By Adam Pagnucco.

Part One summarized the premise of this series: an examination of key stats from the U.S. Bureau of Economic Analysis (BEA) comparing Montgomery County to its largest neighbors. Part Two looked at population. Part Three looked at gross domestic product (GDP). Part Four looked at per capita GDP. Part Five looked at personal income. Part Six looked at per capita personal income. Part Seven looked at wage and salary employment. Part Eight looked at proprietors employment – jobs held by the self-employed. Now we will examine proprietors income.

BEA defines proprietors income this way:

Current-production income of sole proprietorships, partnerships, and tax-exempt cooperatives. Excludes dividends, monetary interest received by nonfinancial business, and rental income received by persons not primarily engaged in the real estate business.

This income is considerably more variable than wage and salary payments as it depends on business risk. As proprietors jobs grow (and they are now at roughly a third of MoCo’s total employment), residents’ income – and county government revenues – will become more erratic over time.

In this series, I use the Washington-Arlington-Alexandria CPI-U to convert nominal proprietors income into 2022 dollars, thereby adjusting for the effects of inflation.

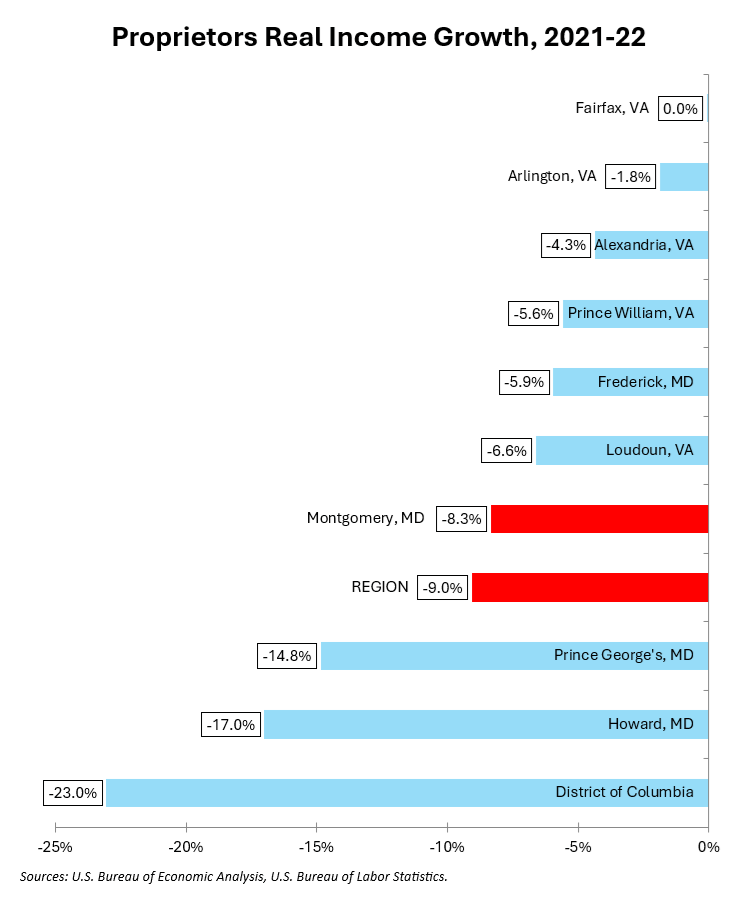

The chart below shows real proprietors income growth (adjusted for inflation) for the large jurisdictions in the region in the most recent year measured.

2022 was a bad year for proprietors. Across the region, proprietors income fell by 3.0% in nominal terms. But because prices grew by 6.6%, real proprietors income fell by 9.0%. MoCo proprietors saw their real income drop by close to the regional average.

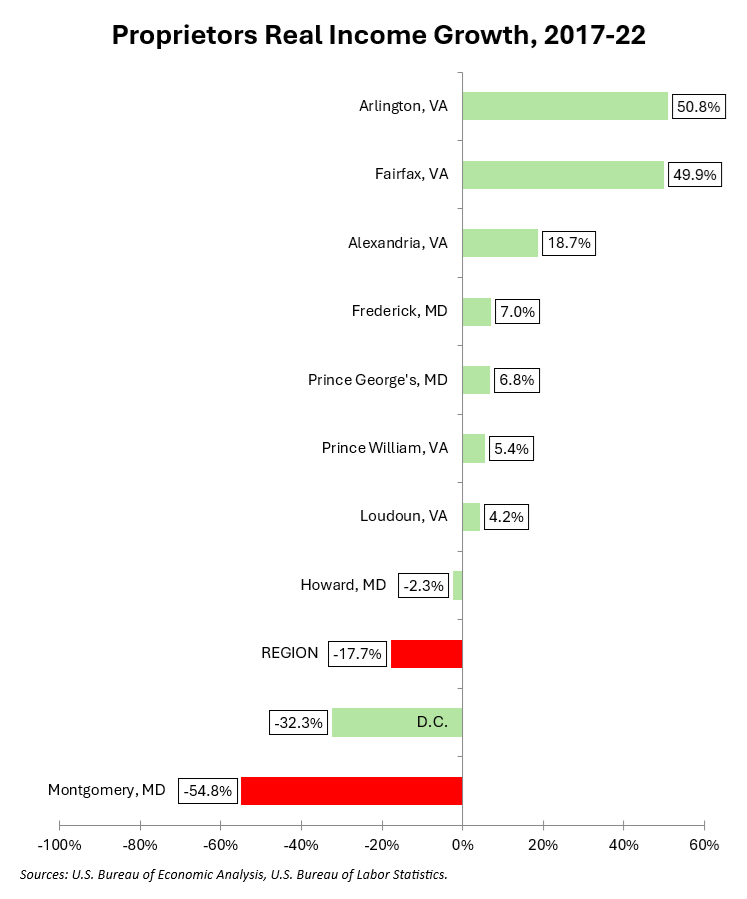

Now let’s look at the five-year change.

MoCo proprietors were absolutely clobbered over the last five years. Aside from D.C., this was unusual for the region.

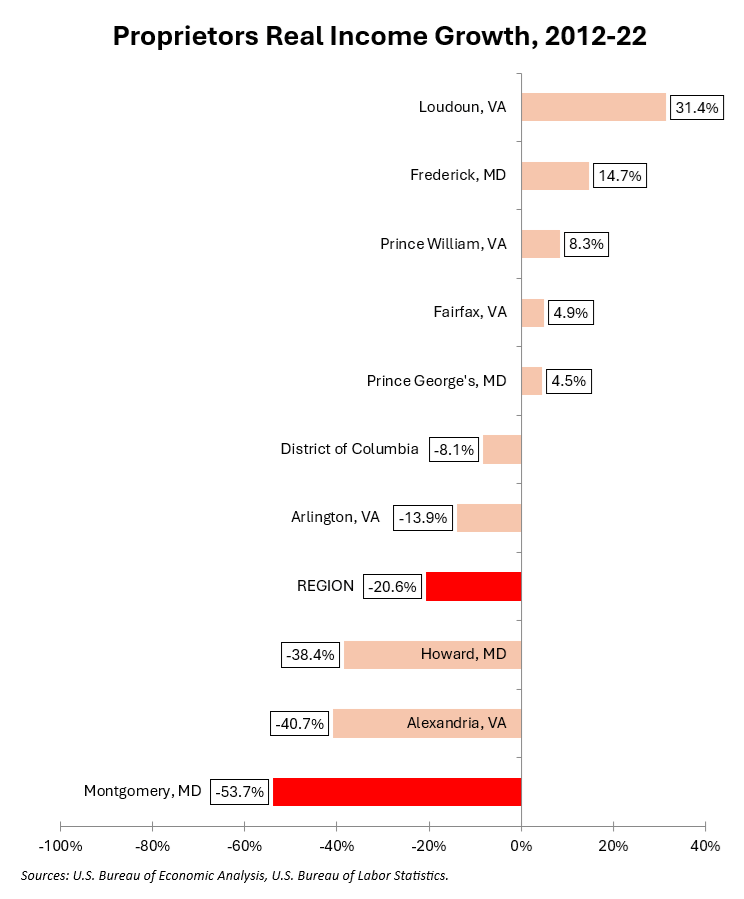

This chart shows the ten-year change.

Again, MoCo was worst in the region over this decade although a few of its neighbors also fared badly.

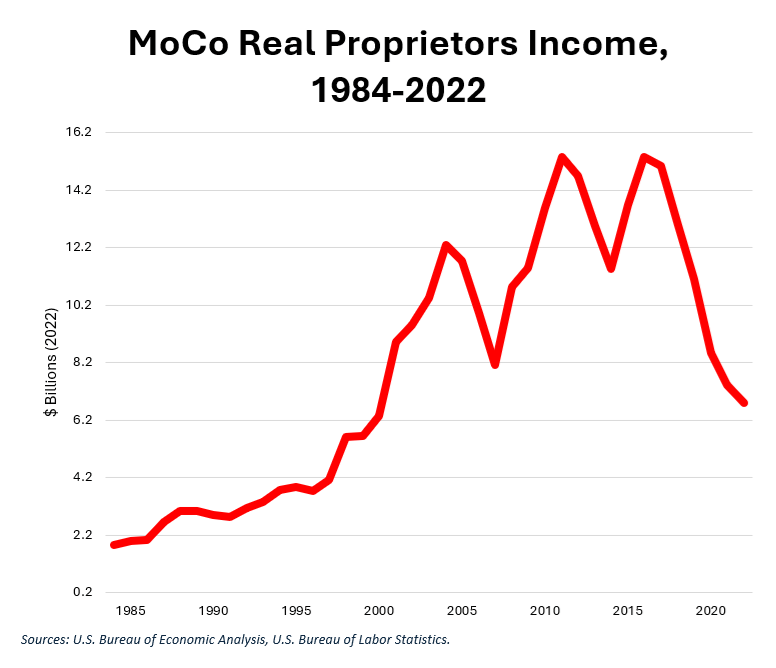

What is going on here? Proprietors income is extremely volatile. The chart below shows real proprietors income in MoCo since 1984. It illustrates a story of continued growth through the early 2000s followed by wild swings. If I were a county government leader, I would not want my revenues tied too closely to this kind of income. But through the income tax – and also in the context of stagnant payroll employment – county revenues are increasingly dependent on this kind of income.

One question I have about this data is whether a relatively small number of highly compensated people are driving it. Do these shifts in income reflect the experiences of a large number of workers or a small number of self-employed people with boom-and-bust income streams? Whatever is going on here, it has negatively contributed to the county’s economy of late.

Next: we will begin looking at the construction industry.