By Adam Pagnucco.

In the wake of Montgomery County’s passage of a new rent control law, the county has seen its multifamily construction market disappear. Will it ever recover?

On July 10, the county council received a briefing on economic indicators from the Montgomery County Economic Development Corporation (MCEDC), the county’s economic development authority, and the Montgomery County Planning Department. The briefing showed a slowdown in the county’s labor market in the first quarter, with the number of employed people falling, the number of unemployed people rising and the unemployment rate rising slightly (although still very low at 3.1% in March). That may reflect the federal cuts of the Trump administration, a problem on the minds of policy makers at the state and local levels. But the real news came on residential building permits, a measure of the county’s construction market.

The report said this:

*****

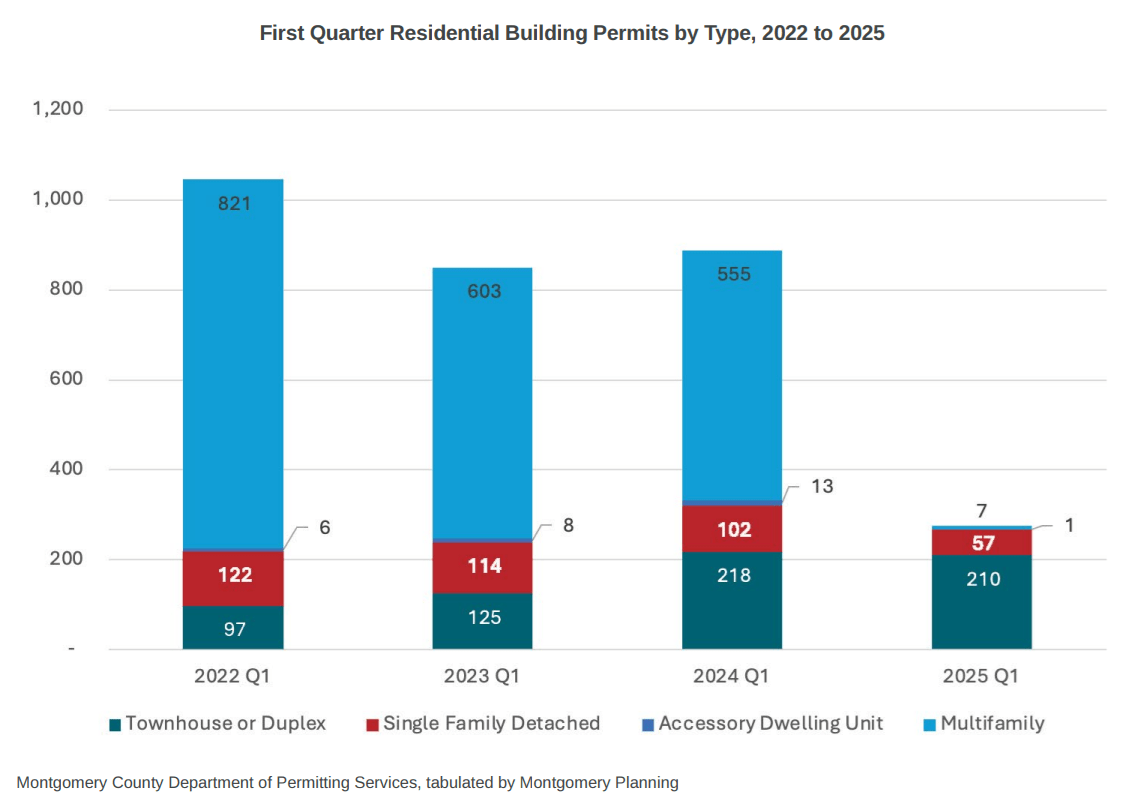

Permits for townhouses and duplexes (210) in the first quarter of 2025 were close to their first quarter levels from 2024, but detached family homes (57) were permitted at about half of the typical first quarter volume of the last three years.

Multifamily permitting can be volatile from quarter to quarter and year to year, but this quarter’s seven units permitted is the lowest multifamily quarterly volume in the dataset we currently use, which goes back to 2019. The next lowest quarter was the previous quarter (fourth quarter of 2024, with eight permits), meaning that only 15 multifamily units were permitted in the six-month period from October 2024 to March 2025. The continuance of this slow pace for another quarter or two could indicate significant challenges in the multifamily market.

*****

That was followed by this bar chart. The light blue portion of the bars represents multifamily unit permits. In the first quarters of 2022, 2023 and 2024, the county saw hundreds of multifamily units permitted. Then the county’s rent control law went into effect on July 23, 2024. And POOF half a year later, the county’s multifamily market has vaporized.

Now let’s bear in mind that this is not some cabal of “evil developers” making such a claim. This is coming from MCEDC, the county’s economic development authority, and the county’s planning department. MCEDC’s board members are nominated by the county executive and confirmed by the county council. Both MCEDC and the planning department are financed by taxpayer money. The source they are citing is the county’s permitting department. The county’s own agencies are telling its leaders that its multifamily construction market has vanished.

One more note: the county’s planning department confirmed that the above data does not include the cities of Gaithersburg and Rockville. Those cities have their own permitting processes and do not have rent control laws.

So what could have caused such an epic collapse? The construction market is burdened by several factors, including high interest rates, the impact of Trump’s tariffs (which has only begun) and a slowing economy. Those are national factors that MoCo leaders can’t control.

Here’s the problem. According to the U.S. Census Bureau, multifamily residential units are rising nationwide. Its latest estimates show the seasonally adjusted annual rate of multifamily (buildings with 5 or more units) permits rising from 393,000 in May 2024 to 444,000 in May 2025, a 13% increase. Raw data for non-seasonally adjusted monthly multifamily units rose from 33,900 in May 2024 to 36,200 in May 2025, a 7% increase.

MoCo’s multifamily housing collapse is an extreme outlier from national trends.

Here’s another data point from the State of Maryland’s planning department. In the five months of January through May 2024, MoCo authorized 1,724 units in buildings with five or more units. The rest of the state authorized 1,404 of these units. That entire period occurred before MoCo’s rent control law took effect. In the five months of January through May 2025, after rent control had taken effect in MoCo, MoCo authorized zero units in buildings with five or more units while the rest of the state authorized 2,038 of these units. (In Prince George’s County, where rent control took effect in April 2023, zero multifamily units were authorized during both of these periods.) Again, while there is a slight difference between county and state data here, this is the state talking – not “evil developers.”

Could this be due to anything other than rent control?

Think about it. As county leaders were pondering rent control two years ago, developers began to preemptively cancel new housing projects. Then the national real estate financing industry singled us out for redlining, with one of the nation’s biggest housing CEOs scolding us for a “poor” political climate. All of this comes on top of a towering, decades-old body of economic research showing the damaging effects of rent control on housing supply, including in Takoma Park and MoCo itself back in the 1970s.

It was all so predictable. Only a nuclear bomb could have caused more annihilation of our multifamily market than rent control.

Will MoCo leaders ever change course? Or will rent control irradiate our housing market forever?