By Adam Pagnucco.

Maryland’s Bureau of Revenue Estimates (BRE) has released its analysis of Governor Wes Moore’s income tax package and it demonstrates an unsurprising fact:

The governor has targeted Montgomery County with a grossly disproportionate share of his tax increase.

First, before considering the governor’s proposal, let’s remember that Montgomery County accounts for roughly one-sixth of the state’s population. However, our residents earn more income on average than residents of most other parts of the state due in part to our extraordinary cost of living. Since the governor is aiming most (but not all) of his tax package at high earners, it’s inevitable that it would skew towards MoCo. But the extreme nature of that skew should give all county leaders pause.

Let’s start with the governor’s proposed 1 percent surcharge on capital gains for taxpayers with more than $350,000 of adjusted gross income, which the governor intends to sunset after four years. The governor believes this will raise $128 million in FY26.

This is what BRE wrote about this surcharge.

In recent years, a little more than three-fourths of all capital gains would have been subject to the tax. About 55,200 taxpayers would have paid the tax in tax year 2020, the latest year of detailed data. The average tax increase was $2,442, but more than three fourths of the revenue gain would have been from about 10,200 taxpayers with FAGI of more than $1 million. The average increase for these taxpayers was $10,393.

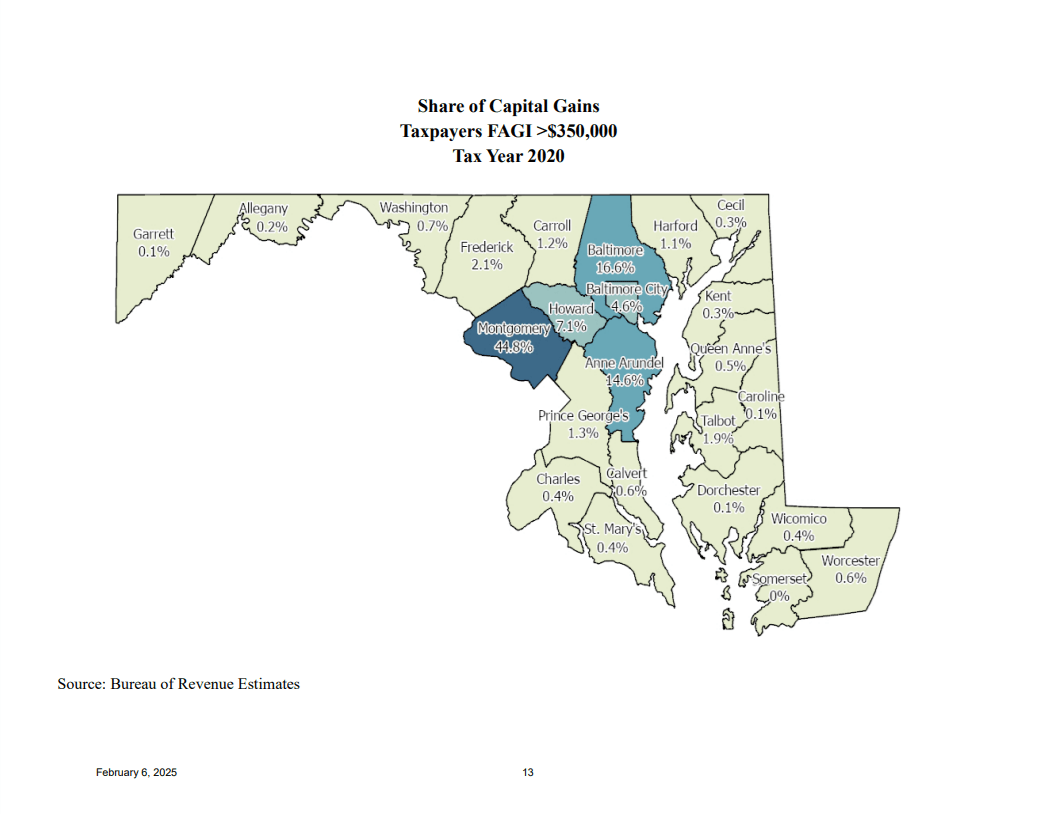

So the surcharge would impact a small number of taxpayers who would each pay a significant amount. (One wonders how mobile they are.) Guess what? Nearly 45% of the affected taxpayers live in MoCo. That’s equivalent to the number of affected taxpayers residing in Baltimore City and Anne Arundel, Baltimore, Howard and Prince George’s counties combined. Check out the map constructed by BRE below.

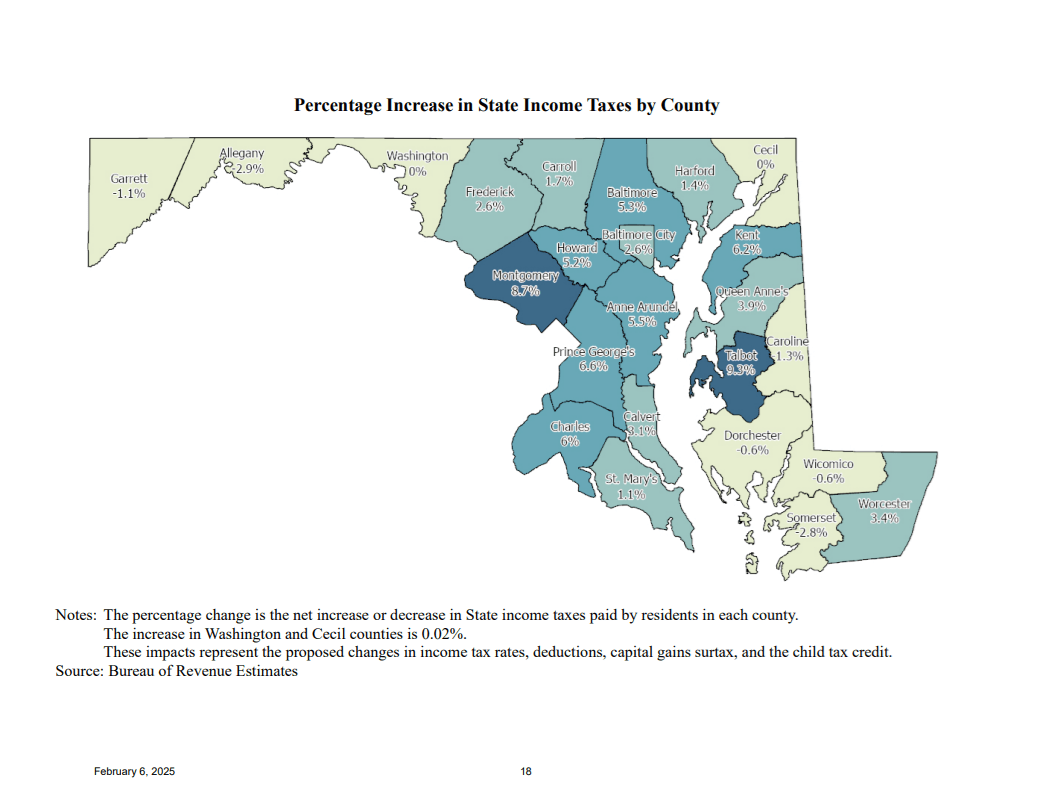

Now let’s get to the full income tax package. Its main elements are a proposal to double standard deductions and eliminate itemized deductions; the creation of two higher rate tax brackets above $500,000 in income; and the capital gains surcharge discussed above. The map below shows that under the governor’s proposal, the state would collect 8.7% more in income taxes from MoCo. This exceeds every other county in the state except for Talbot County on the Eastern Shore, which is small but has a substantial concentration of capital gains earners.

There is more. The governor’s proposal to double standard deductions and abolish itemized deductions affects the calculation of income subject to county income taxes. Thirteen of the state’s 24 counties would lose income tax revenues because of this. Of the eleven counties that gain income tax revenues, none would get more money than MoCo. In FY26, while the counties would get an extra $139 million combined, MoCo would get an extra $75 million – a majority of all the money. In future years, the county would net more than $50 million annually, which would again be a majority of all extra county income. That’s good for MoCo politicians who love to spend money, but it means MoCo taxpayers would get hit twice – once by the state and again by the county. And as I will recount in a future post, many taxpayers who itemize are not wealthy but rather are in the middle class.

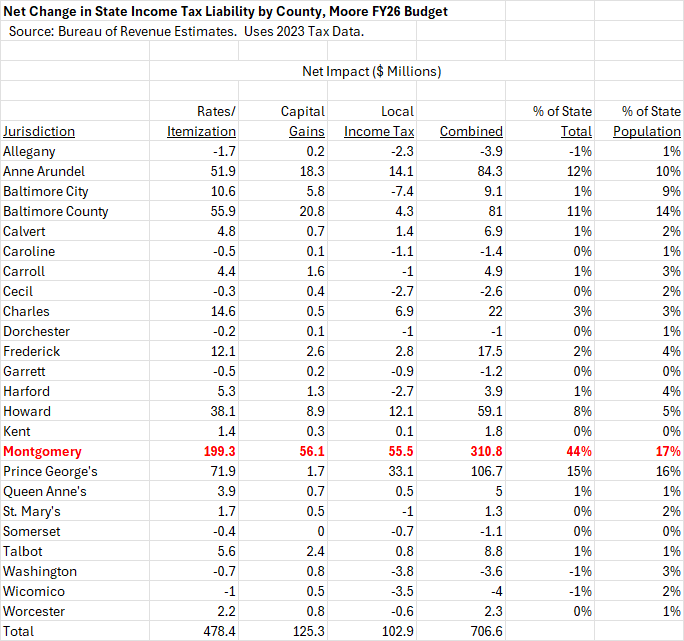

BRE released the impacts of changes to rates and itemization, capital gains, and local income taxes by county. The table below summarizes that data.

Montgomery County accounts for one-sixth of the state’s population but would pay 44% of the combined state and county income tax increase in Moore’s package.

Furthermore, the county would take a $300+ million income tax hit each year.

This comes on top of tens of millions of dollars in state costs shifted onto Montgomery County’s government in Moore’s budget.

Overall, Moore’s income tax package is reminiscent of the 2012 package proposed by Governor Martin O’Malley and passed by the General Assembly. MoCo paid 41% of that year’s state tax increase.

It’s no surprise that the state is making MoCo pay for its problems. It has been that way for a long time. I bet most if not all of MoCo’s state legislators will vote for a package resembling this one. In fact, some of them will try to adjust it to collect even more money from their own constituents.

But over time, targeting us for disproportionate tax hikes is a losing strategy for the State of Maryland. Montgomery County has lost its competitive edge in the Washington D.C. region and has suffered huge losses of taxpayer income due to net outmigration for many years. Yes, we’re the biggest jurisdiction in Maryland and arguably the economic engine for the state. But our engine is breaking down.

Will Moore’s tax hike break us for good?