By Adam Pagnucco.

Once again, County Executive Marc Elrich is saying we need to be like Virginia. And once again, his argument rings hollow because of his blatant cherry picking. I have debunked his argument twice now, but since he ignores facts more than Donald Trump ignores court rulings, it’s time to do it again.

Elrich uses the “we need to be like Virginia” argument all the time, both in private and in public. He did it again in his latest State of the County speech. Elrich loves the fact that Virginia local jurisdictions are allowed to charge extra property taxes on commercial property and he wants the state to give him the same authority.

But Virginia does a lot of things differently than we do, and many of its business-friendly policies more than make up for its commercial property taxes. Here are three quick things we can do if we REALLY want to be like Virginia.

Get rid of the county income tax.

Local governments in Virginia don’t have income taxes. Maryland mandates that counties have income taxes and, until recently, allowed them to charge rates between 2.25% and 3.2%. MoCo charges 3.2% of income, which was once the maximum allowed in state law.

Elrich could propose that the county cut its income tax rate down to 2.25% and lobby Annapolis to let him go to zero. After all, we need to be like Virginia, right? Instead he wants to increase the county income tax to 3.3%, which the General Assembly just allowed counties to do.

The issue is particularly urgent given that Maryland’s combined state and county maximum income tax rate on high earners is now 11.8%, which is more than double Virginia’s top rate of 5.75%. But Elrich could care less despite his claims of “we need to be like Virginia.”

Cut the county’s energy tax by three quarters.

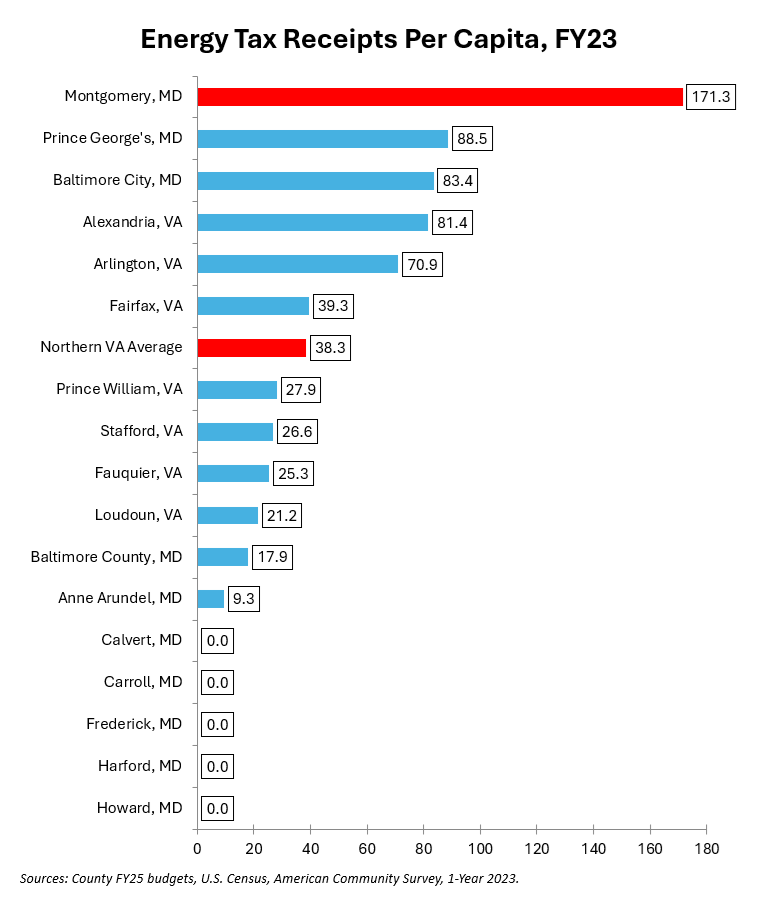

Energy taxes are complicated. Their rates are specified differently and they apply to different forms of energy, making direct comparisons across many jurisdictions nearly impossible. That said, the chart below is an effort to simplify them. It calculates FY23 actual collections of taxes applied to electricity, natural gas, steam, oil and related fossil fuels on a per capita basis by local jurisdiction using 2023 population estimates.

MoCo is a huge outlier in the Washington region, charging FAR more than any of its neighbors on a per capita basis. Most Maryland counties don’t have energy taxes at all. (D.C. is not shown because its public utilities tax applies to telephone, TV and radio and it does not break out collections by receipt type, making apples-to-apples comparison impossible).

If Elrich really wants to be like Virginia, he would propose cutting MoCo’s energy tax by three quarters, which would bring it in line with the average taxes charged by Alexandria City and Arlington, Fairfax, Fauquier, Loudoun, Prince William and Stafford counties. But Elrich has never done so and never will.

Get rid of rent control, BEPS and all-electric building requirements.

Northern Virginia commercial property owners might be glad to pay extra property taxes if it means they can be free of rent control, building energy performance standards (BEPS) and all-electric building requirements, all of which are mandated by MoCo and none of which are mandated in Virginia. Elrich could offer the same trade – higher taxes in return for abolishing MoCo’s various strangulations of the real estate industry. Again, he never has and he never will.

This is now the third time I have debunked Elrich’s argument as cherry picking. (The first two debunkings were published in March 2023 and September 2024.) Elrich’s staff reads this site regularly, just as occupants of the county council building do, so my conclusion now is that he KNOWS his arguments are disingenuous and yet he repeats them anyway. Such repugnant intellectual dishonesty is unusual even among most state and local politicians.

Accordingly, Elrich’s argument here is not worthy of consideration, but rather of condemnation.