By Adam Pagnucco.

Update: The county government is disputing the accuracy of the Census Bureau’s building permit estimates and claims that Montgomery’s numbers are much higher. I am working with the county to determine the status of this data and I’ll report further when I know more.

Update 2: The county says the Census Bureau is wrong and has released its internal building permit data. Please read this post before proceeding to the content below.

Update 3: My most recent post on this data: it’s a mess that must be fixed.

Annual building permit data for 2022 released by the U.S. Census Bureau estimates that Montgomery County had 724 housing units permitted last year. This is the worst year since the current building permit series began in 1990.

The chart below shows MoCo’s units permitted since 1990. Here’s how bad last year’s performance was: its 724 units was lower than the 862 units permitted in 2009, during the abyss of the Great Recession.

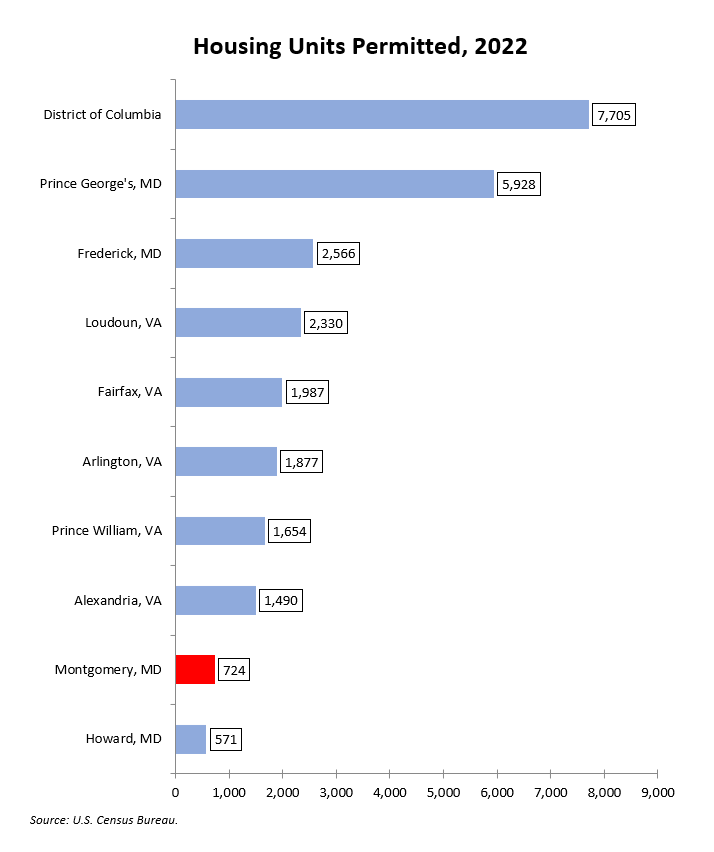

How does this compare to our neighbors? The chart below shows the number of units permitted by the ten largest jurisdictions in the region last year.

Howard County had an off year but its population is roughly one-third of ours. Prince George’s County had a great year but it’s doubtful that will continue given its passage of a tough rent control law and its potential moratorium on most townhouse construction.

There is more. Among the jurisdictions who had more permits than us in 2022 were Spotsylvania County, VA (1,652), Charles County, MD (992), Falls Church, VA (872) and Stafford County, VA (759). All of these jurisdictions are MUCH smaller than MoCo.

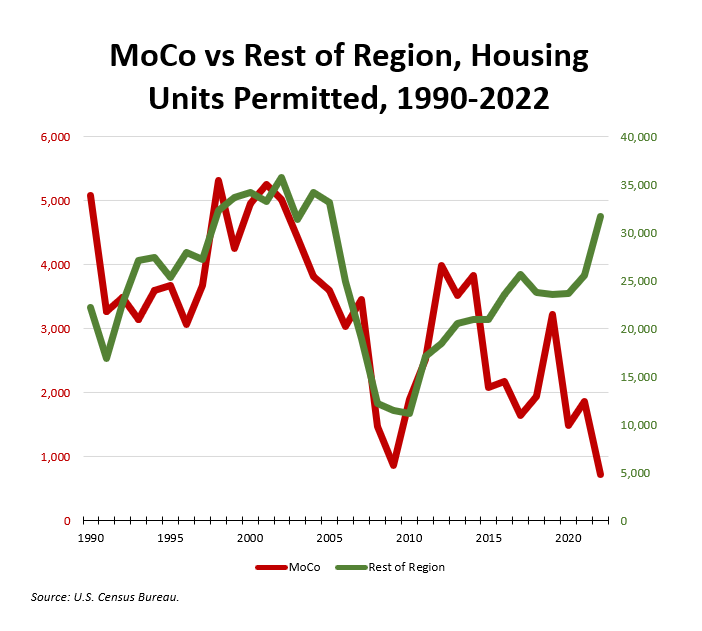

I calculated permits for the rest of the region by subtracting Montgomery County’s permits from those of the total Washington-Arlington-Alexandria metro area. While our permits dropped by 61% last year (from 1,857 to 724), the rest of the region’s permits rose by 24% (from 25,557 to 31,669).

The chart below shows the history of units permitted since 1990 for both Montgomery County (in red, left axis) and the rest of the region (in green, right axis).

For most of this period, the cyclical swings of Montgomery County and the rest of the region behaved similarly. But starting in 2014, the two headed in different directions. Montgomery began to plummet, eventually down to Great Recession levels. The rest of the region has nearly recovered to its pre-Great Recession peak.

Montgomery County has a desperate need for more housing. But given recent tax increases on home building, home sales and property along with the looming threat of rent control, we may not get it.