By Adam Pagnucco.

Recently, Maryland Matters reported on HB 1469, a bill by Delegates Emily Shetty and Joseline Pena-Melnyk establishing a new two cents per ounce tax on “sugary beverages.” In speaking on behalf of the bill, Shetty said, “We have to think about common-sense, evidence-based measures that help bring down costs for our health care system, and that includes efforts like this.”

But will this bill really result in declining obesity and lower health care costs? Let’s read the text of the bill.

The bill, which is titled “Sugary Beverage Distributor Tax (For Our Kids Act),” defines sugar this way:

*****

(M) (1) “Sugar” means a monosaccharide or disaccharide nutritive sweetener that contains at least five calories per serving.

(2) “Sugar” includes glucose, fructose, lactose, and sucrose.

*****

Fair enough. But then the bill refers to “nonnutritive sweeteners,” which it defines this way:

*****

(H) (1) “Nonnutritive sweetener” means a nonnutritive substance suitable for consumption that humans perceive as sweet and contains fewer than five calories per serving.

(2) “Nonnutritive sweetener” includes aspartame, acesulfame–K, neotame, saccharin, sucralose, stevia, and other artificial sweeteners.

3) “Nonnutritive sweetener” does not include sugar.

*****

With these definitions in place, the bill then goes on to define “sugary beverages” that are covered by the tax it establishes.

*****

(N) (1) “Sugary beverage” means a beverage, whether carbonated or noncarbonated, that:

(I) Is intended for human consumption and contains added sugars or nonnutritive sweeteners; and

(II) Is not an alcoholic beverage, as defined under § 18 1–101 of the alcoholic beverages and cannabis article.

(2) “Sugary beverage” does not include:

(I) Natural fruit juice;

(II) Natural vegetable juice;

(III) Milk;

(IV) Infant formula;

(V) A beverage for medical use; or

(VI) Water that is not flavored using sugar or nonnutritive sweeteners.

*****

So the bill, which purports to tax “sugary beverages,” also taxes non-sugary beverages that contain non-sugar sweeteners with “fewer than five calories per serving.”

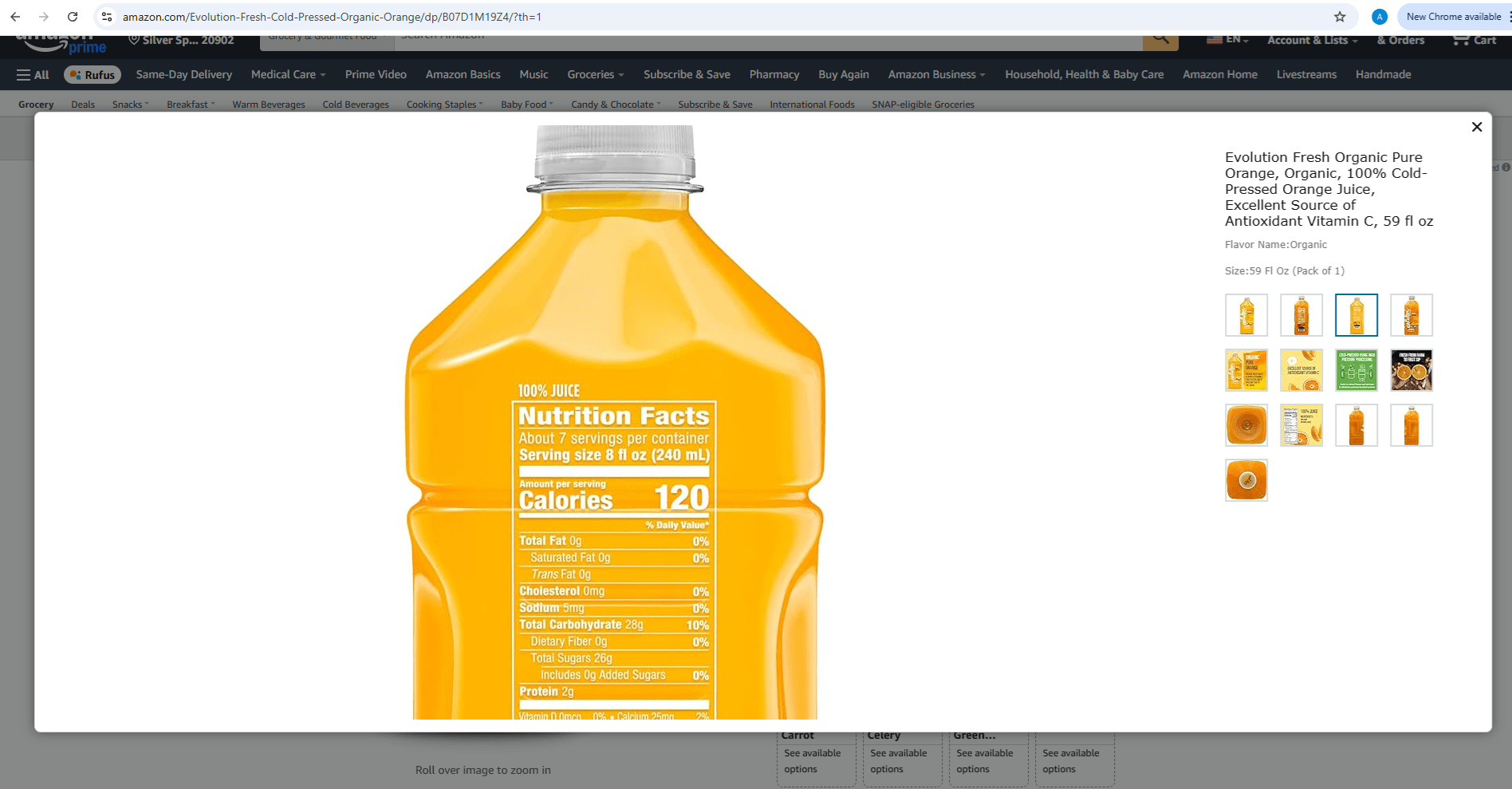

The bill’s targeting is also thrown off by its exclusion of “natural fruit juice.” Some of these juices contain lots of sugar. For example, consider Evolution Fresh Organic Pure Orange, Organic, 100% Cold-Pressed Orange Juice, which contains 26 grams of sugar per eight ounces. That’s comparable to many sodas and much more sugary than the non-sugary drinks taxed by this bill.

Is this sugary beverage exempt while other non-sugary beverages are covered?

This bill is not a sugary beverage tax at all. It’s a tax on many non-alcoholic beverages, sugary or not. So is the Philadelphia tax on which this bill is based.

It’s clear that the state has gigantic budget problems. Is this tax a better way to raise revenue than taxing middle class residents with excessive medical bills, big mortgages and lots of charitable contributions? That might be a debate worth having. But let’s not pretend that such a poorly targeted bill is about public health. It’s really about how the state plans to increase taxes and how much revenue it intends to raise.