By Adam Pagnucco.

Before we delve into Maryland’s net migration of taxpayers, let’s examine three economic characteristics of the state.

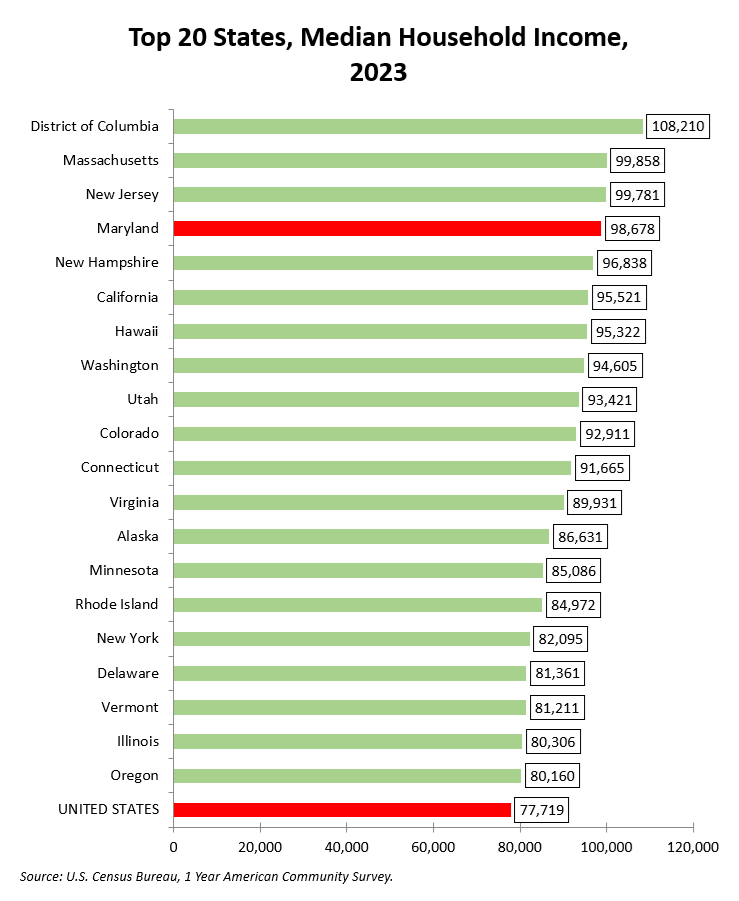

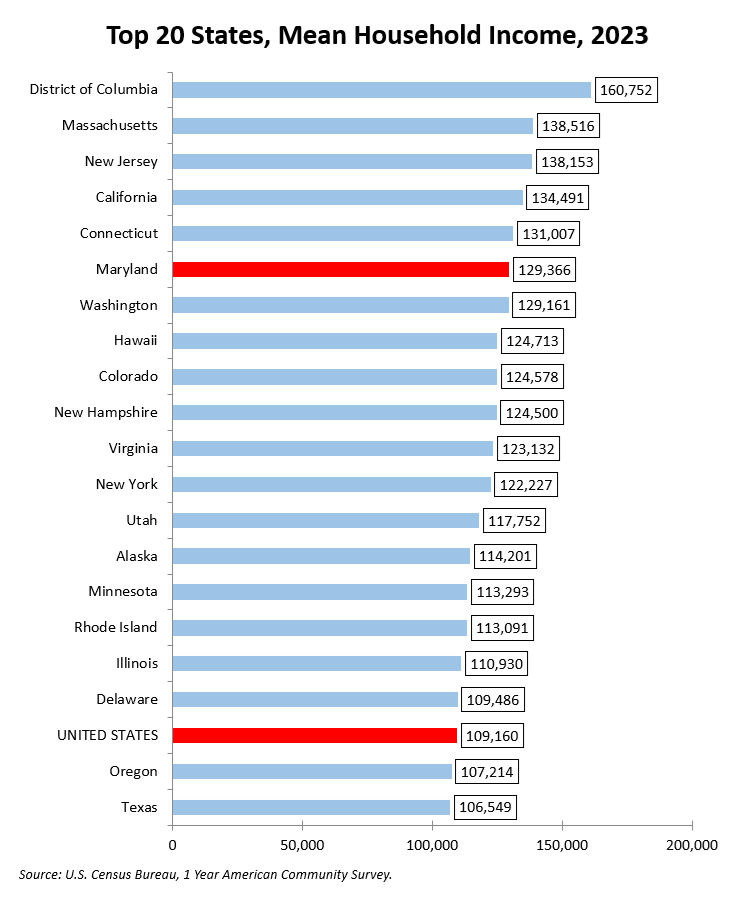

First, Maryland is a high-income state. The charts below show the top twenty U.S. states in median and mean household incomes according to the U.S. Census Bureau’s American Community Survey in 2023. (D.C. is ranked as a state.) Maryland ranks fourth in median income and sixth in mean income.

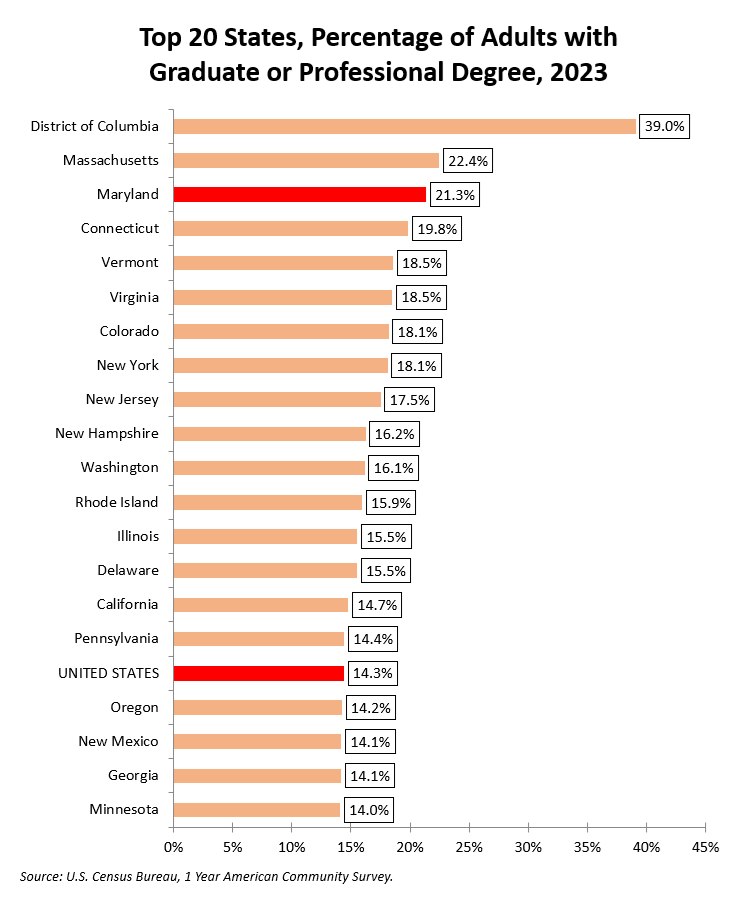

Second, Maryland is a highly educated state. The chart below shows the top twenty U.S. states ranked by the percentage of adults possessing a graduate or professional degree in 2023. Maryland ranks third behind D.C. and Massachusetts.

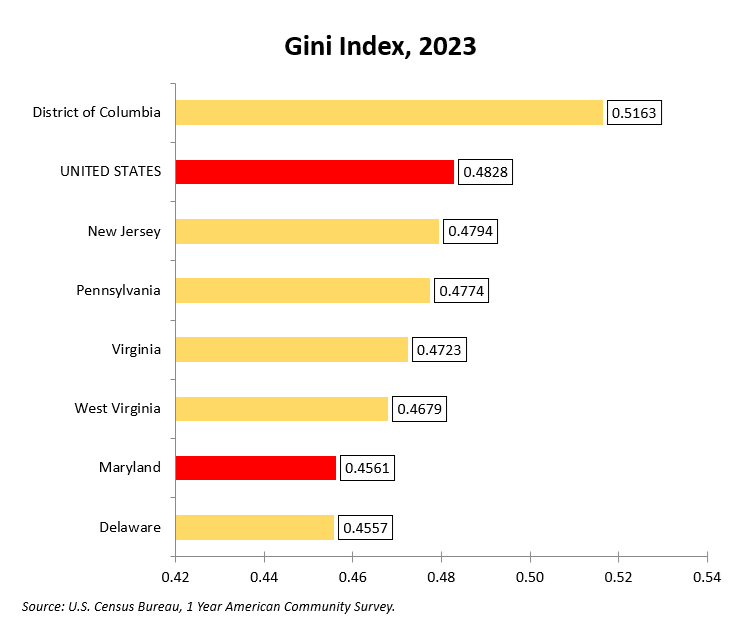

Third, Maryland has relatively low income inequality. The Census Bureau uses the Gini Index to measure income inequality. The index summarizes a range of incomes in one stat, with a value of 1.0 indicating total inequality (with one individual possessing all income) and a value of 0.0 indicating total equality (with every individual having the exact same income). In 2023, Maryland’s Gini Index was 0.4561, which ranked 36th of U.S. states on this measure. The chart below shows the Gini Index in 2023 for states in our region. Maryland has a lower value than its neighbors except for Delaware.

Let’s put this together: Maryland is the only U.S. state to rank in the top six in household income, the top three in education and the bottom third in income inequality.

This confluence of factors is an amazing asset for Maryland. Any other state would kill to have our combination of high income, high educational levels and relative income equality. Whatever our policy makers do, they must not damage this advantage.

More in Part Three.