By Adam Pagnucco.

As county leaders discuss whether to raise Montgomery County’s income tax, it’s time to consider how our tax stacks up against other jurisdictions. Income taxes can be complicated (many taxes are!) but this is intended to be a summary.

MoCo residents pay two personal income taxes in addition to their federal tax: a state tax and a county tax. Maryland’s income tax is progressive, with rates in brackets rising with income. Until recently, county income taxes were required to be flat with a maximum allowed rate of 3.2%. However, Delegate Julie Palakovich Carr passed a state law in 2021 allowing counties to establish brackets too. Anne Arundel and Frederick counties now use brackets but MoCo still has a flat tax. This year, the General Assembly allowed counties to raise their income tax to 3.3% to pay for cost shifts passed down by the state government. That’s what County Executive Marc Elrich has proposed and our council is now considering.

In this analysis, I compared income taxes in MoCo (combining the state and local rates) with other jurisdictions on the East Coast. I included West Virginia because we border it. Most states do not allow local income taxes, but a few do. In my charts, I include separate calculations for New York City and Yonkers, NY; Wilmington, DE; Newark, NJ: and Philadelphia and Pittsburgh in PA, all of which have taxes on income or wages. Most of the states have progressive income tax structures with the exceptions of Massachusetts, Pennsylvania, Georgia and North Carolina, which have flat rates. There is immense variation in brackets among the progressive states. For example, Virginia’s top bracket is $17,000 while New York’s top bracket is $25 million.

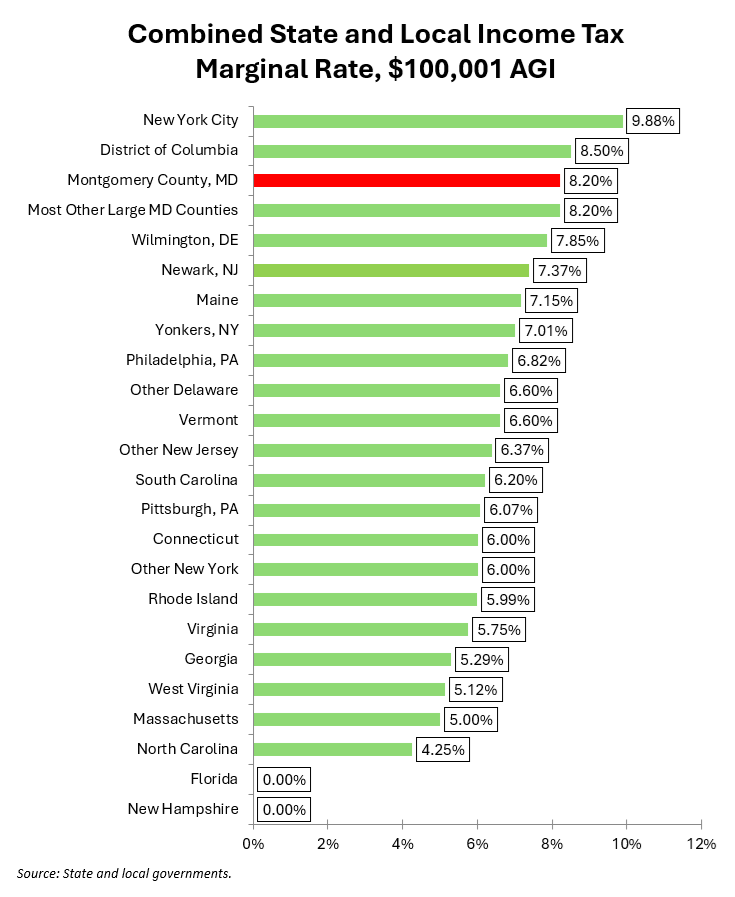

Let’s start with single returns of just over $100,000. The chart below shows marginal combined state and local income tax rates at that level of income in 2025.

Individuals at this level are roughly middle class in MoCo. For these people, only New York City and D.C. charge higher rates than MoCo (and most other large Maryland counties, which also charge the maximum rate of 3.2%).

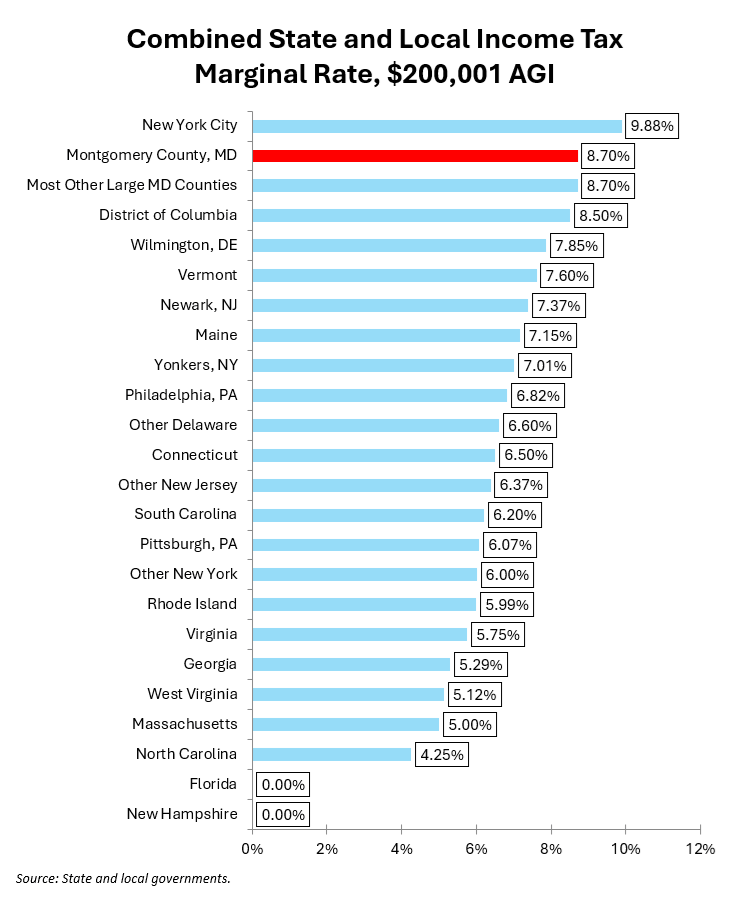

Now let’s look at single returns of just over $200,000. According to council staff, folks who make this much money and more account for a majority of MoCo’s adjusted gross income.

At this level, MoCo and most large Maryland counties are exceeded only by New York City.

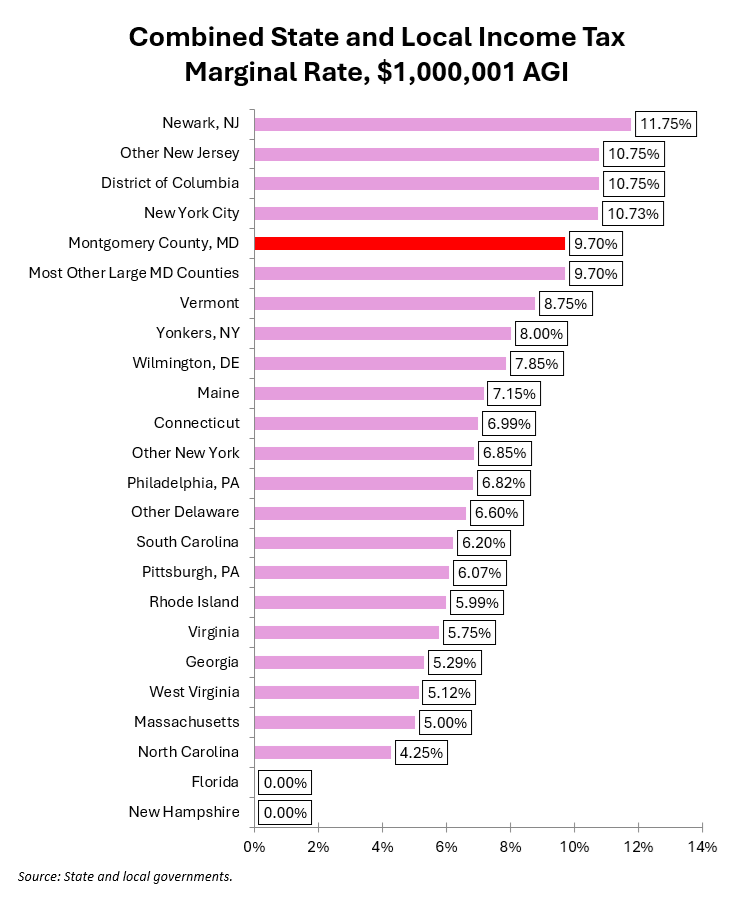

The chart below shows rates for single returns of just over $1,000,000.

New Jersey, D.C. and New York City lead MoCo and many other large Maryland counties here.

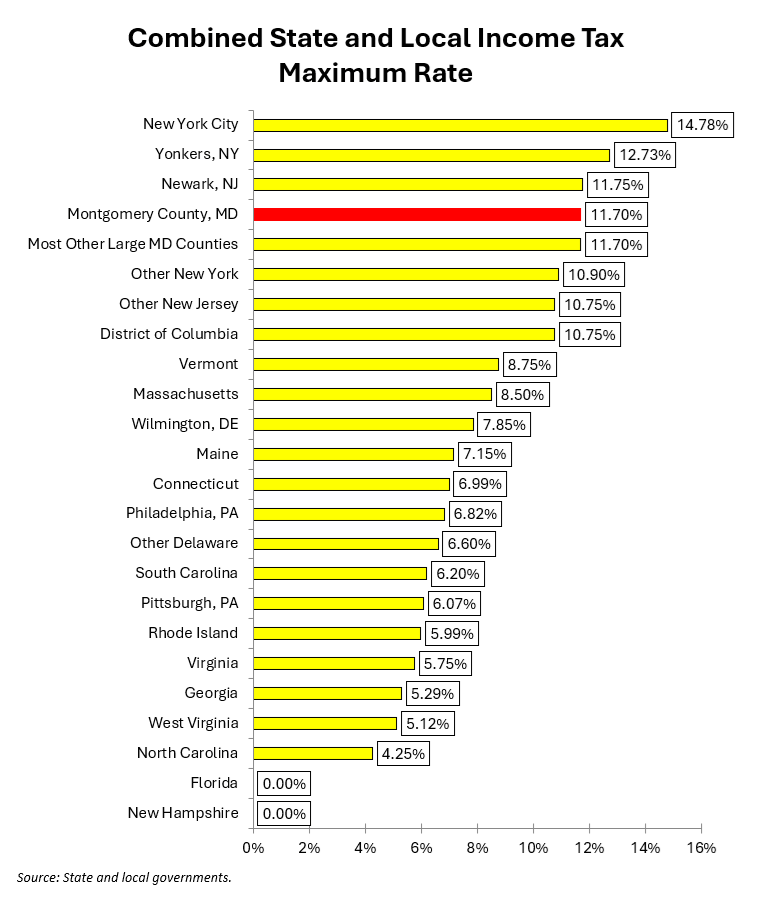

Now let’s consider the maximum rates currently charged by all of these jurisdictions. In Maryland, that includes the 2% surcharge on capital gains on those who make more than $350,000. Not included is the extra 0.1% tax that counties are now allowed to charge, which none of them do (yet). Also not included is the Maryland General Assembly’s recent decision to phase out itemized deductions for people making more than $200,000. Massachusetts charges 8.5% on some capital gains, a divergence from its normally flat rate of 5%.

At this level, MoCo is exceeded only by New York City, Yonkers and Newark. With the extra 0.1% now under consideration by the council, MoCo would surpass Newark.

When D.C. Council Member Jack Evans said “Thank God Maryland keeps raising their taxes,” he wasn’t kidding!

Look folks, when your income tax is comparable to New York, New Jersey and D.C., you’re not in good company. Also of note is that MoCo’s combined rates are higher than Delaware and FAR higher than Virginia. The county council is considering a 0.1% increase to 3.3%, the new maximum in state law, so that change would not alter the above charts much. But I have little doubt that this rate structure contributes to huge taxpayer outmigration from Maryland to states like Florida and Texas (which have no income tax) as well as the Carolinas, Delaware, Pennsylvania, West Virginia and Georgia.

MoCo has a competitive disadvantage here. The council should think long and hard before making it worse.