By Adam Pagnucco.

Part One introduced this series. Part Two examined total employment. Part Three examined private employment. Today, we look at establishments.

The U.S. Bureau of Labor Statistics’ Quarterly Census of Employment and Wages (QCEW) program, upon which this series is based, defines establishments this way:

Economic unit that produces goods or services, usually at a single physical location, and that is engaged in one or predominantly one type of economic activity.

Note: A single establishment generally produces a single good or provides a single service. An enterprise (a private firm, government agency, or nonprofit organization) can consist of a single establishment or multiple establishments. All establishments in an enterprise may be classified into one industry (e.g., a chain); into different industries (e.g., a conglomerate); or into an economic unit that produces goods or services, usually at a single physical location, and that is engaged in one or predominantly one activity (e.g., a factory, a mine, a store, or an office).

In the Washington region, 98% of all establishments are in the private sector, so effectively this stat is a proxy for place of business formation.

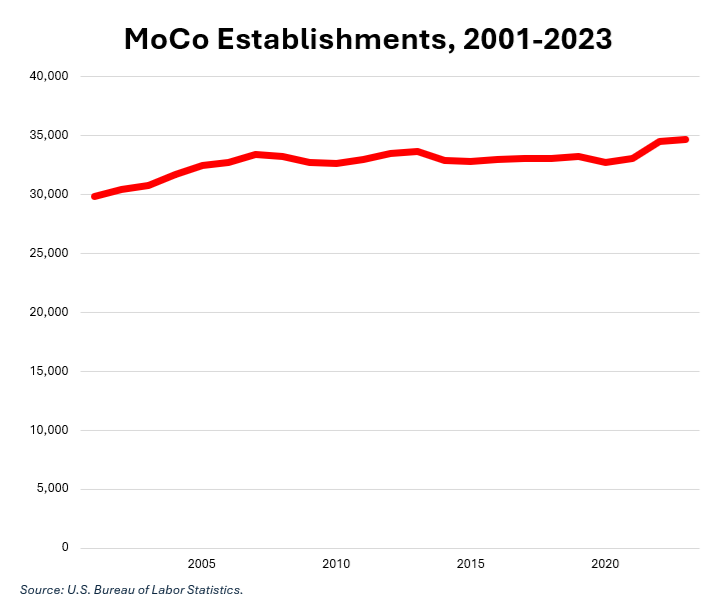

The chart below shows Montgomery County’s establishment count since 2001, when the current QCEW series began.

MoCo’s establishment count grew by 12% between 2001 and 2007 but has only grown by 3.8% since then. All of that growth occurred between 2021 and 2023, which included the later part of the pandemic.

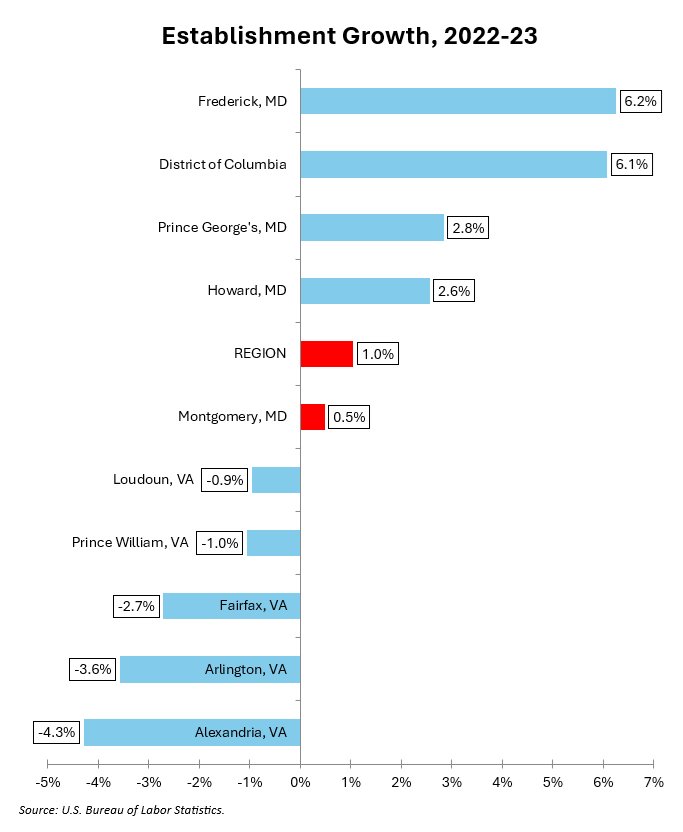

Now let’s see how we did last year. Included are the ten largest jurisdictions in the region as well as the regional total, which includes all jurisdictions in the Washington-Arlington-Alexandria Metropolitan Statistical Area.

As of this writing, we gained 165 establishments for a growth rate of 0.5% in 2023. (The current data is preliminary so the ultimate calculation may vary a bit.) The region’s establishment count grew by 1.0%. All five large Northern Virginia jurisdictions lost establishments in 2023, an unusually bad year for them.

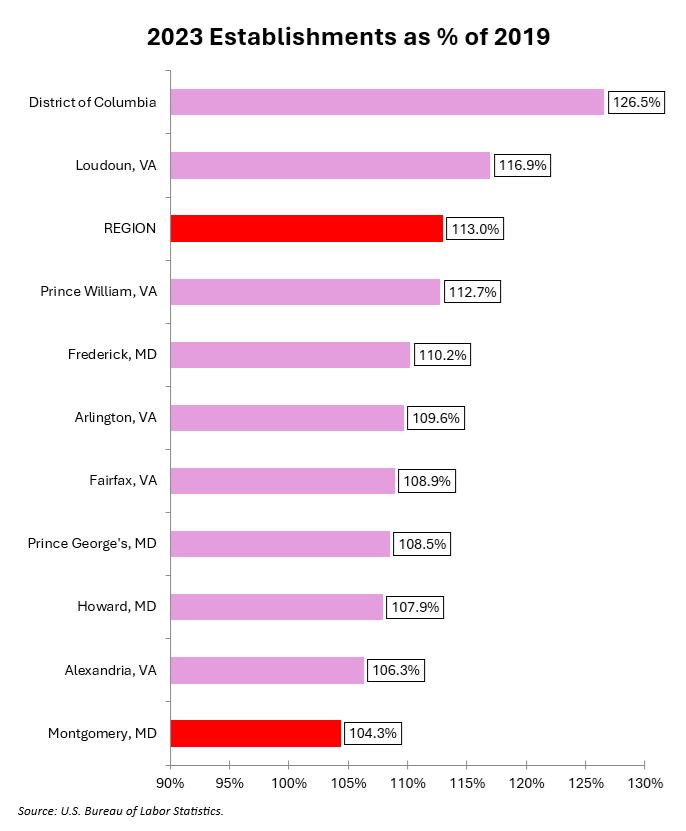

Now let’s look at our 2023 establishments as a percentage of our 2019 establishments. This measures our recovery from the pandemic.

As of 2023, our establishment count was 104% of what it was before COVID struck. While that’s a full recovery from the pandemic – a good thing – it is the worst performance of major jurisdictions in our region.

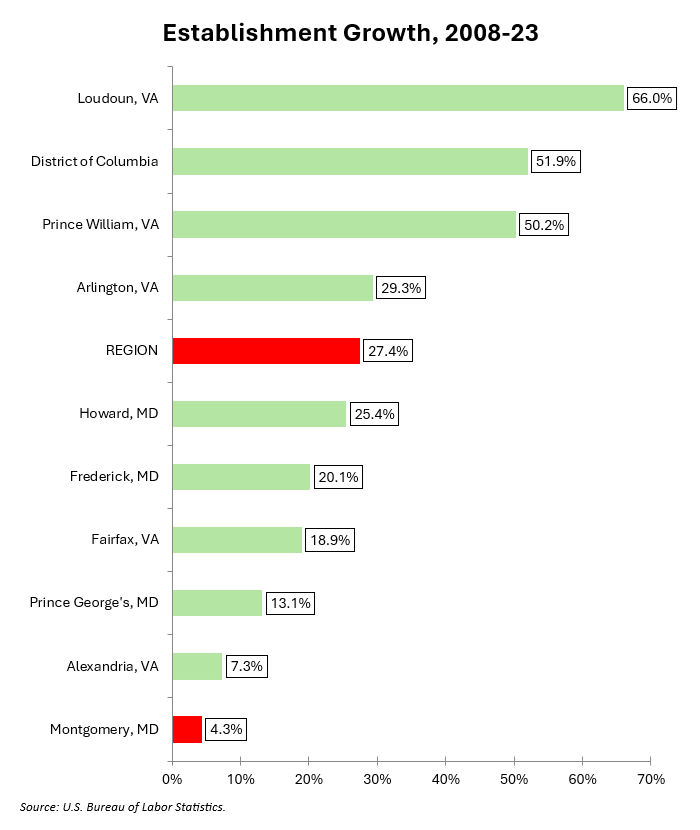

Finally, the 15-year trend appears below. I picked 2008 as the base year because that was the Washington region’s peak employment year before the Great Recession.

Over this period, we are the worst major performer in the D.C. area. Even Alexandria, the sick man of the region, beat us on this measure. This reinforces the allegation that our county is not perceived as the most attractive place to start or expand a business.

Part Five looks at total wages paid.