By Adam Pagnucco.

In a budget message sent yesterday, County Executive Marc Elrich is blaming a collapse in impact tax collections for his recommended cut to the Capital Improvements Program (CIP), which is the county’s six-year capital budget.

First, the CIP is a six-year plan financed by many revenue sources including general obligation bonds (which are backed by the full faith and credit of county government), state and federal aid, impact taxes charged on new development, recordation taxes on property sales, cash and many other smaller pots of money. Every even year, the county executive develops a new six-year CIP and sends it to the county council for review, changes and approval. Every odd year (like this year), the county executive recommends amendments to the CIP which are sent to the council. Because many revenue sources (like impact taxes) are volatile and project schedules often change, amendments can be substantial.

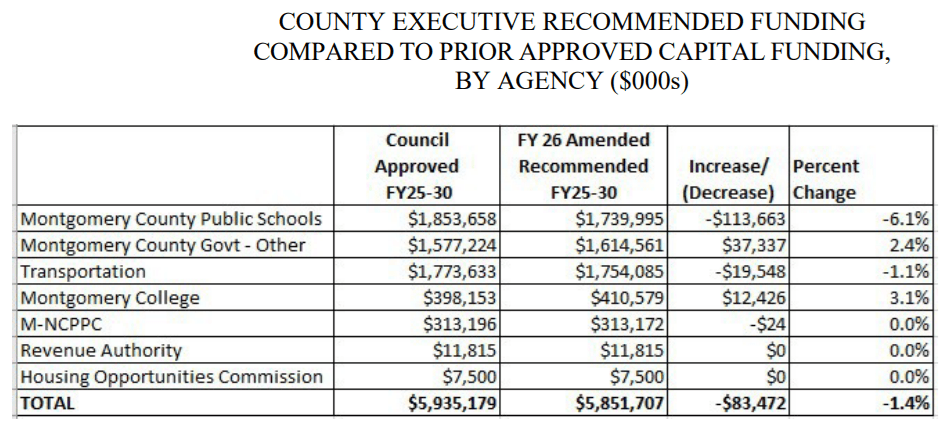

This year, the executive is recommending a cut to the capital budget of 1.4%, including a 6.1% cut to school construction. His message contains the table below.

Elrich writes:

This biennial budget recommendation totals $5.85 billion, an $83.5 million, or 1.4 percent, decrease from the prior approved CIP. While my recommended CIP continues progress on important projects to advance critical policy goals including education, economic development, transportation, and core infrastructure with limited disruption to previously approved projects despite constrained resources and growing cost pressures, this CIP was not developed without difficult decisions. Some projects are deferred, and I am painfully aware that, without more funding, we are limited in our ability to solve local problems and to build the kind of healthy, just, sustainable, and economically vibrant community we want for our residents.

He adds: “Inflation, labor shortages, and a tight construction market continue to be felt in projects across County government.” That statement could apply to the state’s capital budget as well.

Why must the capital budget be cut? Elrich writes this.

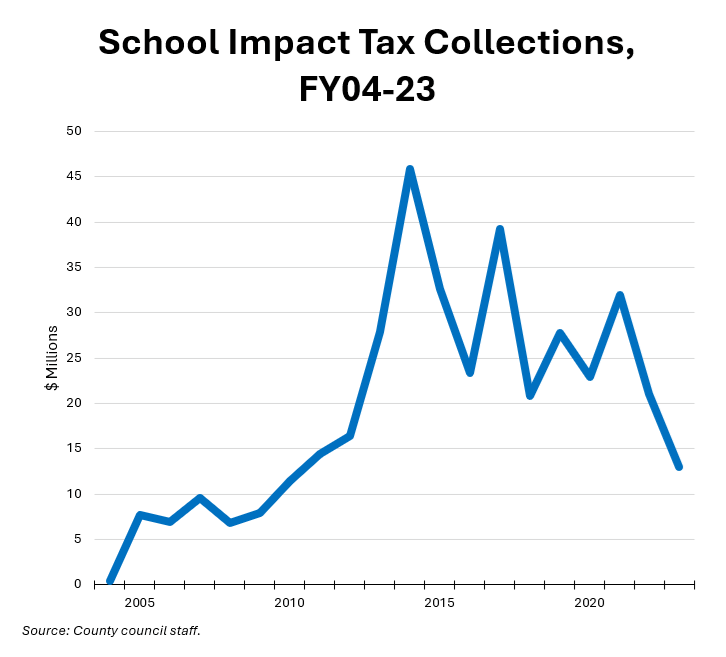

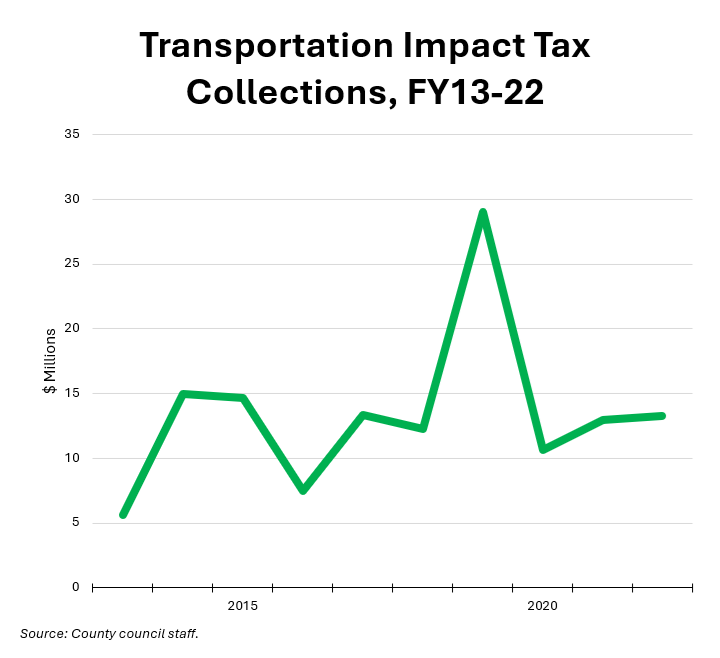

The most dramatic change in CIP funding sources occurred in impact tax receipts. Based on updated estimates, the recommended CIP assumes the use of $197.3 million in transportation impact taxes and school impact taxes – a $69.6 million reduction in CIP funding compared to prior approved estimates. The Department of Finance reduced the forecast of school impact tax estimates for the FY25-30 CIP after a decrease in FY24 collections to levels not seen since the Great Recession. Ten years ago, in FY14, the County collected $60.8 million in school and transportation impact taxes, compared to FY24 collections totaling only $15.6 million, a reduction of $45 million or 74.4 percent. While the FY24 shortfall is mostly attributed to sluggish development activity, the Council continues to pass legislation eroding this important revenue source without first identifying a feasible replacement.

Elrich goes on to single out a recent pair of council bills, including one he just vetoed, as allegedly reducing impact tax collections. And he reiterated his call for higher tax rates on commercial property, which would require approval from the General Assembly to implement.

Impact tax collections are not a new issue for the capital budget. Montgomery County has two of them: one applying to residential development to finance school construction and another applying to all development to finance transportation projects. According to the General Assembly’s Department of Legislative Services, Montgomery County has the highest impact tax rates in Maryland.

Impact tax collections do not appear in the county operating budget revenue schedules since they go to the capital budget. However, I was able to use county council staff packets from 2019, 2023 and 2024 to piece together the following two charts showing recent collections for the school impact tax and the transportation impact tax.

Note that these charts exclude half-year data for FY24 ($2.4 million for schools) and FY23 ($5.2 million for transportation). Those amounts would not change the trends shown above.

Aside from a one-time windfall of $29 million in transportation impact taxes in FY19, these charts show stagnation (in transportation) and decline (in schools). Why is this happening? The answer is that the county’s broad pattern of economic weakness, which I am currently chronicling in a multi-part series, is damaging its ability to collect taxes from real estate development. Even Elrich, a long-time development skeptic, blames “sluggish development activity” for most of last year’s impact tax shortfall. One wonders how much the county’s imposition of rent control, which is known to discourage rental housing construction, has contributed to this.

Economic weakness has real consequences, folks. Not only does it hold back our operating budget, it also prevents us from building the school, transportation, public safety and other capital projects that we need.

Unless county leaders truly focus on turning around our non-competitive economy, these problems will continue.