By Adam Pagnucco.

Fresh off raising taxes by $1.6 billion a year, state legislators have left Annapolis with their work done – for now. But a new review of their session by the Department of Legislative Services (DLS) indicates that taxes will soon be back on the table – and that assumes President Donald Trump will not completely wreck the state’s economy.

In other words, it’s not over.

The 90 Day Report on the 2025 Legislative Session, released just last week, is a mammoth 444-page document that would challenge even the most attentive readers. Among many other things, it tells the story of the state’s deteriorating budget, the proposal by the governor to deal with it and the ultimate results of actions taken by the General Assembly. The short story is yes – the legislature has remedied this year’s problem. But in two years – and perhaps even less – they will have to come back and do more. Much more.

The document summarized the General Assembly’s challenge at the start of the session this way.

*****

Significant projected general fund cash and structural budget shortfalls led to a challenging fiscal outlook as the 2025 session began. In December 2024, projected cash shortfalls totaled $396 million for fiscal 2025 and $2.95 billion for fiscal 2026, with structural shortfalls of $1.07 billion and $2.47 billion, respectively. The structural shortfall was projected to grow to $6 billion by fiscal 2030. Sluggish economic growth, higher than expected entitlement costs, and a long-term commitment to enhancing K-12 education funding contributed to the fiscal challenges.

The immediate challenge occurred despite revenue increases in the September and December 2024 estimates from the Board of Revenue Estimates (BRE) as expenses far exceeded expectations. Significant fiscal 2024 costs were rolled into fiscal 2025, Developmental Disabilities Administration (DDA) and child care scholarship expenses in fiscal 2025 surpassed the appropriation by a wide margin and were projected to grow steadily from the higher level, and the number of Medicaid enrollees and their medical needs surpassed expectations. Rapid growth in these entitlement programs exacerbated the out-year challenge associated with funding ongoing K-12 education enhancements. Growing concerns about the impact of federal government layoffs led BRE to reduce general fund revenue expectations in March 2025 for both fiscal 2025 and 2026. Worries about the potential impact of federal spending retrenchment on the Maryland economy intensified toward the end of session due to pauses in certain federal payments, cancellations of expected funding, and discussions of changes to federal support for various programs, most notably Medicaid. The Transportation Trust Fund (TTF) also faced financial challenges during the session due to a mismatch between available revenues and desired spending on capital priorities.

*****

So three forces were combining to cause budget problems: a sluggish economy; soaring spending on Medicaid, developmental disabilities and child care in the short term; and school spending under the Blueprint program in the long term. The state’s transportation fund was also broken, an issue on which I wrote a series in December 2023.

Here is what the General Assembly ultimately did.

*****

Actions taken by the General Assembly in the budget bill and through final action on House Bill 352 (passed), the Budget Reconciliation and Financing Act (BRFA) of 2025, reduced $1.6 billion of general fund spending, including reductions taken in Supplemental Budget No. 2 at the direction of the General Assembly. The legislature increased general fund revenue in fiscal 2025 and 2026 by a combined $1.48 billion, including $1.2 billion from new taxes and fees, and provided approximately $500 million of additional revenue to the TTF.

*****

In FY25 and FY26, these are the three largest tax increases driving more revenue to the General Fund.

1. Apply a sales tax on data/IT services with a tax rate of 3.0% with the funds directed to the General Fund: $482 million

2. Personal income tax modifications – increasing the standard deduction, eliminating the standard deduction phase-in, establishing a phase-out of itemized deductions, and altering tax brackets to add new brackets for high-income earners: $351 million

3. Personal income tax on capital gains – impose a 2% surcharge on capital gains income with 1.25% distributed to the General Fund: $229 million

Maryland now imposes higher income tax rates on high earners than all of its neighbors, with only the District of Columbia anywhere close.

But that may only be the beginning.

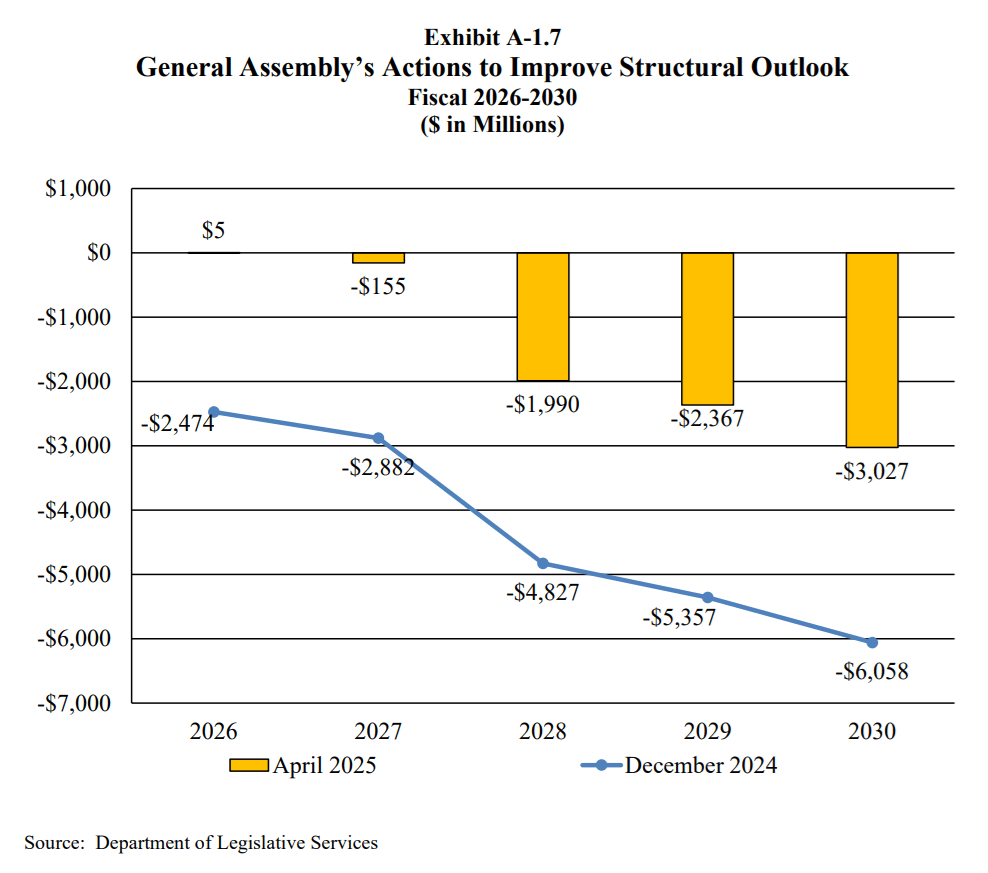

The chart below shows projected General Fund structural deficits from FY26 through FY30. The blue line shows the projections before the 2025 general session. The yellow bars show the projections after the General Assembly completed its work.

The General Assembly made progress, closing the deficits in FY26 and (mostly) FY27. But big deficits reemerge in FY28 and later. Why? The report offers this explanation:

*****

Following the General Assembly’s actions, fiscal 2026 is projected to end with a general fund balance of $315 million. Between fiscal 2026 and 2030, ongoing spending is projected to grow at an average annual rate of 5.8%, outpacing ongoing revenues, which are estimated to grow at an average annual rate of 3.3%. The structural gap grows substantially beginning in fiscal 2028 as the Blueprint for Maryland’s Future costs exceed the available Blueprint revenues and $1.9 billion of general funds are required to close the overall structural gap.

*****

The Blueprint for Maryland’s Future is the state’s program for increasing public school spending and otherwise improving public schools. It imposes substantial spending mandates on state and local governments which are scheduled to grow over time. Few Annapolis power brokers are interested in substantially trimming these mandates with the House of Delegates especially opposed. And so by FY28, deficits resume. And if Trump’s continuing assaults on the federal government and the world economy get worse, deficits could resume even sooner.

All of the above means that the General Assembly’s tax increases (and cost shifts onto local governments) are merely part one in a multi-chapter saga. Expect taxes to be a huge issue in the next round of state elections.