By Adam Pagnucco.

In a long-expected move, Governor Larry Hogan has submitted a long list of state budget cuts to the Board of Public Works. Cuts to state employee salaries and positions are getting a lot of attention. So is a proposed $200 million trim in state aid to public schools, although that needs the consent of the General Assembly to pass. What is less discussed is Hogan’s resumption of a time-honored practice used by higher level governments to dump their problems on lower level governments: the shift and shaft.

Here is how it works. Over the years, state governments decide that they wish to provide certain services, like schools, libraries, colleges, transportation infrastructure, public safety and so on. They could decide to provide them directly through state employees, and sometimes they do in whole or in part. But for reasons of convenience and coordination, they often choose to fund those activities through grants to counties and cities and have them provide the services to residents. Over time, state budgets get in trouble due to economic downturns so cuts are needed. State leaders don’t want to cut services, of course – they don’t want to deal with the backlash and they are happy to have counties and cities continue to provide them. They just don’t want to pay for them anymore. So they cut their grants to lower levels of government and make city and county leaders clean up the mess. (In fairness, the feds do the same things to the states.) The whole process is called “shift and shaft federalism.”

Maryland is no stranger to this concept. The Great Recession of a decade ago hit the state budget HARD. Governor Martin O’Malley’s top priority was preserving state aid for public schools. He was able to accomplish that for the most part through a series of tax hikes, a reduction of hundreds of millions of dollars in highway user revenue funds that had gone to county and municipal transportation budgets and a partial shift of teacher pension payments to the counties. The latter shift was partly ameliorated by supplemental grants paid to the poorest counties to help them meet teacher pension obligations. The counties bitterly resisted these moves, but once the state imposed them, most responded by raising property taxes, income taxes or both.

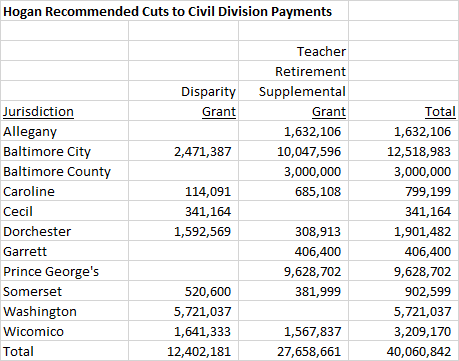

Hogan is now going down the same road as O’Malley. His cut list includes two programs that steer money to county budgets. The first one is the state’s disparity grant program, which sends money to poorer counties in an effort to remedy local tax capacity inequities. The state’s FY21 budget includes a $12.4 million increase in disparity grants which Hogan would eliminate. The second program is the state’s teacher retirement supplemental grants, which are intended to help poorer counties pay for the teacher pension payments that the state mandated in 2012. Hogan would eliminate them too. Combining the two programs, Hogan would cut their funding by 21.5%, one of the biggest percentage cuts in his entire package and close to the 25% maximum cut that the Board of Public Works could impose.

Here is the total impact by county of Hogan’s cuts to disparity grants and teacher retirement supplemental grants.

Three things stand out. First, most of these cuts are regressive. Other than Baltimore County, these jurisdictions have low assessable bases per capita, low income per capita or both. The very reason why these programs exist is to boost poor counties, so cuts to them are bound to be regressive. Second, many of these jurisdictions are governed by Republican local officials. Hogan is cutting his own people. Third, these amounts were included in county budgets passed over the last two months. Each of these reductions blows a hole in county budgets that were already going to be subject to cuts because of declines in local revenues. The tough choices will now get even tougher.

These counties will be pleased to know that Hogan is proposing to eliminate the state’s $75 million supplemental retirement contribution. So while the counties will continue to be expected to pay for state pensions without the benefit of state assistance, the state will save money by cutting its own payments.

It is good to be at higher levels of government!

More cuts to local entities will probably be coming. Hogan proposed cutting $200 million in state aid for public schools (a move that needs General Assembly approval) and $36 million in state aid for community colleges. His package also contains another $130 million “unallocated reduction to local governments” that needs to be considered by the General Assembly. There may also be more mid-year cut packages.

Good luck to the counties. And good luck to the voters too.

Update: Comptroller Peter Franchot has come out against many of Hogan’s cuts, including the cuts to the counties. Assuming that the Board of Public Works sticks to its schedule and votes on the package tomorrow, Treasurer Nancy Kopp will decide the outcome.