By Adam Pagnucco.

An analysis by the State of Maryland’s Bureau of Revenue Estimates (BRE) indicates that Montgomery County residents will pay nearly half of the state income tax increase just passed by the General Assembly. Consider that MoCo has roughly one-sixth of the state’s population.

Previously, I reported that BRE estimated that MoCo would pay 44% of the income tax hike proposed by Governor Wes Moore. The General Assembly made some changes to the income tax increase before passing it. BRE’s new analysis summarizes those changes as follows:

*****

The current proposal will increase by one-fifth the value of the standard deductions, whereas the original proposal would have doubled the values. While the original proposal eliminated itemized deductions for all taxpayers, the current proposal phases out itemized deductions for taxpayers with federal adjusted gross income in excess of $200,000 ($100,000 if married filing separately). The amended proposal keeps all income tax brackets the same as under current law but it establishes two new brackets for higher-income taxpayers with a maximum income tax rate of 6.5% for taxpayers with incomes over $1 million ($1.2 million for joint returns). The Bureau’s estimate of the proposed changes to the child tax credit is unchanged from its original analysis. Lastly, the amended proposal increases to 2% the surcharge on capital gains income for those taxpayers with federal adjusted gross income of greater than $350,000. In combination with the BRFA’s proposed increase in the maximum local income tax rate, the maximum State and local income tax imposed on high income taxpayers with capital gains income will be 11.8% if and when local government(s) exercise the increased authority.

*****

An aside. See how Maryland’s maximum income tax rate on high earners with capital gains income will now be 11.8%? Virginia’s maximum income tax rate is 5.75%. Maryland will now charge high earners more than twice as much income taxes as Virginia.

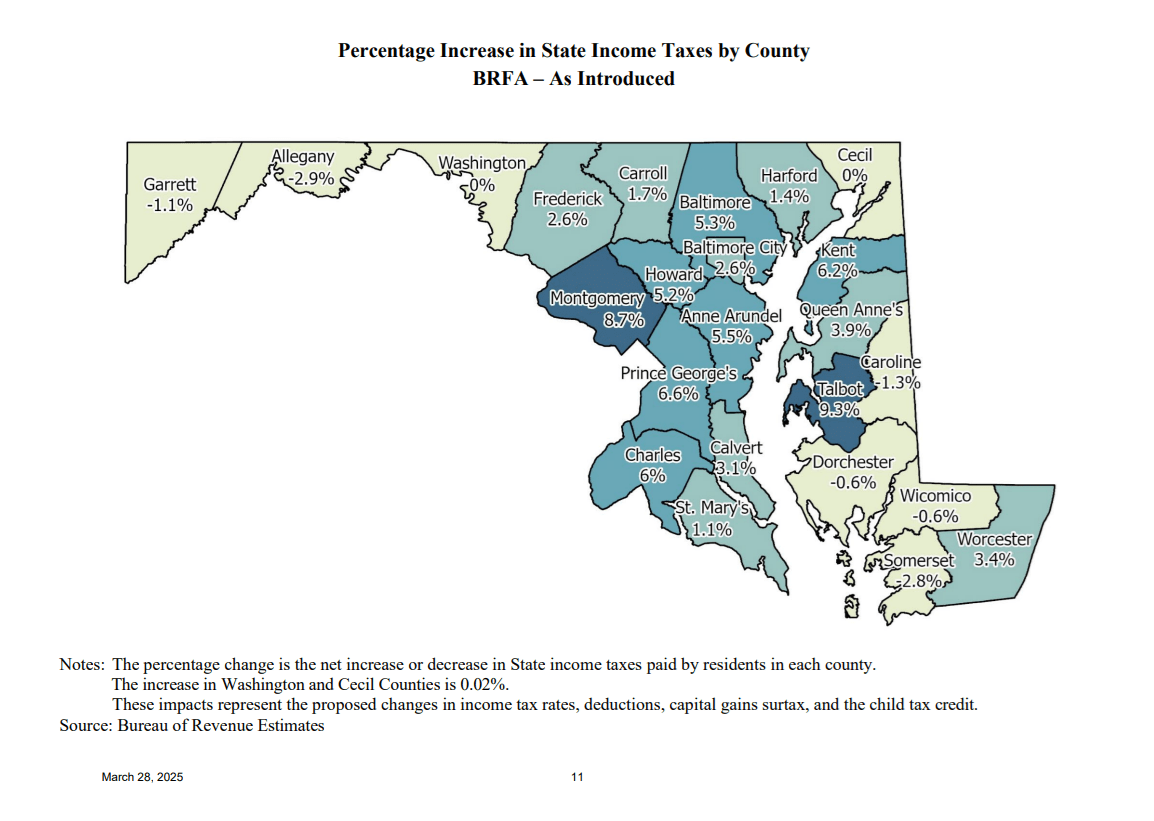

Now to the county distribution of the income tax hike. The skew towards the upper end hits MoCo harder than almost any other county in the state. The map below shows the increase in state income tax payments by county.

Only one county – tiny Talbot County on the Eastern Shore, which depends on high-priced real estate on the bay – will be paying a higher rate of increase than MoCo. Meanwhile, eight counties will be paying almost nothing more or even less than they are now. Those counties are all controlled by Republicans. This makes me wonder why General Assembly Republicans voted against this tax hike. Why oppose what amounts to a massive transfer from MoCo to red jurisdictions?

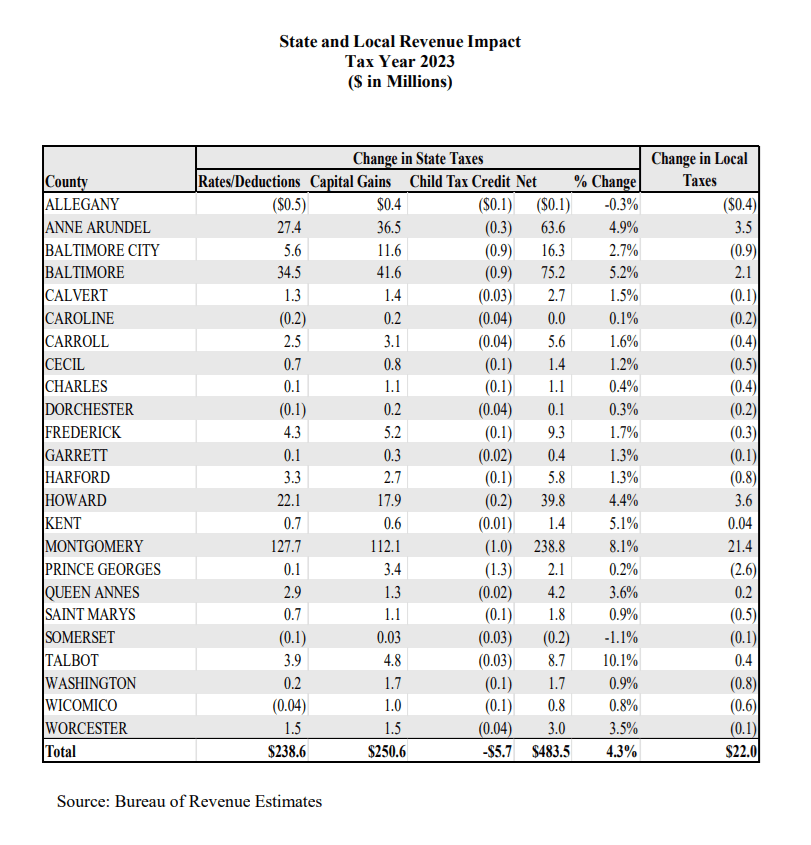

The table below summarizes the income tax increase by county and component. BRE’s estimates are based on tax data from 2023.

MoCo taxpayers are projected to pay 54% of the increase due to rate and deduction changes, 45% of the increase in capital gains tax collections and 49% of the package overall. Additionally, the state’s new limits on itemized deductions for taxpayers making more than $200,000 will result in $21 million in additional income tax collections for Montgomery County government, nearly all of the net combined increase for counties across the state.

And as for the shift and shaft provisions in Moore’s budget? The General Assembly chose to allow counties to increase their own maximum income tax rates from 3.2% to 3.3% to pay for them. How long do you think it will take for MoCo to increase its own income tax rate?

MoCo accounts for a sixth of the state’s population but will pay almost half the state income tax increase. I bet MoCo will also account for a huge share of the state’s new 3% tech tax but I have not seen a county distribution of that tax yet.

This year’s targeting of MoCo bears the echoes of the last time the state raised income taxes, a 2012 increase of which MoCo paid a 41% share. This time around, almost all of our state legislators voted for this tax package despite its heavy burden on their own county. The exceptions were Senator Katie Fry-Hester and Delegates Chao Wu and Natalie Ziegler, who represent a handful of precincts in Clarksburg and Damascus along with northern Howard County. These folks get competition from Republicans in general elections so their no votes were understandable. But all the other MoCo legislators voted yes. As for our county elected officials, if any of them have complained about this, I haven’t seen it.

Has there ever been any other local jurisdiction anywhere in Maryland that has paid for nearly half of a major statewide tax increase? Ever?

And so an unholy, and perhaps unwitting, alliance has arisen to take down Montgomery County’s tax base. First comes President Donald Trump, whose assault on federal funding and jobs is sure to cost MoCo dearly. Second come the Lords of Annapolis, who follow the ancient tradition of soaking the county to pay the state’s bills. And third comes County Executive Marc Elrich, who proposes an unnecessary property tax hike and a gigantic fee hike as the economy teeters on the brink.

Sometimes the unlikeliest alliances are the most effective.