By Adam Pagnucco.

County Executive Marc Elrich has recommended a 3.5 cent increase in the county’s real property tax rate. When combined with his change to the homeowners’ income tax offset credit, the increase is projected to raise $56 million. That may not seem like a lot, but Elrich’s tax hike would result in the highest tax rate levied on MoCo property owners in more than twenty years.

Let’s review the structure of property taxes in MoCo. The county does not have one property tax. It has a lot of them. In addition to a general real property tax, it has property taxes for fire services, recreation, transit, park and planning and specialized taxes for specific geographies. Separate from the above are the property taxes charged by municipalities and the county’s personal property taxes charged on businesses. To get around this complexity, the county calculates a weighted average real property tax rate which is used to compare us to other jurisdictions and examine changes over time.

Since 1990, the county charter has contained a limit on property tax increases. The original limit, which prevailed from 1990 to 2008, limited growth in the volume of property tax collections to the rate of inflation with some exceptions (like new construction). The county council could override the limit with seven of nine votes. In 2008, the voters approved a change in the override to nine votes. In 2020, the limit’s application was switched to the weighted average tax rate rather than the volume of collections. Currently, a unanimous vote by the council is required to raise the weighted average tax rate. (You can read a history of our charter limit here.) Another important change was made by a 2012 state law allowing counties to bypass charter limits on property taxes if new revenues are dedicated to public schools.

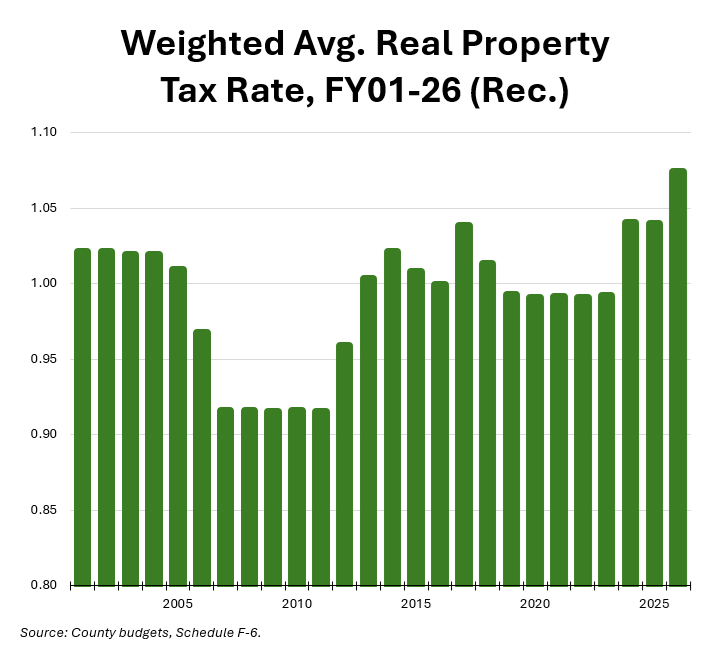

The chart below shows the county’s weighted average real property tax rate from FY01 through Elrich’s recommended FY26 operating budget. The rates are in dollars per $100 of assessed value.

One thing you will notice is a precipitous drop in the rate from FY04 through FY07 as well as smaller drops after the Great Recession. Why was this? Were County Executives Doug Duncan and Ike Leggett and the council members of those days tight-fisted, right-wing fiscal conservatives?

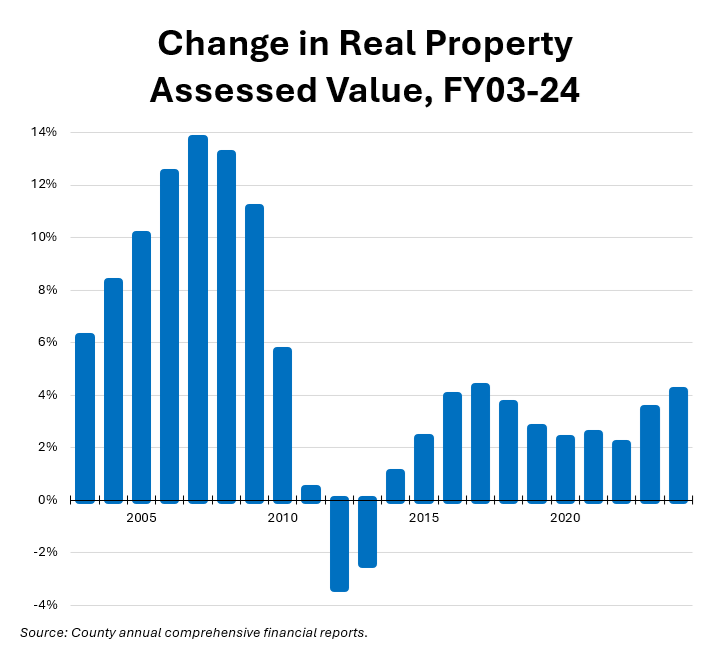

Hardly! The rate drops reflected the structure of the charter limit then in effect. Remember, that charter limit restricted the growth in tax collections to the rate of inflation. With the exception of a brief spike during the pandemic, local price inflation has been 4% a year or less for decades. The county’s assessed valuation of real property has often grown much faster than that. For example, during the five year period of 2005 through 2009, assessed value grew by double digits every year. The chart below shows how assessed valuation has changed over time.

So to stay at the charter limit, Duncan, Leggett and the council had to cut the rate. Even when they broke the charter limit (as they did in FY03-05 and FY09), they either cut the rate or left it virtually unchanged. That was the level of protection offered by the old charter limit. (It’s not a coincidence that the structure of the old limit was negotiated between the county and a group of citizens who had launched a tax revolt.)

That old limit is now gone. In its place is a new limit proposed by Council Member Andrew Friedson and passed by voters in 2020. Because the new limit applies to the rate and not to the value of collections, the protection against rising assessments has been reduced. (The state’s homestead tax credit continues to protect homeowners from taxable assessments rising by more than ten percent in a given year.) At the time that the new limit was proposed, I predicted that it would wind up raising more money than the old limit would have. I bet the passage of time will prove me right.

And so the new limit gives no incentive to county leaders to drop the tax rate. The state’s 2012 exemption for public school spending effectively eviscerates it in any case. That explains why the rate drops of the FY04-07 period will probably never be seen again. At the same time, a non-competitive county economy which will probably worsen due to Trump’s fiscal rampage and big state tax hikes will limit growth in the tax base.

Now we get to this year and Elrich’s newest tax hike proposal. Elrich was first elected in 2018 on a promise to restructure government. He broke that promise and has tried to raise taxes, sometimes successfully, ever since. Elrich now wants to spend money like the county did in the go-go era of the aughts, but he does not have a strong enough economy to support it. That’s why he proposed a property tax increase. If it is enacted, we will get our highest property tax rate in more than twenty years.