By Adam Pagnucco.

CASA, the Maryland-based immigrant rights group, has taken a lot of criticism over its statements about Israel for which it has now apologized. But that criticism has extended to its simultaneous pursuit of taxpayer-funded contracts and advocacy. I discussed its non-profit structure in a previous post. Today let’s discuss its political spending.

CASA’s structure, like that of many other non-profit advocacy groups, is complicated. It operates through three primary entities:

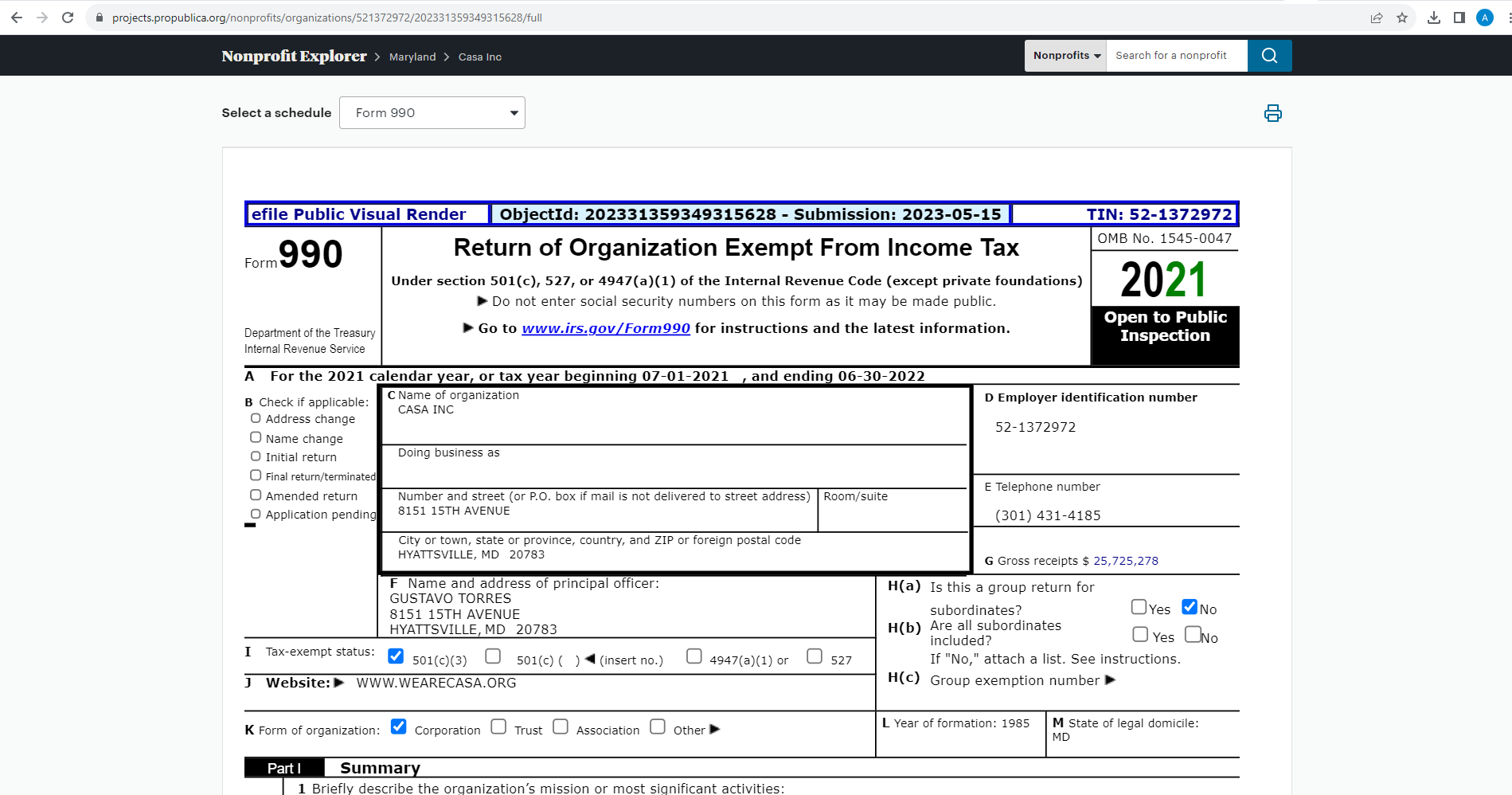

Casa Inc., commonly known as CASA, is a nonprofit with a 501(c)(3) tax status. As a C3, donations to Casa Inc. are tax deductible but it can only engage in limited lobbying with no electoral activity.

Casa in Action is a nonprofit with a 501(c)(4) tax status. As a C4, donations to Casa in Action are not tax deductible. It can engage in lobbying and limited electoral activity.

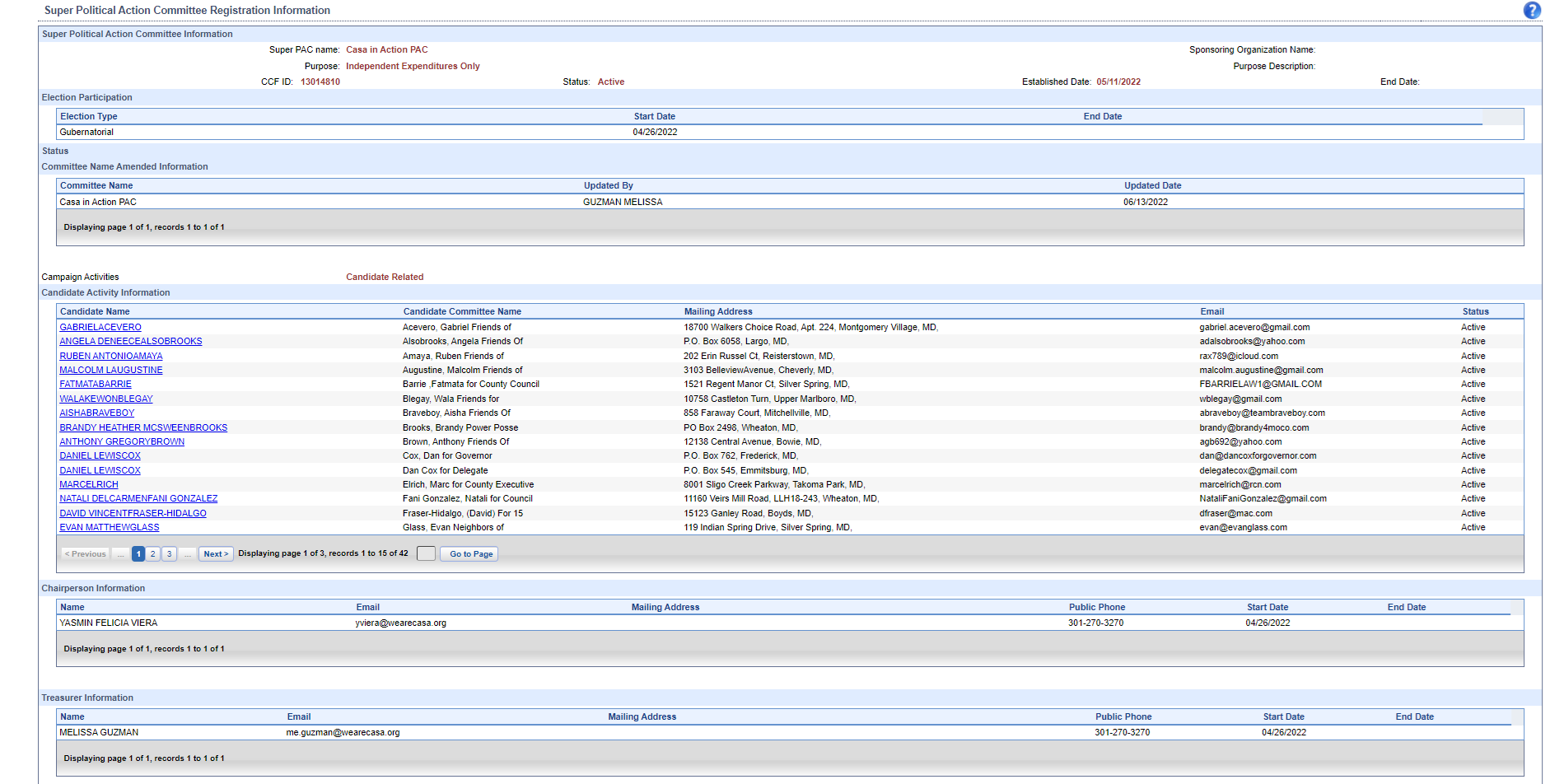

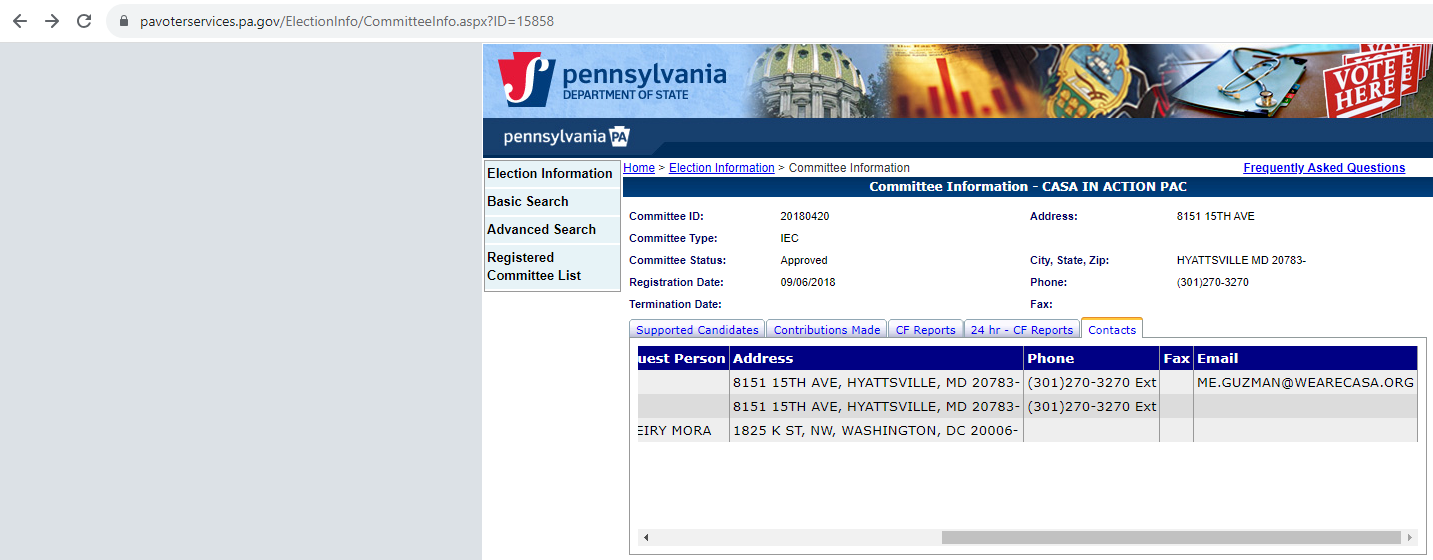

Casa in Action PAC is a Super PAC registered with the U.S. Federal Election Commission (FEC), the Maryland State Board of Elections (SBE) and the Pennsylvania Department of State. Super PACs may accept unlimited contributions from individuals, corporations, labor unions and other PACs and spend them to support or oppose candidates. Unlike C3s and C4s, Super PACs must itemize their contributions in publicly available filings to both the FEC (federal level) and SBE (in Maryland). They are not allowed to contribute directly to candidate accounts and may not coordinate with them under both federal and state law. In practice, the prohibition on coordination is rather weak.

These three entities are legally separate but operate from the same office building and are run by many of the same people. Casa in Action even calls them “the CASA family of organizations” on its website. So we will too.

The CASA family.

CASA Inc., the C3, receives private funding and millions of dollars in government contracts and grants every year. At least some of the latter are awarded on a noncompetitive basis, with one such contract in Montgomery County dating back to FY 2004. According to its IRS filings, a majority of the C3’s budget came from taxpayers in 2022. The C3 has tripled its revenues and quadrupled its net assets since 2018.

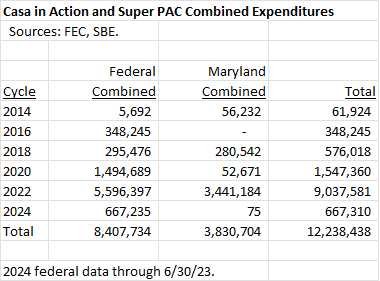

The CASA family has used a variety of entities for political activity. The table below summarizes the federal spending of FEC committees C90015215, C70006481 and C00685693 – the latter being the family’s Super PAC. It also summarizes the Maryland state and local spending of CASA in Action’s independent expenditure committees of 2014 and 2018, its participating organization of 2018 and the Super PAC, first registered in Maryland in 2022. Note that state and local spending outside Maryland is excluded, so these numbers are probably underestimates of total activity.

In terms of how they spend money, Casa in Action and the Super PAC don’t rely on contributions to candidates like traditional PACs. Instead, they run their own campaigns either supporting or opposing candidates. In breaking down Maryland state and local spending of the two entities since 2014, I find that 38% of their money was spent on salaries and compensation, 24% was spent on media and 18% was spent on field.

In addition to its massive growth, two characteristics of the CASA family’s political activities stand out.

The Super PAC takes millions of dollars from C4s, including Casa in Action.

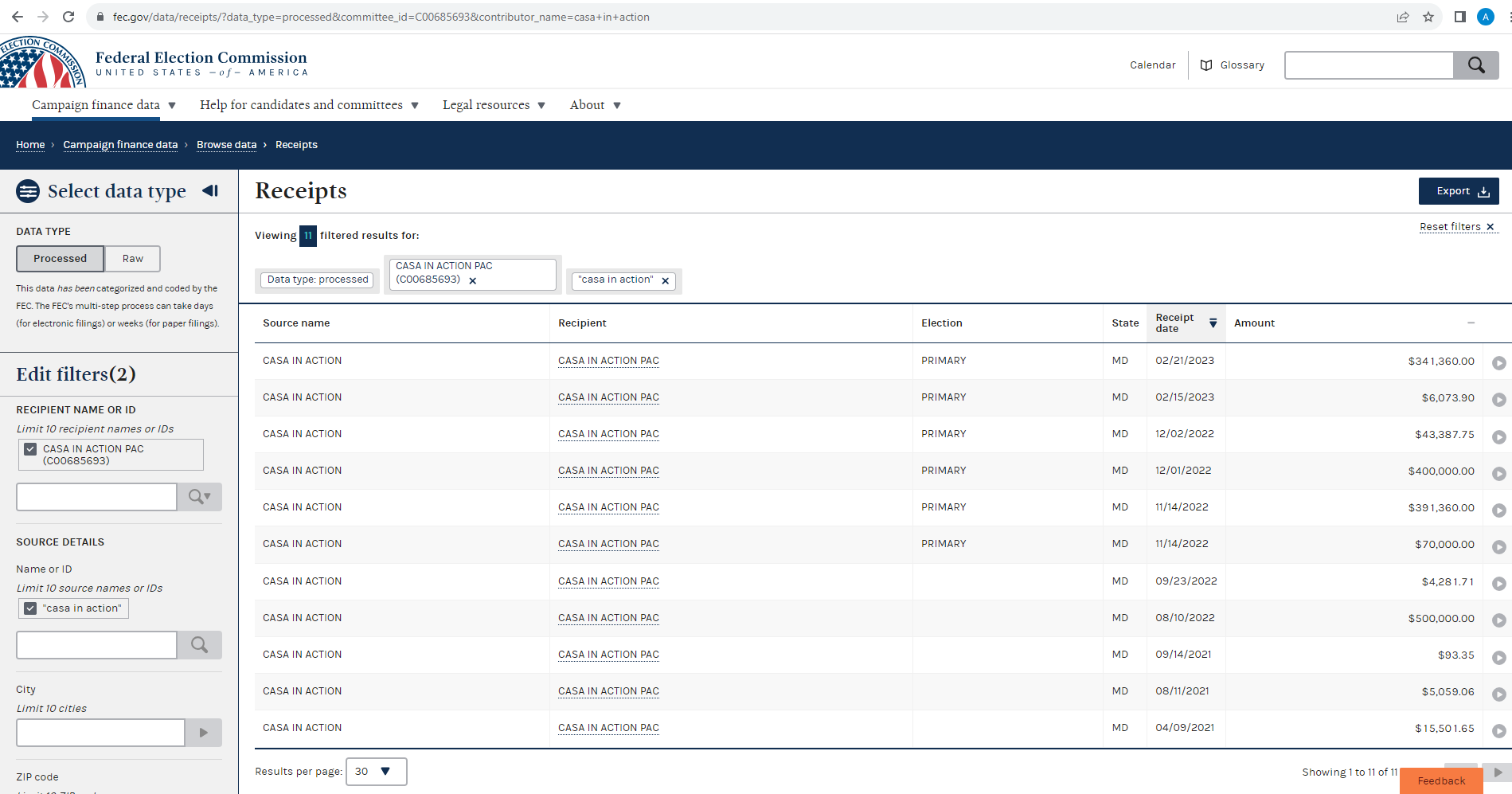

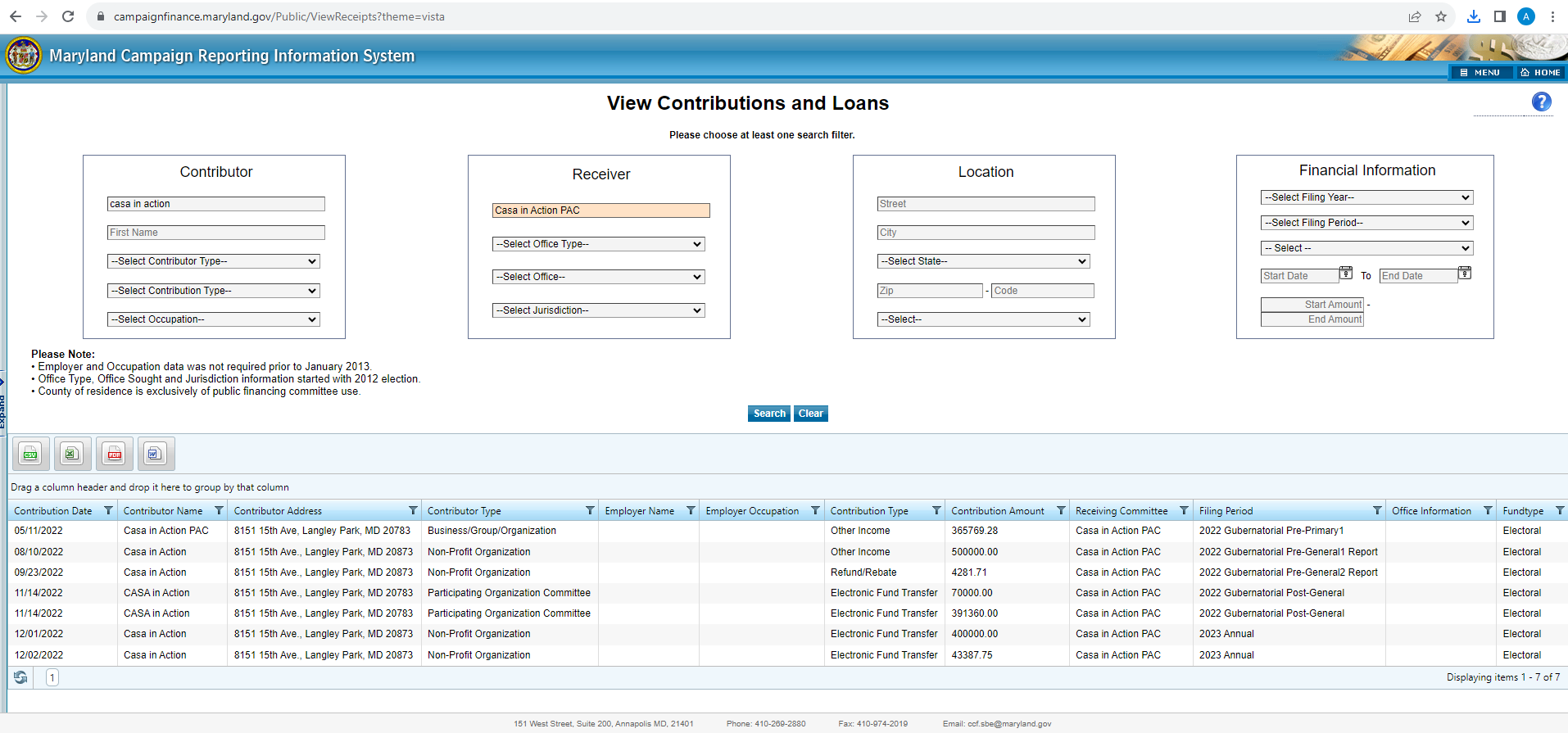

It’s hard to tell what some of the contributors to the Super PAC are but many of them have C4 tax status according to their IRS filings, and the latter give millions to the Super PAC at the federal and state levels. Casa in Action, Casa’s own C4, has given at least $1.41 million to Casa’s Maryland Super PAC and $1.78 million to Casa’s federal Super PAC. The Super PAC has in turn paid money back to Casa in Action. Its July 2023 FEC filing shows the Super PAC paying off debt to Casa in Action for “staff time canvassing management.”

Examples of Casa in Action sending money to Casa’s Super PAC at both the federal and state levels.

Why would the Super PAC take money from C4s? American Civil Liberties Union General Counsel Terence Dougherty explained one reason for such transactions in a 2013 Seattle University Law Review article.

While Super PACs are unlimited in the funds they can raise—including from any single donor—and expend to make partisan communications, they are required to disclose the donors funding these expenditures. Presumably because there are donors who would like to donate to a Super PAC but also would like their contributions to remain anonymous, some individuals who have set up Super PACs also have set up a Section 501(c)(4) organization to which these donors instead contribute, and the Section 501(c)(4) organization donates these contributions to the Super PAC. These Section 501(c)(4) organizations often share the same office space, staff, and other resources as the Super PAC. Because donors to Section 501(c)(4) organizations are not publicly disclosed—donors of $5,000 or more are disclosed to the IRS, but on a section of the form that the IRS will only make public, and will only require the Section 501(c)(4) organization to make public, after redacting the names of donors—a donor that wishes to fund “attack ads” anonymously can donate to the Section 501(c)(4) that is aligned with the Super PAC, and the Section 501(c)(4) can contribute those funds to the Super PAC; the Super PAC only discloses the Section 501(c)(4) as its donor—not the identity of the donor to the Section 501(c)(4).

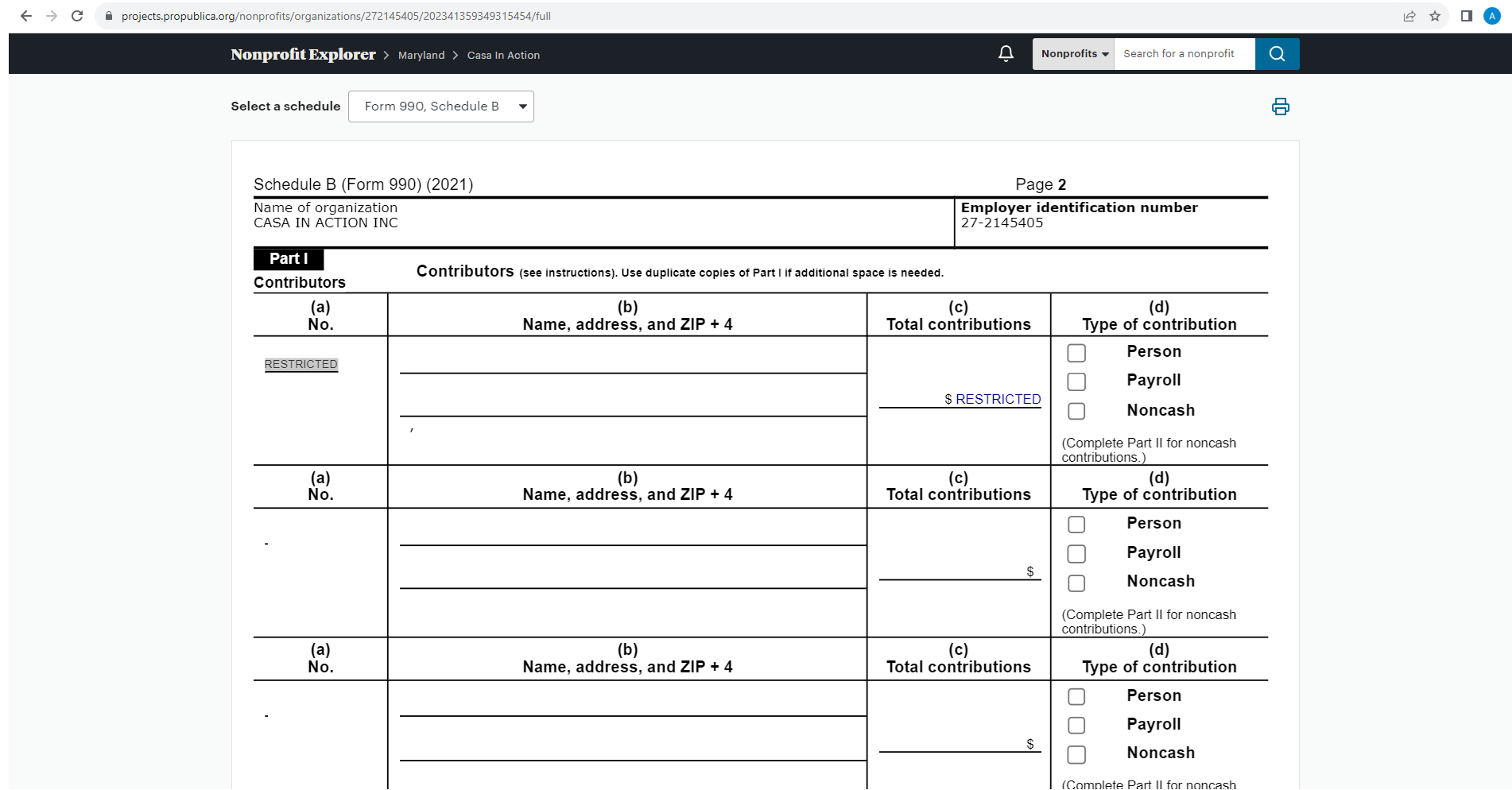

This is why C4s are a major source of dark money for groups all over the political spectrum. As for Casa in Action, the screenshot below from its 2022 IRS filing shows that its listing of contributors is “restricted.”

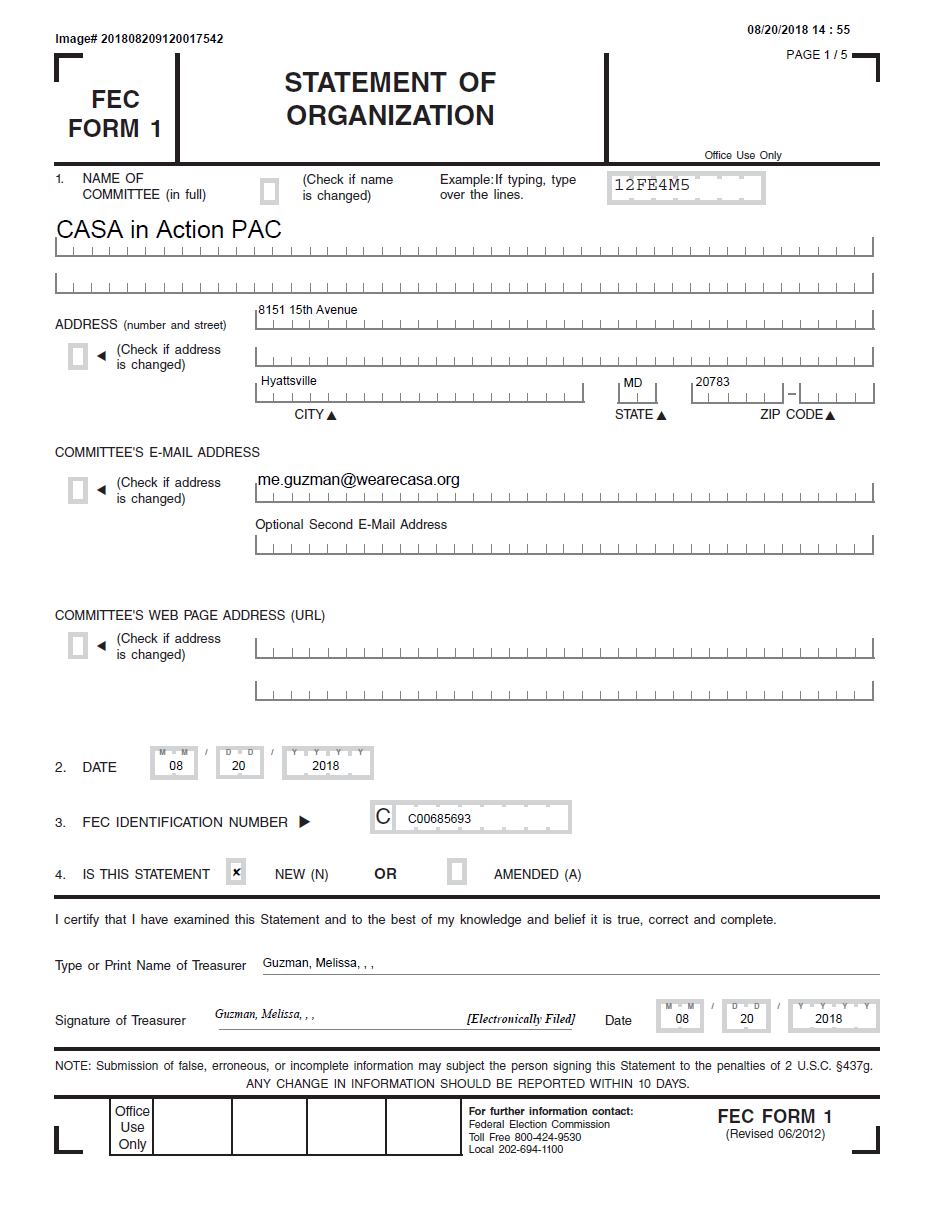

The Super PAC’s officers use email addresses from the C3.

The screenshots below are excerpts from the federal, Maryland state and Pennsylvania state registrations of the Super PAC. Yasmin Viera, the chair listed on the Maryland registration, is currently the Director of Development of Casa Inc. (CASA), the C3. Melissa Guzman, the treasurer on all three registrations, is currently the Chief Operating Officer of Casa Inc. (CASA), the C3.

Note the email addresses used by the PAC officers in the above three filings: they use the domain name “wearecasa.org.” That’s the domain name of the CASA C3’s website. It’s also listed as the CASA C3’s website in its IRS Form 990 filings as shown below.

Is the C3 involved in administering the Super PAC? If so, that would be a major problem for the IRS. Contributions to C3s are tax deductible and they are supposed to stay out of elections. The IRS has written, “Under the Internal Revenue Code, all section 501(c)(3) organizations are absolutely prohibited from directly or indirectly participating in, or intervening in, any political campaign on behalf of (or in opposition to) any candidate for elective public office.”

In summary, CASA has a strong political arm using both its C4 and its Super PAC. The CASA family’s use of C4s, which often do not disclose donors, to fund its Super PAC should be of interest to good government progressives. The use of C3 email addresses to run the Super PAC should be of interest to the IRS as well.