By Adam Pagnucco.

Under County Executive Marc Elrich’s FY26 recommended operating budget, the vast majority of homeowners in MoCo will be charged hundreds of dollars more on their property tax bills next year. For commercial properties, the extra charges will range into tens of thousands of dollars. Will taxpayers receive increased services to go with the steep increases in tax payments?

Higher property tax bills come from three sources. First is the executive’s recommended increase in the weighted average property tax rate of 3.5 cents per $100 in assessed value. Second is the executive’s gigantic recommended solid waste fee increase, which would hike fees on residential properties by 31% and roughly double them on commercial properties. Third is a substantial increase in property assessments which we revealed back in December.

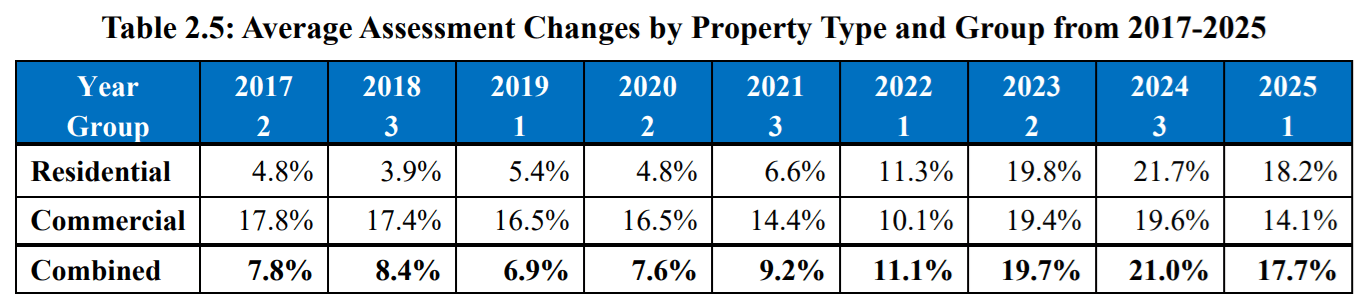

Let’s deal with rising assessments first. The table below comes from a county council staff packet discussing Elrich’s budget. The state divides properties into three assessment groups and reassesses each of them every three years. The table shows average assessment changes for each group reassessed since 2017.

Commercial properties have seen average assessment increases of double digits every year. Residential assessment increases were once more restrained but now exceed commercial increases.

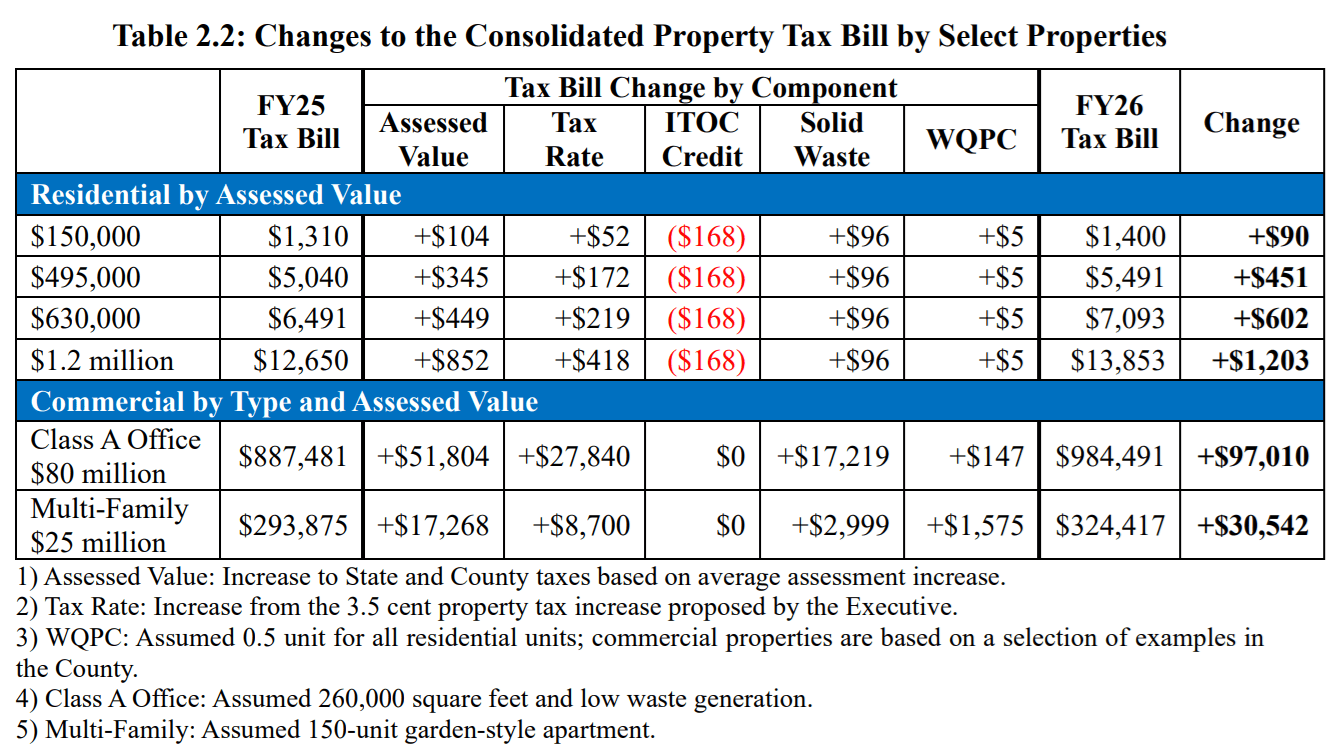

Now let’s evaluate the cumulative impact of rate increases, fee increases and assessment increases. The table below shows FY25 and FY26 property tax bills for a sample of residential and commercial properties. Each source of change is listed separately. ITOC refers to income tax offset credit, which is a credit available for owners occupying their residential properties that Elrich would like to increase. WQPC is the county’s water quality protection charge that Elrich would like to raise by $5.

Every single property in the illustration would get a larger property tax bill, even residential properties assessed at $150,000. (There can’t be a lot of those in MoCo.) For context, consider that the average MoCo residential assessment in the property group just reassessed by the state is $766,421. That means the average homeowner’s property tax bill is set to rise by roughly $700 under Elrich’s budget.

What’s interesting about the above analysis is that the largest component of the bill increases is not the tax rate or fee increases but the assessment increases. Even if the county council rejects Elrich’s tax and fee hikes, the vast majority of residential tax bills will still rise by hundreds of dollars.

All of this comes on top of the massive tax increase package passed by the General Assembly. An early analysis of that package’s income tax increase found that 44% of its cost would be paid for by Montgomery County residents. The General Assembly made some changes to that package so it’s not clear what that percentage is now, but it’s probably not terribly different. Another issue is that the General Assembly allowed counties to raise their maximum income tax rate from 3.2% to 3.3%, a measure which MoCo has not yet adopted.

In a recent county government survey of residents, 42% feel they pay too much for the services they receive and another 7% said that they would accept service reductions in exchange for lower taxes. Just 11% of respondents say they are willing to pay more taxes to get more services.

With the state raising taxes and President Donald Trump clobbering the stock market, the global economy and the region’s federal jobs base, how many MoCo residents are willing to pay several hundreds of dollars more to their county government?