By Adam Pagnucco.

Back in 2012, the last time Maryland was in a serious budget crisis, then-D.C. Council Member Jack Evans uttered one of the most infamous quotes in local political history. In surveying regional tax rates, Evans said in a council committee meeting, “Thank God Maryland keeps raising their taxes.”

Evans has been out of office for five years. If he were still in the Wilson Building, what would he say today?

A decade before Evans’s quote, I was a D.C. resident looking to move out. I loved D.C. and especially its Adams Morgan neighborhood, which had everything I needed within a short walk. But bad schools, rampant crime and outrageous home prices had convinced me to leave. My choices were Maryland and Virginia. I rated both states equally. Each of them had high-performing school districts, nice neighborhoods, lots of amenities, Metro rail service and strong economies.

The tie breaker was the political leadership. I’m a Democrat and my party had been ruling Maryland and its largest localities for many years. (GOP Governor Bob Ehrlich was the first governor from his party since the 1960s.) Virginia had Governor Jim Gilmore, who had little policy agenda other than trying (and failing) to eliminate car taxes; the immigrant-bashing Prince William County official Corey Stewart; and obnoxious Senator George Allen, who later became notorious for calling an Indian man “macaca.” If the two states were tied in every other way, I was headed towards the one with leaders who reflected my politics.

I was not alone in leaving D.C. Every year, thousands of D.C. residents move to Maryland or Virginia. The District acts as a regional transmitter of population, importing people from all over the country to work in Congress, the federal government or their related interest group industries and eventually exporting them to nearby localities.

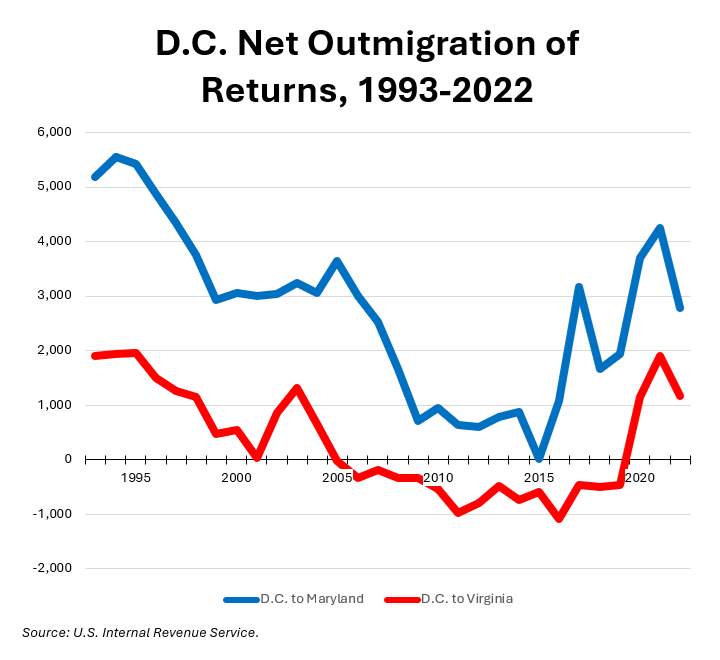

The U.S. Internal Revenue Service (IRS) measures taxpayer migration between states and counties. (I am currently using this data in my Maryland Wealth Drain series.) The chart below shows net outmigration of tax returns from D.C. to Maryland and Virginia from 1993 through 2022. Negative net outmigration represents a net inflow from one of those states to D.C.

Maryland has had regular net inflows of returns from D.C. over the years with a near pause during D.C.’s revitalization period. Virginia once had a net inflow of returns from D.C., then a net outflow, and once again a net inflow during the pandemic.

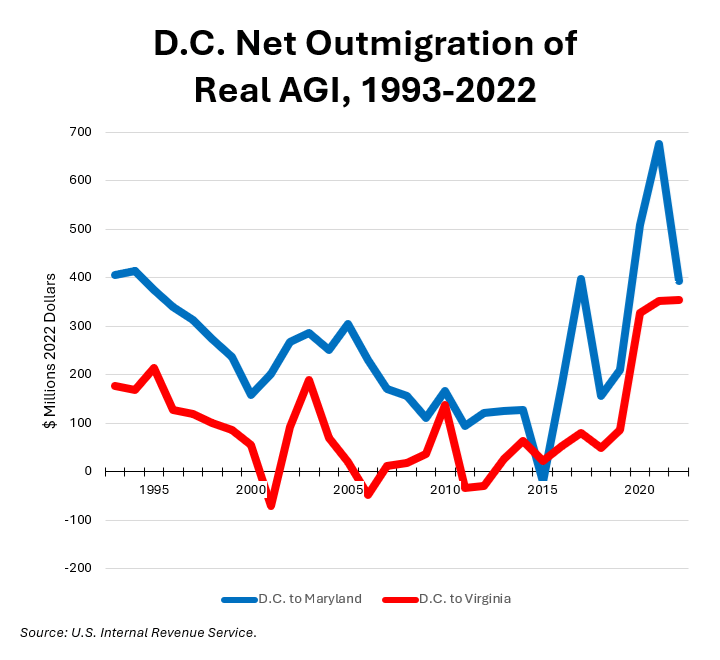

Now let’s look at the net outmigration of adjusted gross income (AGI) from D.C. to Maryland and Virginia. AGI is shown in 2022 dollars using the Washington-Arlington-Alexandria CPI-U to adjust for inflation.

On this measure, both states have regularly had net inflows of taxpayer income from D.C. Maryland has seen more of it but Virginia has been catching up. One reason for the inflows is that, for both states, the average income of people moving out of D.C. is almost always higher than the average income of people moving into D.C.

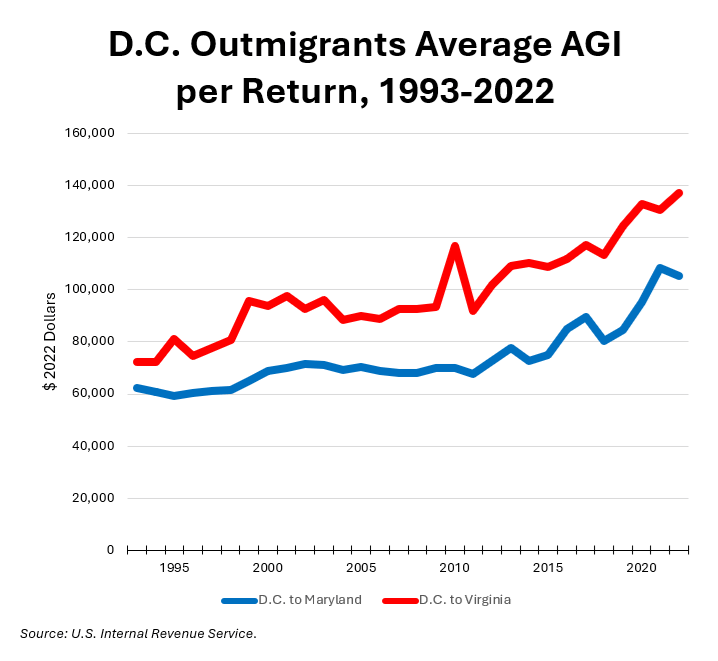

Overall, Maryland has done better at attracting taxpayer income from D.C. – one of the few economic advantages it has possessed over Virginia in recent years. But the charts above show that Virginia is closing the gap. Virginia has also had one crucial edge: their migrants from D.C. tend to have higher incomes than the ones moving to Maryland. The chart below shows the average AGI per tax return of D.C. migrants into Maryland and D.C. migrants into Virginia from 1993 through 2022. Average AGI is shown in 2022 dollars using the Washington-Arlington-Alexandria CPI-U to adjust for inflation.

Why is Virginia better at attracting wealthy people from D.C.? One reason is that its top income tax rate is 5.75% while Maryland’s combined state and county top rate is 8.95%. Under the tax package just announced by Maryland’s leadership, that combined top rate will rise to 9.8%, giving wealthy D.C. residents even more reason to prefer Virginia.

Look at what’s happening today. Virginia has a $2.1 billion budget surplus. Governor Glenn Youngkin is pushing for big tax cuts. The state’s Democratic General Assembly prefers spending more on education and healthcare along with a $1 billion tax rebate. By contrast, Maryland leaders just struck a deal to impose a gigantic tax hike package. All of this occurs in the context of a widening economic gap between Northern Virginia and Maryland’s D.C. suburbs.

This huge difference between the states did not exist 25 years ago. If these conditions had prevailed when I was a D.C. resident, I can’t say that I would have chosen Maryland over Virginia. That sets up the big question.

How will residents and businesses view Maryland and Virginia now?