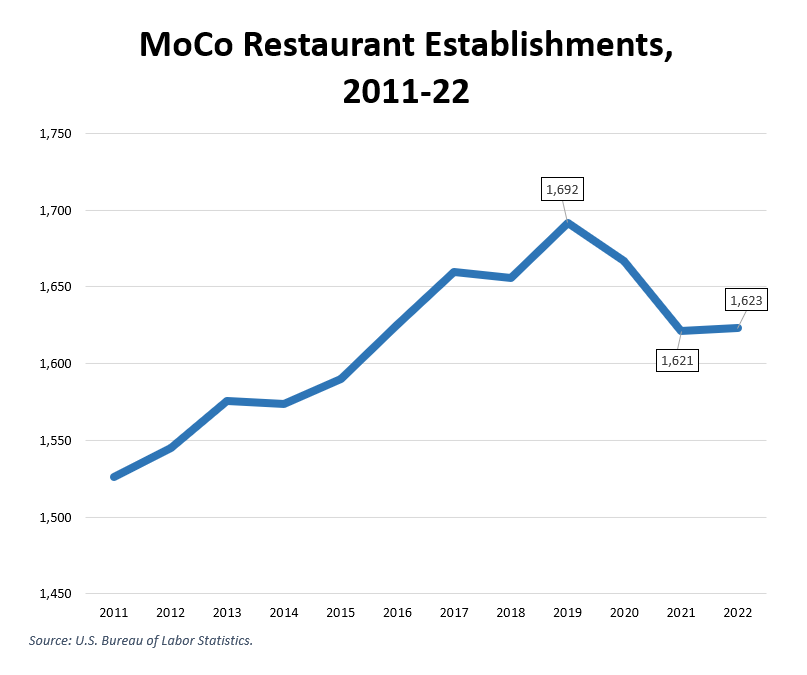

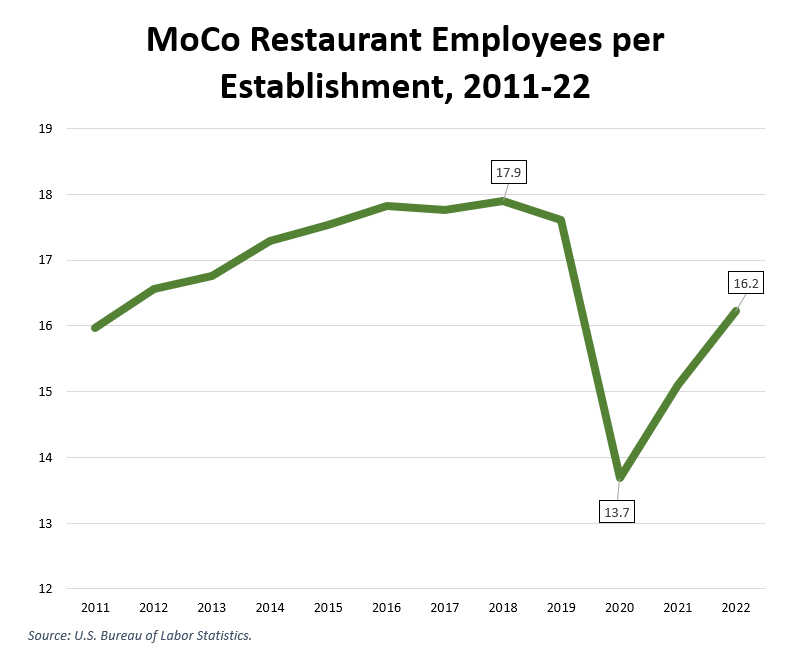

Montgomery County’s restaurants have not recovered from the pandemic.

The COVID pandemic was uniquely devastating for the county’s restaurant industry by discouraging customers, raising input prices and prodding temporary government restrictions. To illustrate the extraordinary damage this industry suffered, the charts below show employment, establishment count and employees per establishment in Montgomery County’s restaurant industry from 2011 (the earliest year available) through 2022.

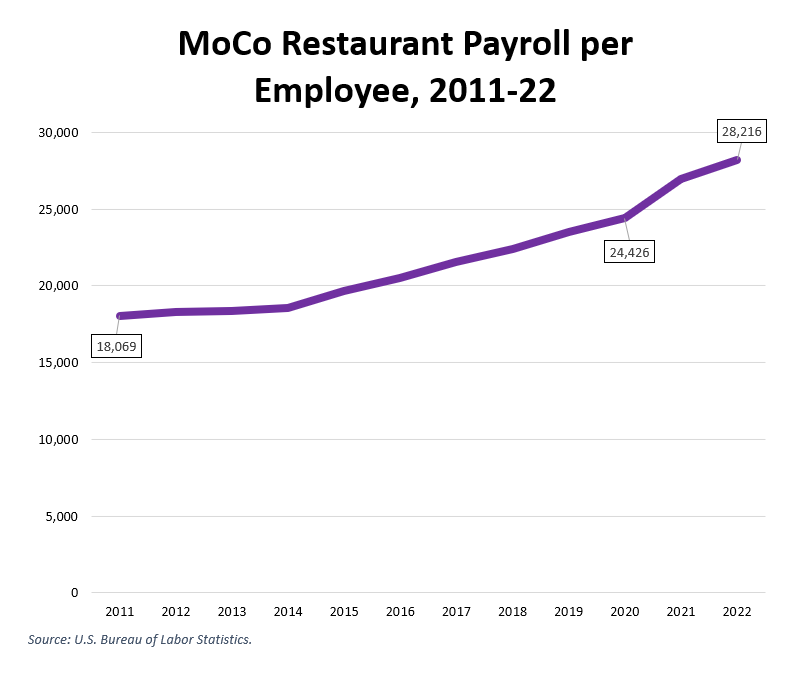

Payroll per employee has increased in the county’s restaurants.

Facing a labor shortage that has not abated since the pandemic, the county’s restaurants have increased pay. The chart below shows payroll per employee in Montgomery County restaurants from 2011 through 2022, but it has a big caveat: it is based on employer payroll data for purposes of unemployment insurance and is probably very spotty on inclusion of tips, especially those paid in cash. It also contains part-time jobs.

This data shows a 15.5% increase in wages in county restaurants from 2020 through 2022. That’s far higher than the 6.4% increase paid to all county private sector workers over the same period and reflects the impact of a very tight labor market – something that has greatly advantaged the restaurant workforce.

Restaurant prices are way up.

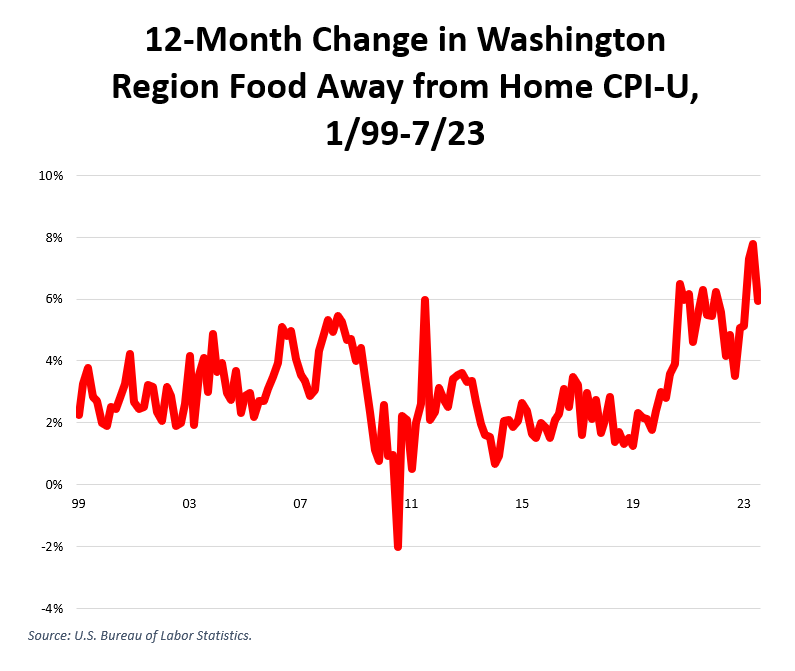

The chart below shows the 12-month change in the Washington-Arlington-Alexandria CPI-U’s food away from home component, which reflects restaurant prices, since 1999.

The twelve-month change in restaurant prices was +7.3% in March 2023 and +7.8% in May 2023. Those are the largest price hikes in the entire series and reflect the problems that the industry has had in adjusting to food price increases and labor shortages.

D.C. restaurants are instituting service fees to offset increased minimum wages.

In the District of Columbia, where voters have approved a phased-out ban of the tip credit, restaurants are instituting service fees and surcharges to pay for higher payrolls. MANY media outlets including Axios, Washingtonian, the Post, WUSA, WAMU and others have covered these fees. Some range up to 20% and the phaseout is just starting.

All Purpose DC Riverfront restaurant clearly states its 20% service charge at the bottom of its menu.

Back in April, Restaurant Business Online reported that 70% of D.C. restaurants planned to add surcharges and that 150 had already done so. Additionally, they reported:

Nearly 4 of 5 (79%) of the respondents said they’ll likely have to raise prices this year to counter the higher wages servers and bartenders will receive. Two-thirds said they’ll likely reduce their waitstaffs this year, and 3 of 4 reported that the needed money will come in part by tempering increases in the pay of back-of-house workers.

Still, many participants indicated that they’re giving up on what’s become one of the nation’s most vibrant dining markets. Forty-six percent they’d forgo Washington and open their next restaurant in nearby Virginia or Maryland, which both have a tip credit.

In July, one of D.C.’s fastest growing restaurateurs told Axios, “I’m not opening any more restaurants in D.C… The city is no longer welcoming to small businesses.”

Let’s put all of the above together. Ravaged by the pandemic, suffering from a labor shortage and facing large increases in food costs, area restaurants are sharply raising their prices. If they have to institute even more price increases to meet added payroll costs, at what point will consumers reduce their restaurant purchases? And if they do, what does that mean for restaurant employees?

The council must ask these questions as they consider whether to repeal the tip credit for minimum wage.