By Adam Pagnucco.

According to county council staff, compensation for Montgomery County employees has been increasing at more than double the rate of growth of county revenues over the last three fiscal years. If that trend continues, the county must either cut back on spending growth or raise taxes to pay for it.

Employees of Montgomery County government are represented by three unions: Fraternal Order of Police (FOP) Lodge 35, International Association of Fire Fighters Local 1664 and UFCW Local 1994 (MCGEO). Collective bargaining for all three unions is established in the county’s charter. The unions negotiate agreements with the county executive and any items requiring funding require approval by the county council. Occasionally, legislation is required to codify changes to employee benefits.

Wage compensation has many components, of which three account for most costs. First, employees receive general wage adjustments intended to offset inflation. Second, employees who are not at the top of their pay scales receive service increments typically set at 3.5%. Third, employees who have reached certain years of service (typically 15 years or more) receive longevity increments usually exceeding 3%. Not all employees receive all of these increases but many receive both general wage adjustments and service increments. The combined increase of these two can exceed 6% and sometimes hits double digits in certain years. Management and other non-represented employees receive increases similar to unionized employees. Other agencies (like MCPS, Montgomery College and Park and Planning) negotiate separately with their unions but their agreements often resemble those of the county.

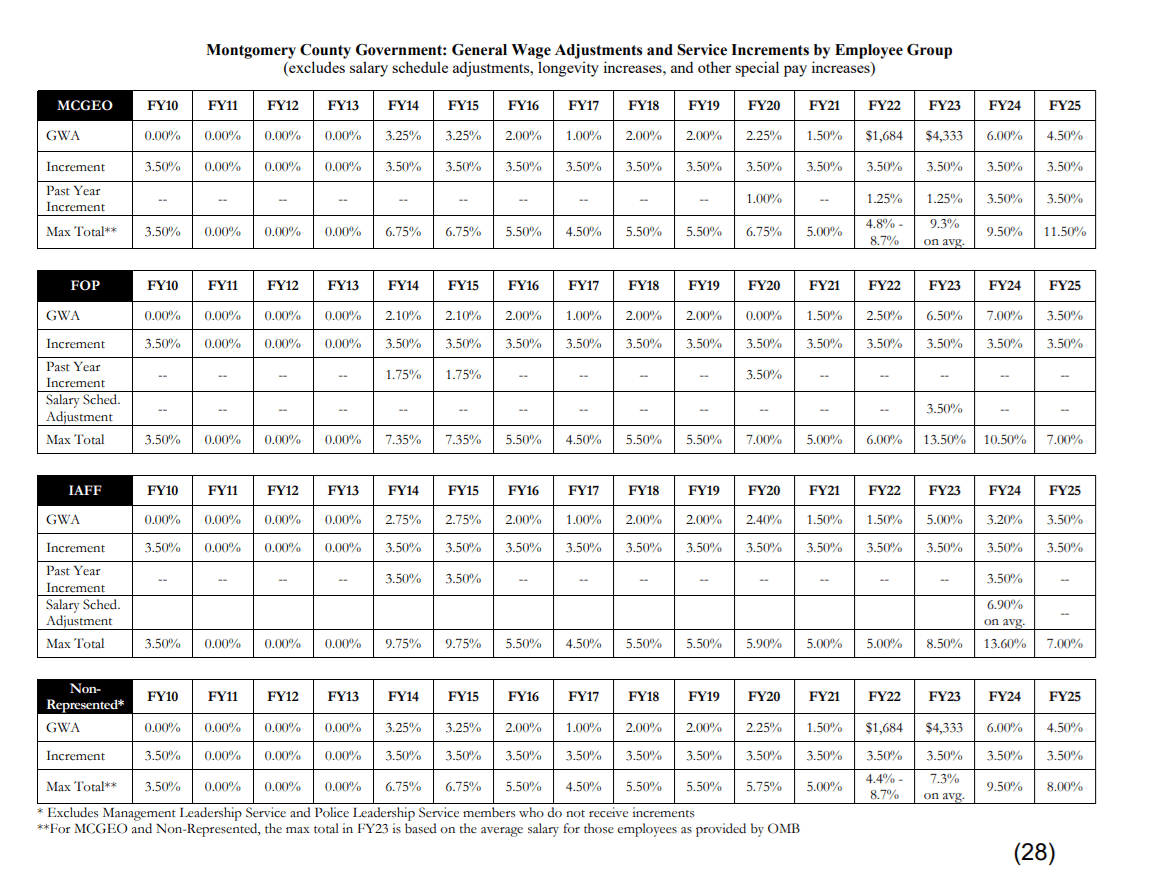

The table below from a recent council staff memo shows general wage adjustments and service increments for the three county unions. “Past year increments” refer to service increments that were not awarded during the Great Recession but are being paid to employees who worked then and are still in county government now.

Not all employees get all of these increases but many – and in some years, a majority – do. While employees did not get wage increases during the Great Recession, they are getting them now. And with local price inflation typically less than 3%, these wage increases have exceeded inflation – sometimes by a lot – for more than a decade. This year, the combined general wage adjustment and service increments range from 7% to 11.5%.

The county’s benefit programs have also become more costly due to negotiations resulting in legislation to enhance benefits. Since 2022, the council has passed ten bills to enhance benefits: Bill 7-22E, Bill 8-22, Bill 10-22, Bill 23-22, Bill 19-23E, Bill 20-23E, Bill 21-23E, Bill 41-23E, Bill 46-23E and Bill 9-24. The cumulative effect of these bills will cost the county many millions of dollars a year for the indefinite future.

The county government has an interest in attracting employees with competitive compensation packages. It also has an interest in affording those packages. Each year during budget time, the council’s central staff prepares a memo comparing the growth in county government compensation costs to county revenues. The memos are rooted in a fiscal policy resolution passed by the council stating, “As a means to preserve long-term budget sustainability, the annual growth rate of total compensation costs (including all wage and benefit costs) should be similar to the annual growth rate of tax-supported revenues.”

In this year’s memo, the staff does not pull punches. The staff states:

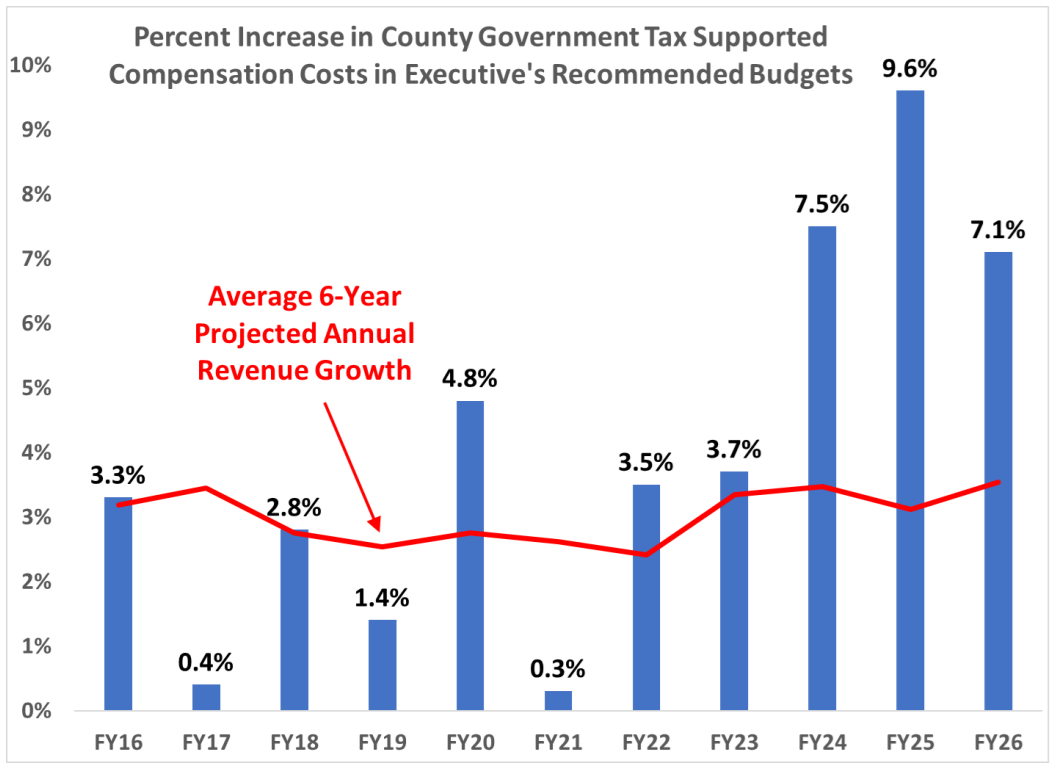

The Executive’s FY26 budget would grow County Government tax supported compensation expenditures by 7.1% above the FY25 level. The proposed increase would be the third consecutive year of compensation cost growing at a rate greater than 7%. No recommended budget included compensation growth at a rate greater than 5% in any year during the previous decade. The Executive recommended tax supported compensation cost increases of 7.5% in FY24, 9.6% in FY25, and 7.1% in FY26 represent a significant departure from the rate of growth in previous years; the average recommended increase in tax supported compensation cost during the years FY16-FY23 was 2.5%.

The staff then prepared the chart below comparing compensation cost increases (in blue bars) and projected annual revenue growth (red line). See how much compensation growth has exceeded revenue growth in the last three years?

The staff calculates that if the current trend continues, it would add an additional $1.19 billion to the budget above the level of compensation cost increases if they were to grow at the same rate as revenues over the next six years.

The staff finishes with this statement.

The compensation spending pattern recommended by the Executive produces a budget sustainability challenge. The unavoidable outcome of a recurring trend of this sort is to constrain the County’s ability to meet future spending priorities (including future year pay adjustments) and/or to necessitate raising new revenue.

Now I will push back on this one thing: no one should blame the county executive alone. It’s the council that approves cost increases in collective bargaining agreements. It’s the council that approves increases in county government positions. And it’s the council that passed the legislation on benefits above. All of those actions increase the county’s budget base year after year.

And so what did the council do when confronted by this information from its own staff? They unanimously approved the new agreements again.

Unless revenues someday pick up (and when will that day be?), the resulting dynamic is that taxpayers must pay occasional tax increases not to gain additional services but merely to keep up with the significant cost increases of existing services created by the executive and the council together.

Will this ever change?