By Adam Pagnucco.

Governor Wes Moore’s budget and tax package has been widely depicted as progressive in the media. And there is reason to believe that. Two of its more prominent features are its establishment of higher rate income tax brackets for taxpayers earning over $500,000 ($600,000 for joint returns) and its four-year 1% surcharge on capital gains over $350,000. But one provision of the plan will undoubtedly impact a significant part of Maryland’s middle class and undermine a key Moore policy priority. It deserves scrutiny from the General Assembly.

Moore’s budget highlights document includes this component.

Double the standard deduction and eliminate itemized deductions. A higher standard deduction provides simple and broad tax relief to all Maryland taxpayers, while removing itemized deductions from the Maryland income tax ensures all taxpayers are treated equally. Further, ending itemized deductions to support a more generous Maryland standard deduction removes a huge area of uncertainty–for both the State and its taxpayers–tied to the ongoing and volatile federal tax debates in Washington.

What does this tradeoff between the standard deduction and the itemized deduction mean for middle class taxpayers? Let’s do some math.

When completing their income tax returns, Maryland residents are allowed to take either a standard deduction or itemize their deductions. According to a recent General Assembly fiscal briefing, doubling the standard deduction would bring it to $5,600 for single payers and $11,200 for joint payers. So anyone currently taking a deduction for less than these amounts would be better off under Moore’s plan. Anyone currently taking a deduction for more would be worse off. Moore would also get rid of the standard deduction phase-in for very low-income taxpayers, which is definitely a win for them.

How does this play out for taxpayers? Let’s use Internal Revenue Service data for Maryland taxpayers, which includes many stats for federal income tax returns across income categories. The most recent year available is 2022.

The first factor to consider is the use of itemized deductions. Folks who use standard deductions now will clearly benefit from Moore’s plan because their deductions would double. It’s only those who use itemized deductions who might be worse off.

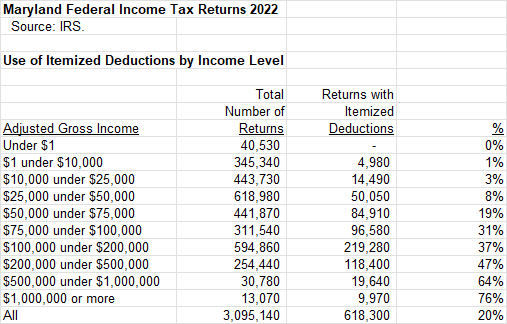

These are the percentages of Maryland federal income tax returns by income level that used itemized deductions in 2022.

The percentage of returns that itemize climb with income level. That makes sense. Itemizing deductions is a pain. It’s only worth doing if you have a lot of costly items to deduct, and generally, that fits the profile of folks with money.

But it’s a fallacy to suggest that only wealthy people itemize. Look at the three income categories between $50,000 and $200,000. Between a fifth and a third of these folks itemize. No one would call a person making $50,000 in Maryland “wealthy.” And as for a household making $200,000, bear in mind that the average salary of an MCPS teacher was $98,474 last year. A dual-income household making around $200k is MoCo’s middle class.

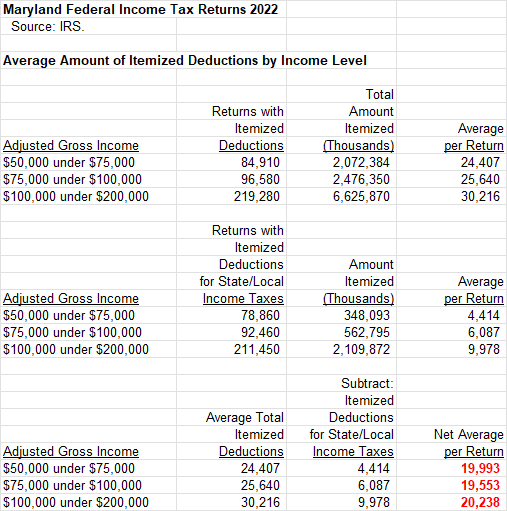

How much are these folks taking in itemized deductions? We can figure that out, but let’s start with a reminder: Maryland does not allow state income taxpayers to deduct their full federal itemized deductions. This year’s income tax form clearly shows that Maryland taxpayers start with their federal itemized deductions but are then required to subtract any itemized deduction they made for state and local income taxes. That makes sense: of course Maryland is not going to give people a tax break for paying state income taxes.

To figure out the impact on middle class taxpayers of Moore’s proposal, we must calculate 1. the average amount of itemized deductions they take and then 2. subtract the amount they deduct for state and local income taxes. The table below does that for three income tax categories: $50,000 to $75,000, $75,000 to $100,000 and $100,000 to $200,000.

The average amounts deducted net of state and local income taxes are in the vicinity of $19-20,000 for each of these income groups. Consider that doubling the standard deduction would make it $5,600 for single payers and $11,200 for joint payers. That’s a big difference.

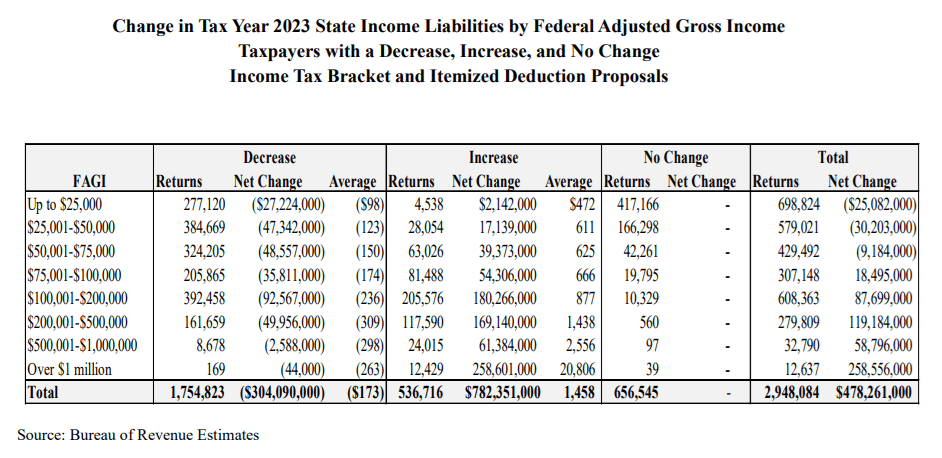

After I began crunching this data, the state’s Bureau of Revenue Estimates released its analysis of the governor’s income tax package. One section of that analysis reviewed the impact on taxpayers by adjusted gross income level using tax data from 2023. The impacts include all changes, not just itemization, but folks earning between $50,000 and $200,000 are not affected by the package’s other two primary components (higher tax brackets above $500,000 and a surcharge on capital gains over $350,000). The table below shows the number of taxpayers in each income category who would pay a net tax increase vs a net tax decrease due to the governor’s package.

At the $50,000-200,000 income levels, there are 922,528 returns getting average tax decreases ranging from $150-236. These are the folks who are using standard deductions. As stated above, they are bound to benefit from Moore’s plan.

But at these income levels, there are also 350,090 returns getting average tax increases ranging from $625-877. These are the folks who are itemizing. These are serious tax hikes and they dwarf the average amounts received by the net beneficiaries of Moore’s plan. As a matter of fact, returns in the $75,000-100,000 and $100,000-200,000 ranges are getting a net tax increase overall.

If you are a middle class resident who itemizes deductions, check your tax return. You may be getting a tax hike.

Which itemizing taxpayers will suffer the most if itemization is abolished? According to the IRS data, the largest itemized amounts deducted by Maryland taxpayers in 2022 were state and local income taxes ($8.9 billion), charitable contributions ($5.6 billion), home mortgage interest ($5.6 billion), real estate taxes ($3.1 billion) and medical and dental expenses ($2.4 billion).

State and local income taxes are irrelevant here because the state already does not allow them to be deducted from state income taxes. But the other items form a road map on who will get hit: recent home buyers with high mortgage interest payments, people with unusually high medical expenses and people making large contributions to charity. Does the General Assembly really want these folks to pay more taxes? And how does the state’s nonprofit community feel about getting rid of tax deductions for charitable contributions?

As for Moore, he has rightly focused on dealing with the state’s housing affordability problems. But his proposal to abolish mortgage interest deductions will make it harder for folks to pay for housing, especially those who just bought homes (like young people). That makes his tax proposal all the more baffling. He is undermining his housing agenda.

As long as this part of Moore’s tax plan remains intact, it’s wrong to characterize his package as sparing middle class people from a tax increase. And if it’s passed by the General Assembly as written, one decidedly upper class person will benefit from it a lot.

Larry Hogan.