By Adam Pagnucco.

Montgomery County has suffered a net exodus of taxpayer income over the years. We are not alone as most other jurisdictions in the region have also experienced drains.

Why is this happening?

The Internal Revenue Service (IRS) data may show what is occurring but it does not state why. Here are a few factors that may be playing a role, both individually and in concert.

Rising telework

The spike in telework during the pandemic has not fully gone away. This does not explain pre-pandemic income losses but it probably explains at least part of the accelerating losses in D.C. and Arlington and the spike in gains for Frederick in 2020 and 2021.

Employment shift

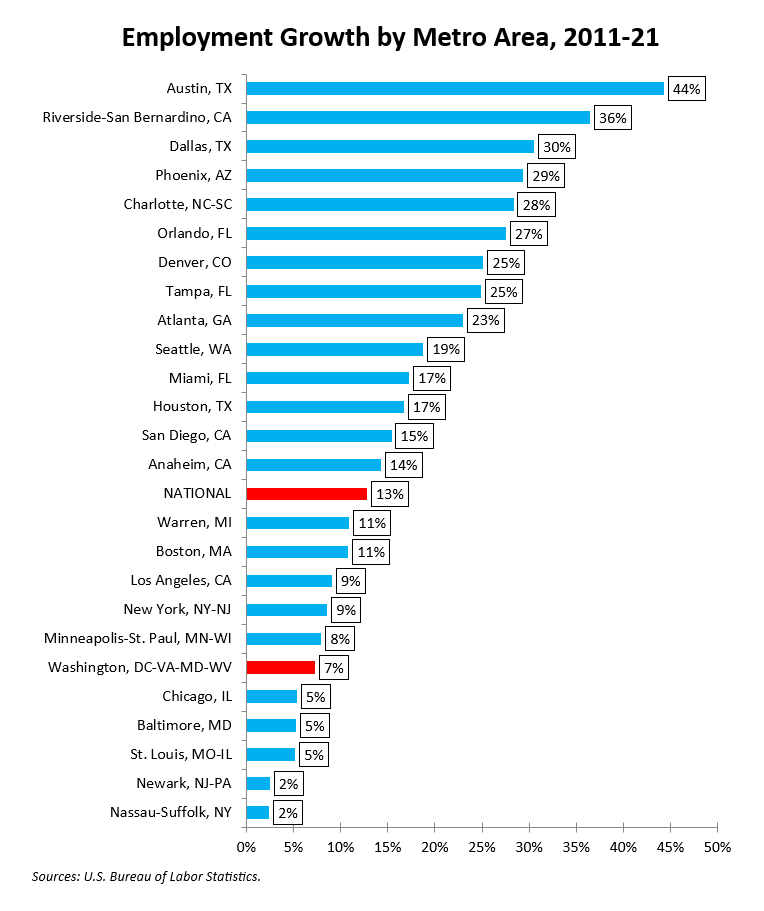

The chart below shows employment gains from 2011 to 2021 for the 25 largest metro areas in the U.S. The Washington region has been one of the slower growing large areas in the country. Could taxpayers be following job opportunities elsewhere?

Home prices

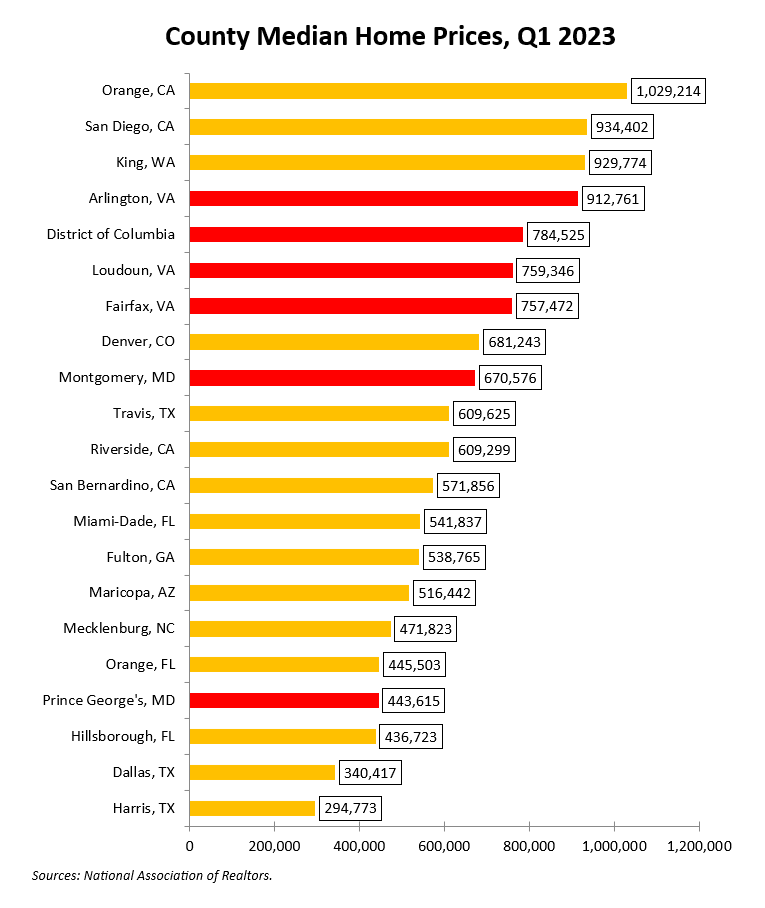

The chart below shows first quarter 2023 home sale prices from the National Association of Realtors for our region’s largest jurisdictions and the biggest counties in those metro areas that exceeded us in employment growth (as shown in the chart above).

Except for Prince George’s, our jurisdictions have more expensive home prices than most of our faster-growing competitors. The combination of slower job growth and pricier housing is not a great one for attracting migrants.

Cost of living

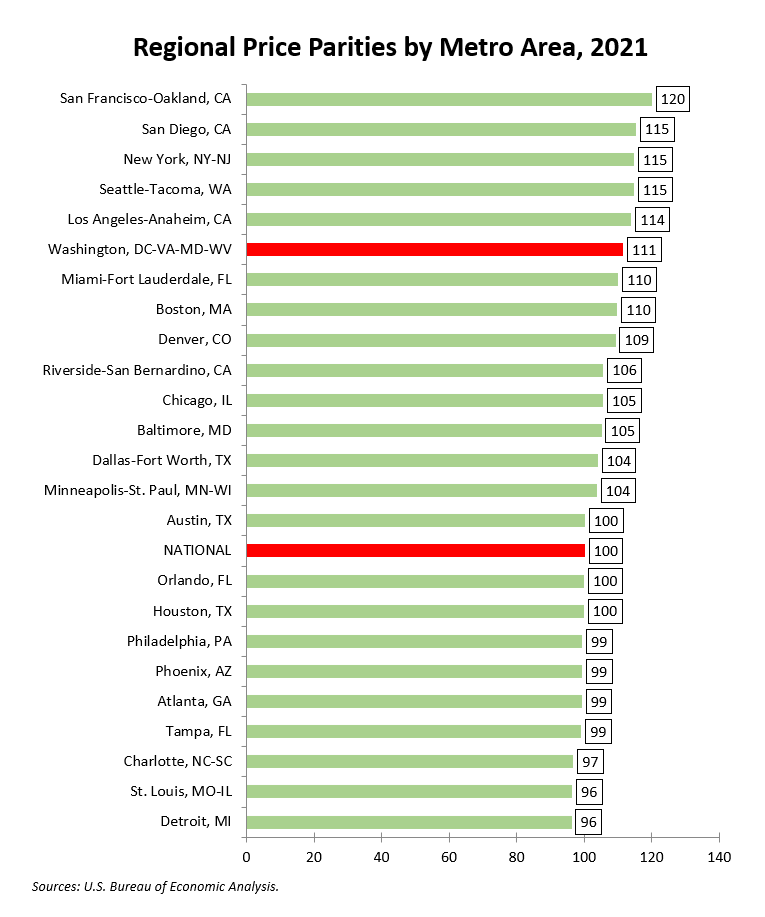

The U.S. Bureau of Economic Analysis calculates regional price parities for metro areas, which it defines as “the differences in price levels across states and metropolitan areas for a given year and are expressed as a percentage of the overall national price level.” The chart below shows how the Washington metro area compared to other metro areas on this measure in 2021.

Our cost of living is not a great deal for migrants, particularly given our slow employment growth.

Taxes

According to the Tax Foundation, Maryland ranked 35, D.C. ranked 39 and Virginia ranked 43 of the 50 states in state and local tax burdens in 2022. In terms of state business tax climate in 2023, Virginia ranked 26, Maryland ranked 46 and D.C. ranked 48. Taxes may be part of the reason for out-migration.

There is one tax that is more directly relevant to adjusted gross income movement than most others – the individual income tax. For those making $250,000 a year, the combined state and local income tax brackets are 9.25% for D.C., 8.95% for most of Maryland’s large jurisdictions (including Howard, Montgomery and Prince George’s), 5.75% for Virginia and zero for Florida. This provides a strong incentive for high income people to avoid living in Maryland and D.C. and their adjusted gross incomes have a disproportionate impact on out-migration statistics.

Two more taxes are noteworthy: estate taxes (which are charged to estates of people who have passed away) and inheritance taxes. Virginia has neither. D.C. has an estate tax. Maryland is the only state in the country that has both an estate tax and an inheritance tax. This cannot be a positive factor in getting wealthy people to retire in Maryland.

The combination of slow employment growth, relatively high income taxes on high earners (at least in Maryland and D.C.), high home prices and high cost of living is probably not an attractive one for domestic migrants. All of that comes on top of estate taxes in D.C. and Maryland and Maryland’s inheritance tax, both of which encourage wealthy retirees to move. Unless these factors change, we are likely to see more out-migration of taxpayer income from Montgomery County and much of the rest of the Washington region.