By Adam Pagnucco.

Last month, I wrote about how Governor Wes Moore’s budget proposal shifted millions of dollars in state costs onto the counties, with tens of millions owed by MoCo. The term for such maneuvers, inflicted by higher-level governments on their subordinates, is “shift and shaft.” Well, the shifting and shafting may not be complete as the General Assembly’s staff is proposing even more of it. And surprise! – MoCo is the biggest target.

First, a bit of history. The State of Maryland once covered the cost of teacher pensions. But in 2012, Governor Martin O’Malley proposed a partial shift of those costs onto the counties. Most of Montgomery County’s state senators and delegates voted in favor of the shift despite the fact that our county faced the most liability. MoCo now pays more than $77 million annually towards teacher pensions.

Fast forward to today. Moore, following in O’Malley’s footsteps, wants to shift more costs onto the counties. Among them is more teacher pension liability, of which MoCo’s share would be $20 million a year. For context, during the county’s budget debate of two years ago, each penny of the property tax (which then equaled about one percent) was projected to raise $22.3 million. So Moore’s shift of teacher pensions alone would cost MoCo taxpayers close to the equivalent of a one percent increase in property taxes.

State legislators are scrambling to avoid some of the budget cuts in Moore’s plan. General Assembly staff is now recommending one way to do that: shift some more pension costs to the counties. Here is what the staff wrote about the issue.

*****

Local Share of Teacher and Community College Retirement System Payments:

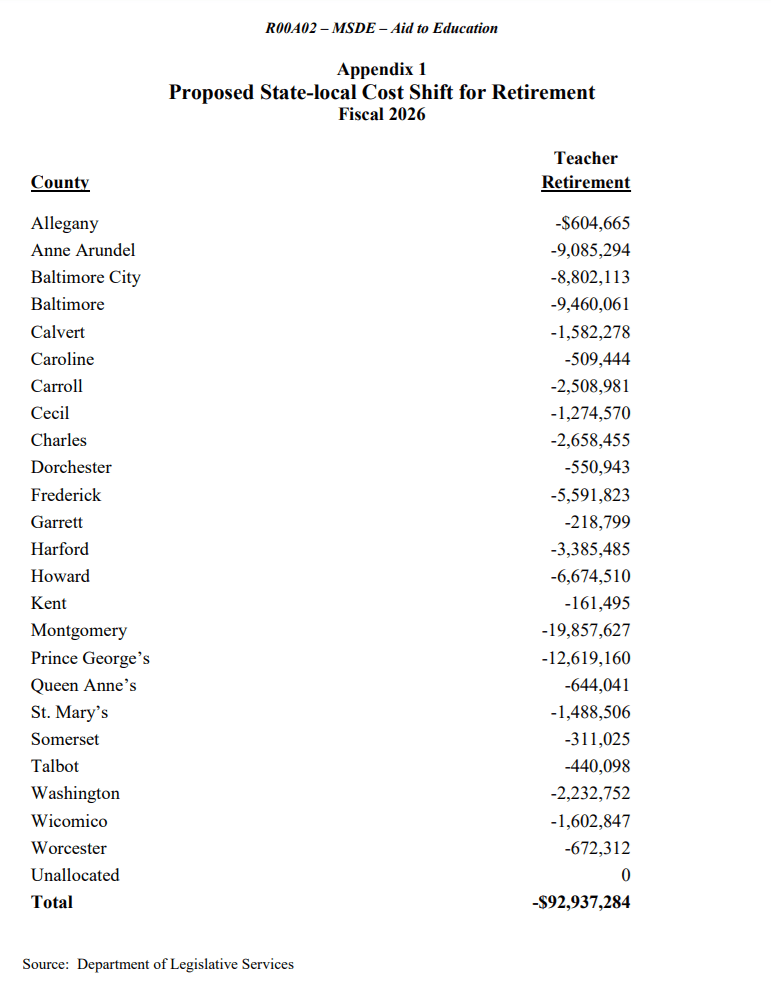

Beginning in fiscal 2026, this provision would reduce the State share of annual employer pension contributions for members of the Teachers’ Retirement System/Teachers’ Pension System (TRS/TPS) employed by local school systems and community colleges. The TRS/TPS membership includes, among others, (1) teachers and principals employed by local school systems; (2) specified community college faculty members; and (3) librarians employed by county libraries. Specifically, starting in fiscal 2026, general fund expenditures decrease by $97.7 million annually, which is equal to one-half of the year-over-year increase in employer contributions from fiscal 2025 to 2026, as determined by the actuary, for members employed by local school systems and community colleges, of which $92.7 million is accounted for within this budget. The amount of the reduction remains constant in the out-years. Employer contributions by counties and Baltimore City increase commensurately in proportion to their respective shares of TRS/TPS membership. DLS recommends shifting 100% of the fiscal 2026 increase in the State share of teacher retirement costs to local jurisdictions. Appendix 1 presents the proposed State-local cost shift in the BRFA as introduced.

*****

Here are the costs to the counties of such an additional shift as shown in Appendix 1.

MoCo’s share is another $20 million, again the highest in the state. If the General Assembly goes along with the recommendation of its staff, MoCo will face added cost equivalent to nearly a two percent property tax increase.

This would come on top of Moore’s state income tax increase, of which nearly half would be paid by MoCo. Let’s remember that our population is roughly a sixth of the state’s.

The dark irony here is that state leaders are now warning about a shift and shaft from the federal government. Republicans in Congress are considering cutting the federal government’s share of Medicaid costs and shifting it to the states. That possibility prompted this comment by Maryland State Senate President Bill Ferguson to Maryland Matters.

*****

Spiking costs of Medicaid — a cost the state splits with the federal government — have been blamed for part of a $3 billion deficit that Maryland faces in its fiscal 2026 budget. A shift to 47% federal and 53% state funding could have dramatic effects on the state budget.

“We know that Medicaid has been a driver of some of our challenges in the state,” Ferguson said. “Additional cuts to Medicaid or additional cost shifts will have an absolutely devastating impact on the state of Maryland, and so when we look at the challenges that we’ve been facing at the beginning of session, we said, we have to see what the actual data shows. The reality is, it’s worse than we expected, and what’s coming down from the federal government.”

Ferguson predicted “a very sobering conversation about what this budget looks like in the next 30 days.”

*****

So the feds shift costs to the state. The state shifts costs to the counties.

Guess who gets the shaft?