By Adam Pagnucco.

Every college student taking Economics 101 learns about how supply and demand interact to set market prices. Wages are prices set in labor markets. When growth in demand for labor exceeds growth in supply, wages go up as employers bid against each other to hire workers. When the opposite occurs – growth in supply exceeds growth in demand – wages fall as workers compete for a limited number of job opportunities. That’s how it’s supposed to work according to theory, and that’s how it has worked (more or less) in prior business cycles.

But so far, that’s apparently NOT how it has worked during the COVID recession. Why?

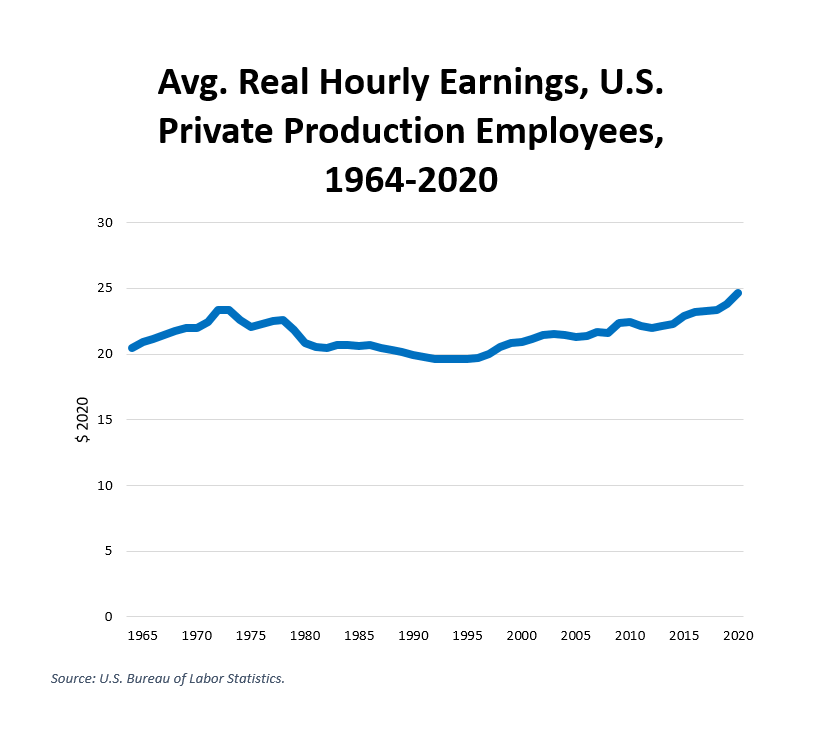

First, let’s look at history. The chart below shows average real hourly earnings (in 2020 dollars) for U.S. private sector production workers from 1964 to 2020. Besides the flat U shape, you can see how wage increases moderated during certain periods, like the early 1970s, the early 1980s and the early 2010s. That makes sense since those were periods of recession. Jobs were lost, hiring demand was down and that put downward pressure on wages.

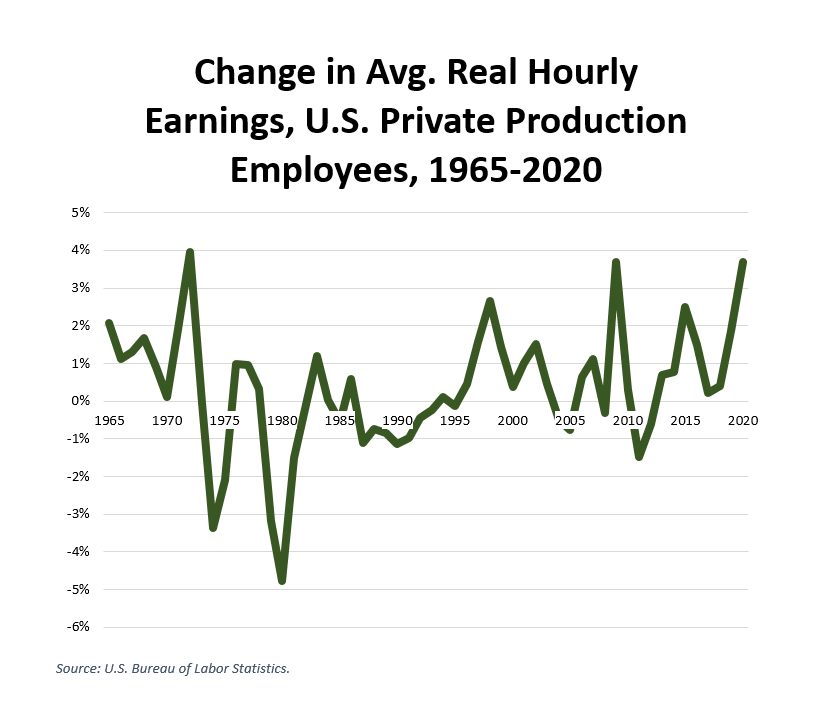

The chart below shows the change in average real hourly earnings and brings out the contrasts shown above even more. Big drops in real wages occurred during the oil embargo recessions of the 1970s and early 1980s and a smaller drop occurred during the Great Recession. Again, this is what we expect to see.

But now look at 2020, the year of the awful COVID recession. Preliminary data indicates that real hourly earnings actually rose by 3.7%, the third HIGHEST real increase on record since 1964. (The two higher ones were 4.0% in 1972 and 3.7% in 2009, both peak years immediately prior to recessions.) Everybody knows there have been job losses during the COVID recession so why are average wages going up?

We’ll have more in Part Two.