By Adam Pagnucco.

In a brand new six-year fiscal plan, the county government’s Office of Management and Budget (OMB) reports that the county is projecting an unexpected windfall of more than $100 million in each of the next two fiscal years, with even higher amounts projected in out years. So why is County Executive Marc Elrich talking about tax hikes?

First, Elrich has a long history of supporting tax increases. He voted for four big ones – a 13% property tax hike in FY09, an energy tax hike in FY11, a recordation tax hike in FY17 and an 8.7% property tax hike in FY17 – when he was on the county council. As county executive, he proposed a property tax hike as soon as the pandemic hit and followed with a recommended 10% property tax increase three years later. (The county council scrapped the earlier tax increase and cut the later one by more than half.) Elrich has also favored a charter amendment to make property tax increases easier, supported raising income taxes on high earners and vetoed two bills that cut taxes on development in 2020 as well as another one last month. Lately, he has expended much energy on behalf of a proposal to raise commercial property taxes, an option he is raising once again as Donald Trump resumes the presidency. The problem with the latter idea is that Elrich needs authorization from the state to do it, but he will keep asking nonetheless.

Against this backdrop of tax talk, county OMB Director Jennifer Bryant has written the county council with happy news: revenues are coming in over estimates by more than $100 million in this fiscal year and the next. In a December 5 memo containing the county’s latest six-year fiscal plan, Bryant writes:

The updated Fiscal Plan reflects an upward revision in FY25 revenues of $132.1 million and an upward revision in FY26 revenues of $127.7 million compared to the FY25 Approved Fiscal Plan. The FY24 Preliminary Year-End Closeout results in an increase of approximately $63.6 million in anticipated reserves compared to estimates in the approved fiscal plan. This results in FY24 preliminary actual reserves at 15.8 percent, exceeding the County’s 10 percent reserve policy by $375.1 million.

Why are revenues up? Bryant elaborates:

The Department of Finance’s December 2024 Revenue Update and Economic Indicators reflects an upward revision in FY25 tax revenues of $132.1 million from the approved fiscal plan. This revision is based on updated economic assumptions and recent tax collections data and reflects the state of most tax revenues through November 2024. The taxes most affected are the income tax (up $124.1 million from the approved fiscal plan); the property tax (up $1.9 million); the combined transfer tax and recordation tax (up $14.3 million); and excise taxes (down $8.3 million). FY26 revenues are $127.7 million more than estimated in the approved fiscal plan due to upward revisions in the income tax of $66.7 million, $56.5 million in the property tax, $18.7 million for combined transfer and recordation taxes, and a downward revision in excise taxes of $14.1 million.

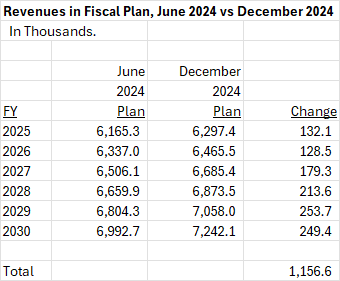

Increased revenue projections pertain not just to this fiscal year and the next one, but also through FY30. The table below compares total revenues between the June 2024 fiscal plan and the newest one Bryant just released. Over the six year period of FY25-30, total projected revenues have been revised upwards by more than $1.1 billion.

What does this mean? As I have previously written, Montgomery County has problems with economic competitiveness that have posed challenges to revenue growth. However, the county’s revenue estimates have been very conservative of late, which has bailed out county leaders who are eager to spend money. Oh the joys of tight-fisted green eye shades in the finance department!

Now let’s not over-sell this. The danger of Trumpism is real. But it won’t materialize overnight and now the county has a billion-dollar revenue pad to deal with it.

So why would any county leader propose a tax hike?

Bryant’s memo and the new fiscal plan can be downloaded below.