By Adam Pagnucco.

Part One explained the context of this series and some characteristics of the IRS taxpayer migration data on which it relies. Part Two revealed that Maryland is the only U.S. state to rank in the top six in household income, the top three in education levels and the bottom third in income inequality. Part Three showed that Maryland has lost billions of dollars of adjusted gross income (AGI) in recent years. Today, we will look at migration by county.

In 2018 and 2023, I looked at taxpayer migration for local jurisdictions in the Washington region. The numbers I present today differ a little from those I published last year for two reasons. First, the prior series used the Washington-Arlington-Alexandria CPI-U to calculate real dollars whereas this series uses the national CPI-U. Second, the IRS has tweaked its estimates since we last published. Despite these changes, the basic trends remain the same.

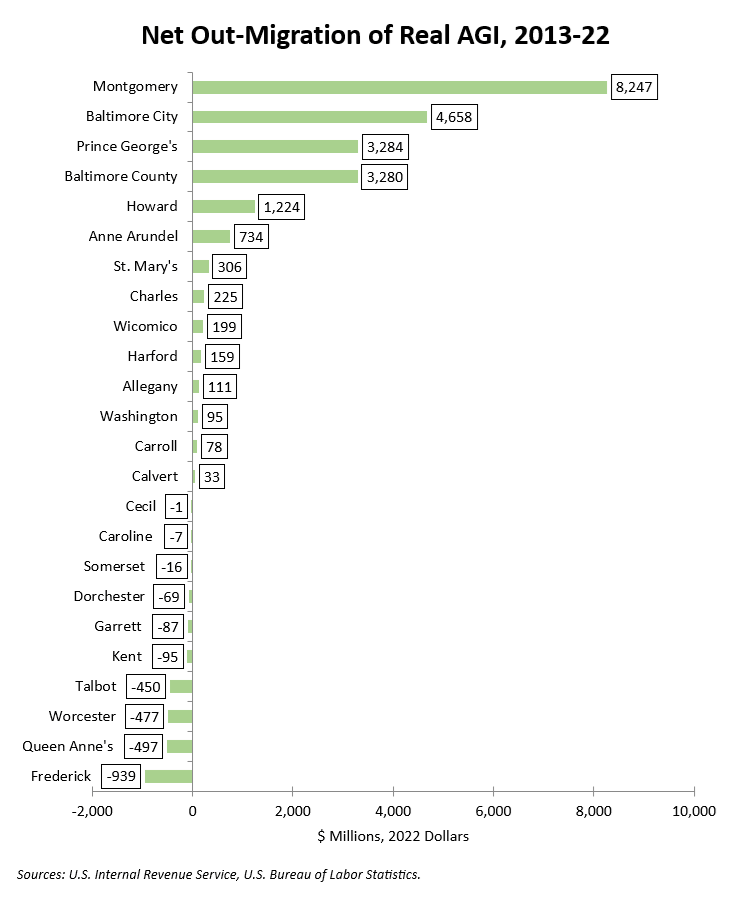

The chart below shows net out-migration of AGI by county over the most recently available decade (2013-22). Amounts are adjusted for inflation in 2022 dollars. Negative numbers represent net in-migration. Montgomery County is the runaway leader in lost income in the state with Baltimore City and Prince George’s and Baltimore counties following.

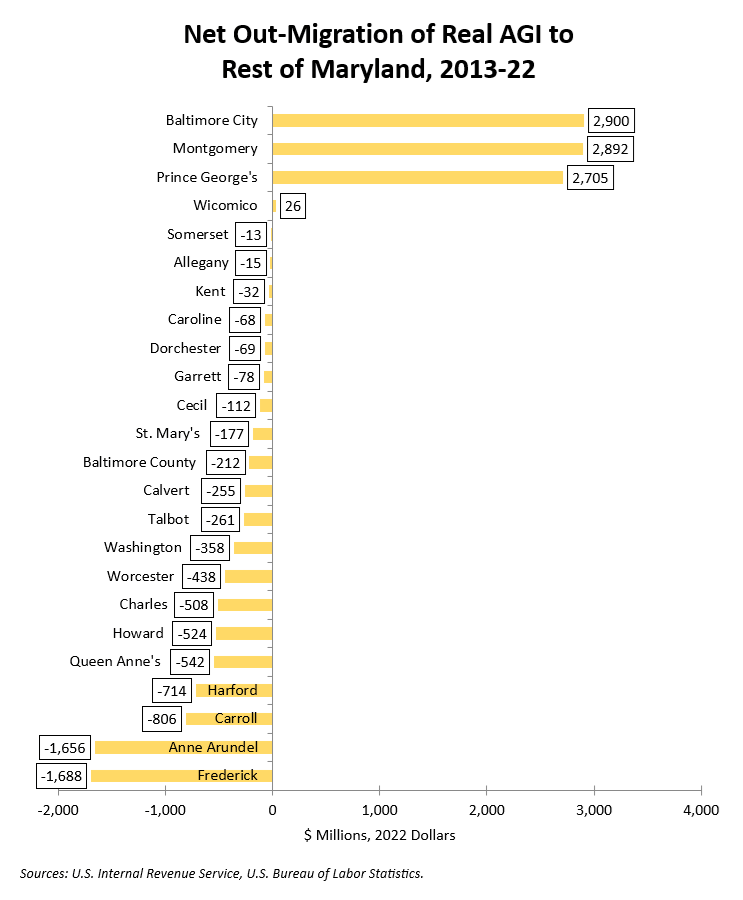

One issue with the chart above is that it includes income flows both within Maryland and between Maryland and other states. From the state’s perspective, it does not matter whether income moves between Maryland counties because it is still subject to state income taxes. So the chart below shows net-outmigration of AGI by Maryland county to the rest of Maryland.

Here we see that Baltimore City and Montgomery and Prince George’s counties have transferred nearly $3 billion each to the rest of the state over the last decade while all other counties except Wicomico have been net beneficiaries. One limitation of the IRS data is that it does not explain why this pattern has occurred.

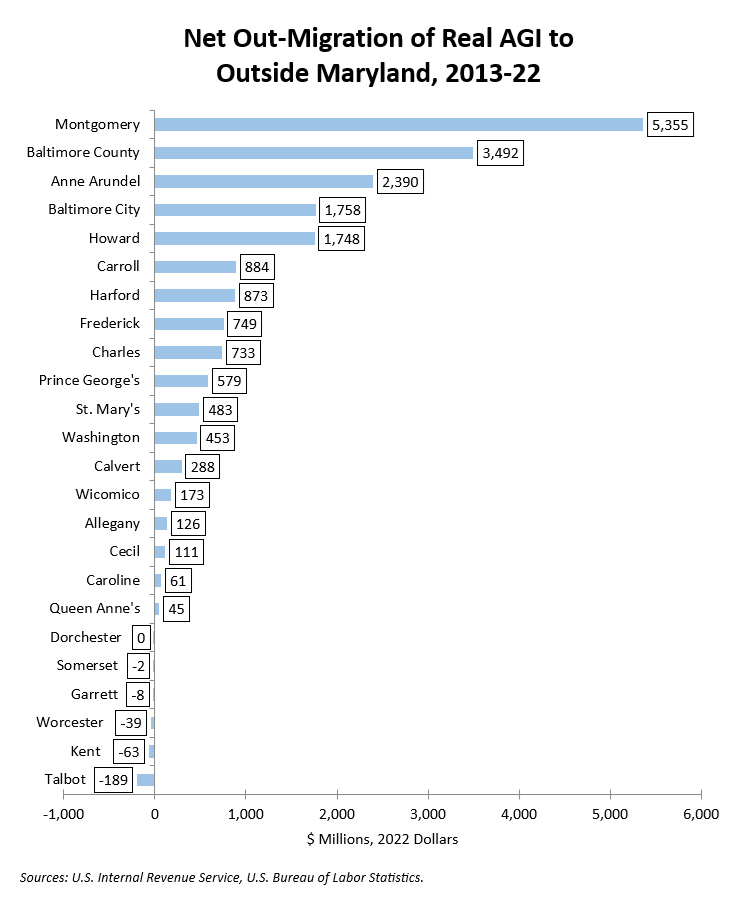

The chart below subtracts in-state migration from all migration and shows net out-migration to other states.

And so Prince George’s County loses lots of AGI to the rest of Maryland, Baltimore and Anne Arundel counties lose lots of AGI to other states and Baltimore City and Montgomery County lose lots of AGI to both. The problems of the latter four jurisdictions are a significant challenge to the state’s income tax collections.

We will have more in Part Five.