By Adam Pagnucco.

Remember the county’s $120 million budget shortfall? While up to half of it may have been caused by tax planning by rich people, the rest was in broad shortfalls across a range of taxes. The County Council approved a FY18 savings plan of $53 million in January, but what happened to the rest of the shortfall? Nothing was published in the press. In fact, the council did cut another $62 million last month and, it seems, no one noticed.

What happened?

One of the county’s long-term obligations is money it owes for retiree health benefits, also known as other post-employment benefits (OPEB). These benefits are becoming rare in the private sector but they are still common in state and local governments. In 2008, the Governmental Accounting Standards Board (GASB) told state and local governments that they had to begin accounting for OPEB and prefunding it in the same way that they do for pension benefits. In other words, each government would have to publish a funding ratio and start saving for future benefits rather than simply paying as they went. MoCo had a plan to ramp up OPEB prefunding, but the Great Recession hit and the county couldn’t contribute towards OPEB for a couple years. Since then, the county has socked away $797 million to meet future OPEB benefits.

That sounds like a lot of money, but the county’s actuarial liability for OPEB is currently calculated at $3.3 billion, meaning that its funding ratio is 24%. That would be terrible for a pension plan – consider that the county’s pension plan is currently 92% funded. But 24% is actually decent for an OPEB plan considering that state and local governments have only been prefunding them for ten years. The State of Maryland’s OPEB plan was just 3% funded in 2015 and MoCo’s ratio was better than 38 states. Even so, the county has a lot of work to do to get its funding ratio up and it makes millions in contributions every year to get there.

In FY18, the county had budgeted $122 million for OPEB contributions. But the county had a problem: less than half of its FY18 shortfall of $120 million had been eliminated. As late April came around and the FY19 budget process was underway, the County Executive and the County Council had a choice. They could cut over $60 million in current year spending two months out from the primary election. Or they could find the money somewhere else.

You guessed it – in a resolution introduced and adopted on the same day, April 24, the council unanimously cut $62 million from the county’s FY18 OPEB contribution. This fiscal year’s spending on services won’t take another cut, which is great news for incumbents running for reelection or higher office. And as Bethesda Magazine reported, the council has proposed adding up to $21.6 million more to next year’s budget and has so far identified just $1.6 million in offsetting spending cuts. How do you think they will make up the difference?

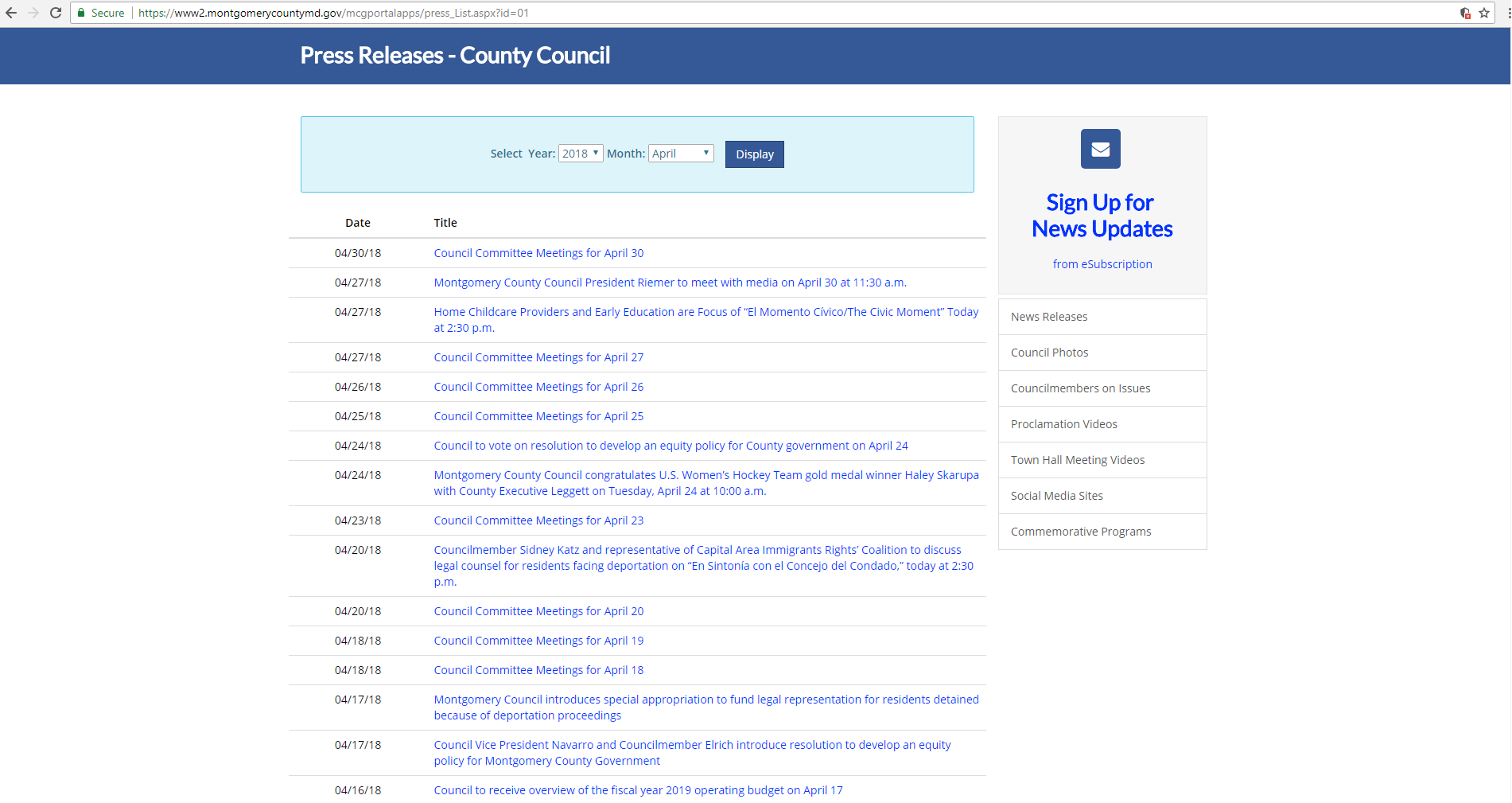

The County Council did not send out a press release headlining the diversion of $62 million of retiree health contributions to support general spending on April 24. It was buried in a press release spotlighting a resolution on equity data. As a result, the press totally missed it.

Now look, folks. The county is good at saving money. They are setting aside close to 10% of revenues as reserves, an important reform adopted during the Great Recession that helped save the county’s AAA bond rating. The pension fund is in excellent condition at 92% funding. And as stated above, the county has done a better job at prefunding retiree health benefits than most other places.

But grabbing retiree health contributions and using them for general spending is something that is normally done in a recession when the alternative is layoffs. That’s what happened a decade ago and it was justified considering the financial trouble the county was facing. Now, despite huge evidence to the contrary, county leaders are telling us that the economy is in great shape. The Council President told Kojo Nnamdi a few days ago that we have “a very strong economy” and “this is a good time in Montgomery County.” Well, if the economy is so great, then why redirect $62 million of retiree health money to prop up this year’s budget?

And if we are diverting retiree health money now when times are supposedly good, what will happen when the next recession comes?