By Adam Pagnucco.

Part One outlined the largest increases in Superintendent Thomas Taylor’s recommended FY26 operating budget. Today, let’s look at the category accounting for his largest dollar increase: fixed charges.

The Financial Reporting Manual for Maryland Public Schools defines category 12 (fixed charges) this way:

*****

Charges of a generally recurrent nature which are not readily allocable to other expenditure categories. Included are:

- local school board contributions to employee retirement and social security;

- employee insurance benefits (health, life, accident, disability, etc.);

- fidelity insurance, personal liability insurance, and judgements (distribute to General Support Services on the Fixed Charges supplemental report group);

- interest on current loans; and

- personnel tuition reimbursements for all staff (distribute to the proper category on the Fixed Charges supplemental report group).

*****

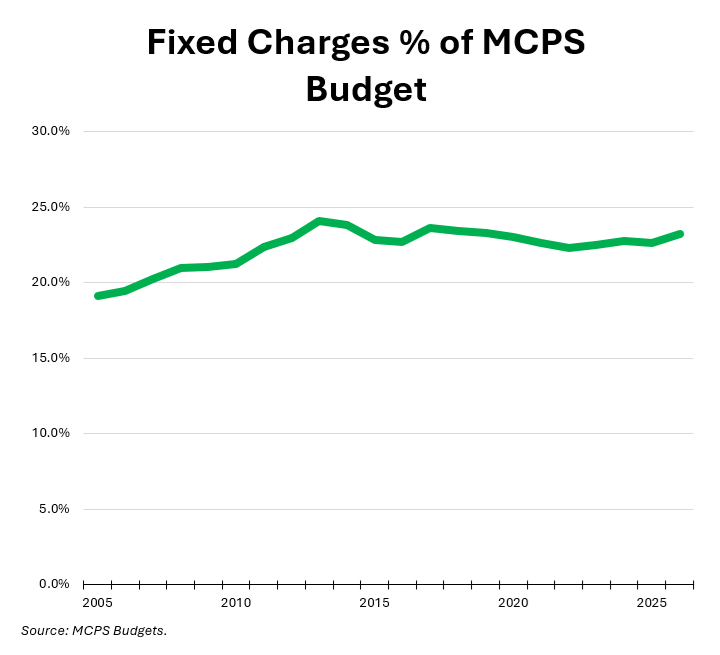

In practice, nearly all of this category is employee benefits. It does not include positions. Over time, fixed charges has accounted for between one-fifth and one-quarter of MCPS’s operating budget. Taylor is proposing an 11.8% increase in fixed charges, totaling $88.5 million. No other category is receiving a larger dollar increase.

Why is fixed charges getting such a big increase? MCPS’s Employee Benefits Plan (EBP) has been operating at a deficit for some time. The issue was discussed at the county council in February 2024. At that time, a council staff packet revealed that MCPS’s EBP fund had run deficits of $5.6 million in FY21, $21.7 million in FY22 and $35.8 million in FY23. MCPS was projecting another deficit of “over $25.0 million at the end of FY24.” The council approved a resolution allowing MCPS to transfer $5 million from its fund balance to help cover the deficit, but that was effectively a band-aid.

That was not good enough for Taylor. His budget said the following about the benefits plan.

Providing excellent health benefits is a key component of investing in our staff. Unfortunately, our Employee Benefits Plan continues to experience fiscal challenges, despite the funding added to the plan in recent years. As a self-insured entity, this is an issue we must address and the magnitude is such that it will require multiple years to resolve. For FY 2026, I am recommending that $40.0 million be included in the operating budget to continue to reduce the deficit that the Employee Benefits Plan has carried for the past few years. We are working closely with our employee associations to develop structural approaches that will improve the fiscal position of the Employee Benefits Plan going forward.

Taylor’s budget slides indicate that he would like to add $40 million in both FY26 and FY27 to address the issue. In one slide, he mentions, “Collaborative support from Associations to improve stability in the Employee Benefits Plan.”

Collaborative support is an interesting phrase because employee benefits are a mandatory subject of bargaining between MCPS and its unions. Currently, employee cost shares are 12% for health maintenance organization plans and 17% for point of service, prescription, dental and vision plans. These rates are set in the current collective bargaining agreements of the teachers union and the support staff union. Is Taylor alluding to changes in these splits? If he is, they won’t happen without union consent.

While Taylor’s ask for fixed charges is large, it’s not unprecedented. Benefits have always eaten up a big chunk of MCPS’s operating budget. The chart below shows the percentage of the budget going to fixed charges since FY05. Taylor’s percentage of 23.2% is similar to the average percentage of the prior 21 years (22.2%).

Next: special education.