By Adam Pagnucco.

One of the major themes of this site in recent times is that the county’s rent control law, passed in 2023, is preventing construction of multifamily housing. It’s not just because building owners dislike rent control because it limits revenue increases in the absence of any limits on cost increases (such as county property tax hikes). It’s also because real estate financiers dislike investing in projects subject to rent control and have redlined Montgomery County as a place to invest. In any event, MoCo has just seen an all-out collapse of multifamily permits that makes it an outlier in the region.

Now the Planning Department has gathered additional evidence of the deterrent effect of rent control on housing production. In a recent Residential Development Pipeline Analysis Project Update, planning staff examined the status of the “pipeline,” which consists of projects that are approved but unbuilt. The pipeline now consists of roughly 29,500 housing units, of which “about 14,700 are beyond initial entitlement stages and positioned to begin the permitting process.” According to the U.S. Census Bureau, MoCo had a total of 408,680 housing units in 2024.

Planning staff wanted to know why these projects are still unbuilt. They wrote:

*****

Montgomery Planning conducted the first phase of a Development Pipeline Analysis to better understand why many approved housing projects remain unbuilt and how the county can improve both housing delivery and the way the Pipeline is presented to the public. This first phase of Montgomery County’s analysis reviewed 88 projects accounting for 99% of unbuilt units in the Pipeline and included a developer survey (47 responses) and 14 follow-up interviews to capture barriers and market conditions, input from regulatory planners, and a review of peer jurisdiction practices. Planning Staff also tested refinements to how projects are categorized and presented. These early findings highlight both the barriers that stall development and the limits of the current Pipeline as a predictor of housing production.

*****

Here’s one thing of many I have learned about developers over the years: most of them are reluctant to go on the record about why they’re not building approved projects. It’s bad for business. But they will go off the record. They did just that in my 2023 Crossroads series in which they blasted rent control. Their position appears not to have changed given their comments to planning staff.

As mentioned above, staff conducted both a survey of developers (with 47 responses) and 14 follow-up interviews. They wrote:

*****

The questionnaire responses indicated that while a majority of projects are actively advancing, many are doing so cautiously, and only a plurality of all respondents (37.5%) is committing all necessary resources to advance the project. Nearly one-third of respondents’ projects are inactive or receiving only minimal resources. The most frequently cited impediments to project completion were financial infeasibility, construction cost increases, and local policy constraints—particularly rent stabilization. A few respondents are pursuing amendments to existing entitlements.

*****

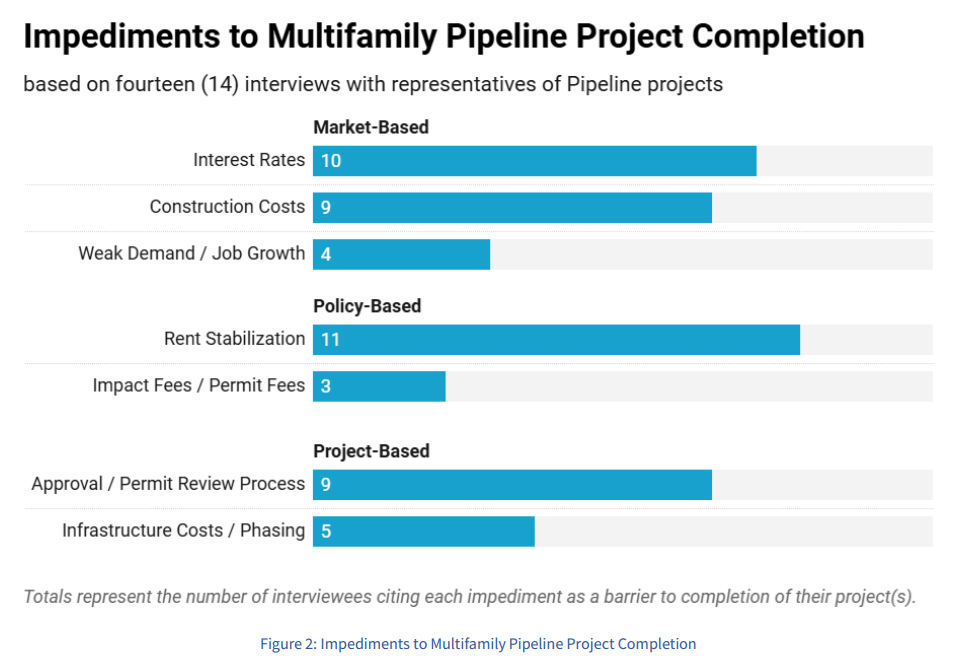

In the 14 follow-up interviews, the issues below were the most commonly identified as impediments to multifamily construction. Rent control led the list.

Here is what the staff wrote about rent control.

*****

Interviewees cited several local policies as barriers to project completion. By far the most common policy barrier mentioned was the rent stabilization regulation passed in 2023, which became effective on July 23, 2024. While many projects with unbuilt units in the Pipeline predate the regulation, interviewees cite a broader chilling effect on construction financing. Additionally, financing is typically closed after all approvals are complete, so some projects that entered the Pipeline prior to the regulation may now be impacted. While several other local policies—including the cost and timing of impact fees and permit fees—were mentioned by interviewees as impediments, none received the near-unanimous attention given to the rent stabilization regulation.

Rent Stabilization: Cited in 11 interviews

- Lack of exemptions for new construction, which respondents stated results in negative impacts on potential exit values as purchasers “price in” the future applicability of the policy.

- Vacancy control, a provision which limits the ability for landlords to increase rents on a unit upon tenant turnover. Respondents noted vacancy control is “atypical nationally” and imposes “a different level of control” by shifting from a tenant-based protection to a unit- or property-level restriction.

- Political risk and perception, which most respondents cited as the key challenge of the policy. While views are mixed about the direct financial impact of the policy on multifamily rental operations, respondents overwhelmingly cited “headline effects” and a countywide “redlining” by capital allocators due to perceptions of a hostile climate for investment and the potential for additional negative policies during the life of their investment.

*****

There’s that word again: “redlining.” Even if developers would like to build multifamily rental housing here, they are struggling to get financing. So why not build somewhere else where rent control is not an issue?

Rent control is not the only issue preventing housing construction and the full report is worth reading. But it’s now crystal clear that rent control is undermining the important goal of most county leaders – as well as Governor Wes Moore – of expanding our housing supply.

So what are county elected officials going to do about it?