By Adam Pagnucco.

County Executive Marc Elrich is pushing the county council to pass his newly proposed income tax increase by alleging that the only alternative is “cuts.” This quote from Bethesda Today is just one example:

“I’m hoping that the majority of council members are amenable to this. I mean, there is no way to fund the things we need to do in the budget if we don’t do this,” Elrich said. “The worst cuts you could make are certainly to the school system, but everything else would wind up coming out of social services, environmental programs. And I’m really concerned.”

First, let’s remember what is a cut and what is not a cut. A cut is an actual reduction to a spending level. For example, if $10 million is spent on a program this year and $5 million is spent on it next year, that’s a $5 million cut.

Here is an example of something that’s not a cut. $10 million is spent on a program this year. The county executive proposes that $15 million be spent on it next year. The county council appropriates $12 million instead. That’s not a cut, that’s an increase of $2 million.

Politicians know this perfectly well (most of them are not that bad at math), but they play this game to get their way in service of more spending. Elrich is not the only one to engage in such tactics.

Now to policy making. Under the county’s charter, the county executive is required to send a recommended operating budget to the council every March 15. That budget is the starting point of the council’s annual operating budget deliberations, which typically conclude in mid-May. The council may add to or subtract from the contents of the executive’s budget with two primary limitations: the final approved budget must balance revenues and expenditures, and it must comply with state mandates (such as the state’s maintenance of effort law on school spending).

No executive loves having a council make massive changes to their budget but the prudent ones pick their battles. (See this post for an example of how Elrich picks more battles than most.) So will the council spend more or less than Elrich wants this year? For an answer to that, let’s look at history.

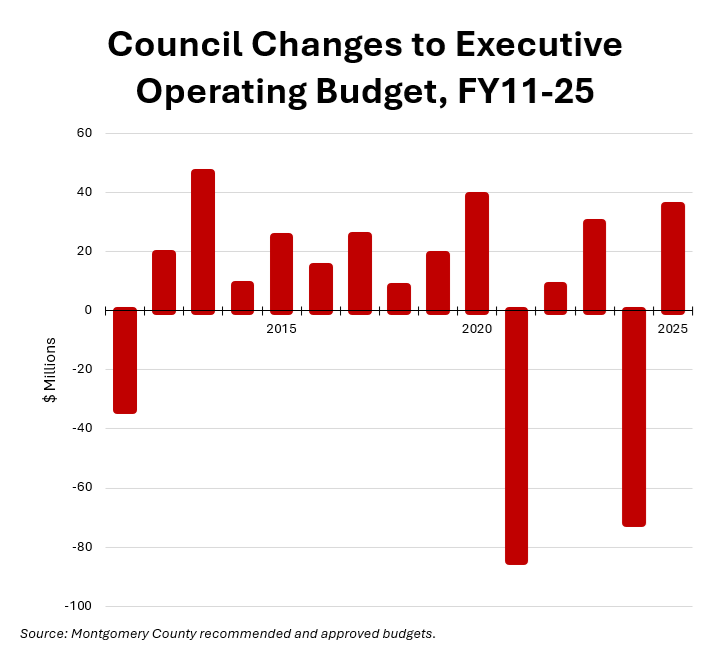

The county’s website lists both recommended and approved budgets going back to FY11. In FY11-19, the county executive was Ike Leggett; Elrich has served since. The chart below shows the net additions or subtractions the council’s approved budget made to the executive’s recommended budget from FY11 through FY25.

In most years, the council added to the executive’s budget, sometimes by tens of millions of dollars. That sounds like a lot of money, but in a multi-billion dollar operating budget, it usually amounts to one percent or less. Tactics for getting extra money have included funding reserves at slightly lower levels than the executive recommended, going into the retiree health care fund (OPEB), altering budgets for utilities and snow cleanup, fund transfers and squeezing a bit of cash from the capital budget. The council’s former staff director, Steve Farber, was a wizard at these kinds of things. Even when I worked there, I didn’t fully understand how Farber was able to pull these things off, but he did!

Since FY11, there have been three years in which the council approved less money than the executive recommended. These years are instructive.

In FY11, the council approved $33 million less than Leggett recommended. That was a terrible year, the worst year of the Great Recession, and revenues were written down while the council did its work. I wrote about that year in a post titled Ike Leggett’s Greatest Achievement.

In FY21, the council approved $85 million less than Elrich recommended. That was the start of the pandemic and the council passed a same-services budget without raises for county employees. (Don’t worry about them because they later made a killing on emergency COVID pay.) The council also rejected a property tax hike proposed by Elrich.

And in FY24, the council approved $72 million less than Elrich recommended primarily because they approved a smaller property tax increase (4.7%) than what Elrich proposed (10%).

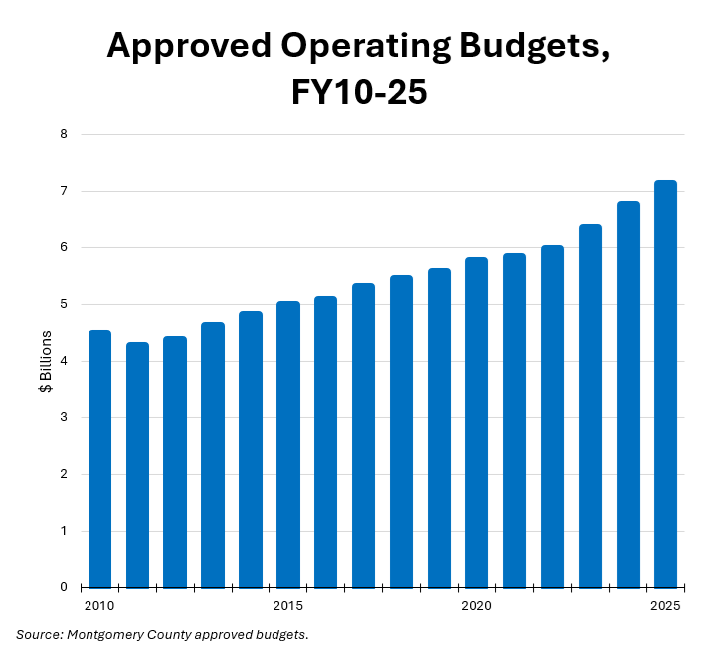

Were these cuts? Take a look at the chart below, which shows the total approved operating budgets passed by the council since FY10.

FY11 indeed saw a cut of $91 million from FY10’s approved spending level. That occurred during the Great Recession, the only force powerful enough to compel the county to actually cut overall spending. Since then, there have been no overall cuts in total approved operating budgets.

What will the council do this year? Elrich’s original recommended budget included a $56 million property tax increase and a $50 million solid waste fee increase. Since then, he has proposed replacing the property tax hike with an income tax increase raising $70-80 million. However, since his recommended budget included a total of $525 million in new money, most of it due to rising property assessments and income tax collections, the council can increase spending by a lot even without more taxes and fees.

If the council abstains from or reduces the tax and/or fee hikes, they may approve less money than Elrich recommended. If they do, Elrich and his allies will call it a “cut.” In fact, it will likely be an increase, potentially in the hundreds of millions of dollars. So continues the rhetoric, the spending and – of course – the politics.