By Adam Pagnucco.

The State of Maryland’s ability to fund transportation projects is in serious jeopardy. Let’s begin exploring why by discussing its revenues.

The Transportation Trust Fund (TTF) is used by the Maryland Department of Transportation (MDOT) to fund operations, maintenance and construction of roads, transit, airports, the Port of Baltimore and the Motor Vehicle Administration. This represents almost all state-level transportation work other than toll projects (which are discussed later below). TTF capital funds are expended through a six-year plan known as the Consolidated Transportation Program (CTP), which is updated annually.

The TTF has a variety of revenue sources. Their distribution and uses in FY23 are shown below.

Many of these revenue sources have problems.

Motor Fuel Taxes

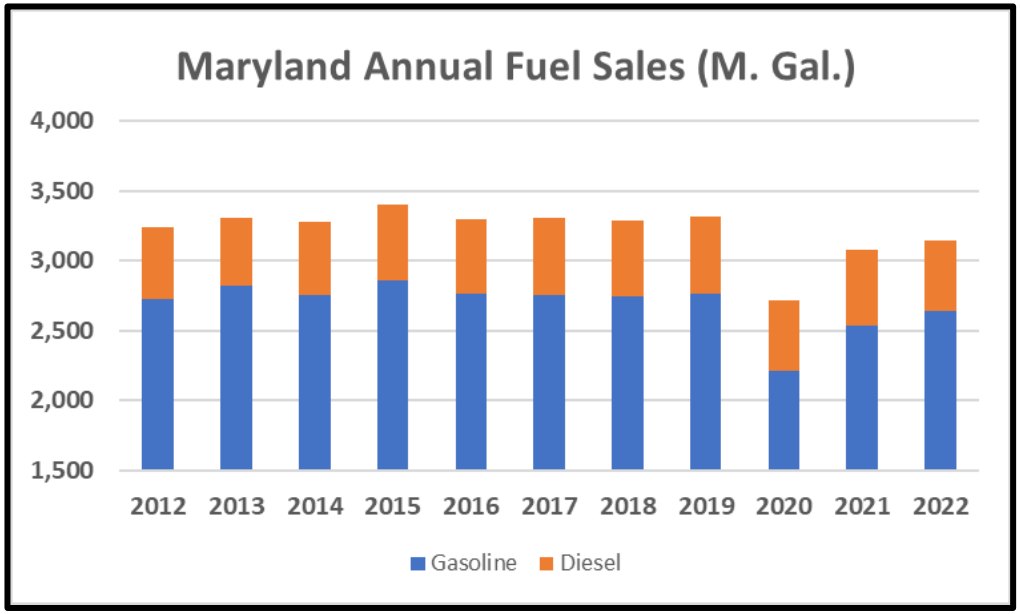

The state imposes a gasoline tax per gallon that has been increased almost every year since 2013. The problem with this tax is that sales of gasoline and diesel were flat for several years before falling during the pandemic and not recovering since. The chart below from a presentation to the state’s Commission on Transportation Revenue and Infrastructure Needs (TRAIN Commission) shows sales over the last decade.

The impact of sales on revenues has been somewhat mitigated by substantial gas tax hikes in the last two years. But it has not been enough as MDOT has commented, “Fuel tax revenue is declining over time due to increased fuel efficiency and electrification of vehicles.”

Electric and Low Emissions Vehicles

The slide below from a presentation to the state’s TRAIN Commission shows skyrocketing registrations of electric vehicles, which do not pay gas taxes, since 2016.

MDOT projects that these vehicles will comprise 26% of Maryland’s light duty vehicles by 2031. While they are great for controlling greenhouse gas emissions, they are terrible for the TTF.

Passenger Fare Revenue

MDOT supports two transit agencies: WMATA and the Maryland Transit Administration (MTA). Both depend on revenue from passengers for a substantial portion of their budgets. However, that revenue has been severely damaged by the pandemic, not just in Maryland, but nationally. The chart below from the American Public Transportation Association, which calls this a “fiscal cliff,” shows the national impact of the pandemic in real dollars through 2020.

This has been a problem in Maryland. MDOT has said, “Transit ridership and revenue at MTA and WMATA have not recovered from the COVID19 pandemic, and the long-term recovery of ridership and revenue remains uncertain.” As for WMATA, its 2022 annual comprehensive financial report shows that its operating revenues began to decline as early as 2015 and then dropped by two-thirds during the pandemic.

Federal Money

Federal funds account for roughly a fifth of the TTF and they were temporarily increased during the pandemic. That masked preexisting state revenue problems which are now returning as COVID funds expire. MDOT has commented:

In 2019, the Department of Legislative Services identified that Maryland’s transportation revenues were failing to meet the Department’s capital needs. In 2020, one-time federal COVID relief money provided $1.8 billion to MDOT and $2.8 billion to the Washington Metropolitan Area Transportation Authority (WMATA) to help sustain critical transportation services despite the significant impacts of COVID on transportation usage and revenues. These funds will be fully exhausted in FY 2024, and the structural budget deficits present in 2019 will return if no action is taken.

Furthermore, most federal money comes with a catch: it requires state matching funds. That means that state revenue shortfalls endanger federal money and can’t necessarily be cured by federal money.

Tolls

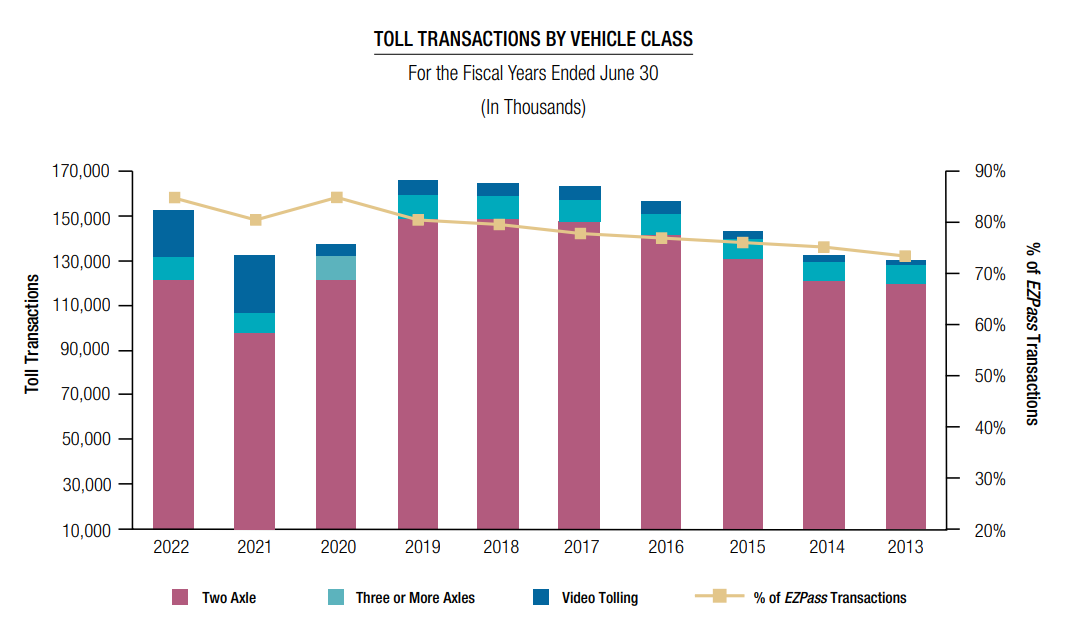

Finally, let’s look at toll revenues, the major source of revenue for the Maryland Transportation Authority (MDTA). The agency is separate from MDOT and uses tolls to operate toll roads and finance debt used to build toll roads. According to MDTA’s 2022 annual comprehensive financial report, the number of toll transactions was damaged by the pandemic and has not recovered as shown in the chart below.

Toll revenue in FY22 was $703 million, up from $585 million in the pandemic year of FY20 but not much higher than the $685 million collected in FY19. Toll revenue growth has been constrained by three rounds of toll cuts under former Governor Larry Hogan and, as we shall see, has not kept pace with recent increases in operating expenses.

This is just a partial list of the state’s transportation funding headaches, but let’s look at the big picture. A combination of the pandemic, declining fuel sales, a switch to electric and low emissions vehicles, a flight from transit and other factors has decimated state transportation revenues, and that’s in addition to toll cuts.

We will look at costs next.