By Adam Pagnucco.

County Executive Marc Elrich released his FY24 recommended operating budget today. There is a lot to read in there, but the headline is this: he is proposing a 10 cent property tax hike, which equals a ten percent increase in property taxes. Since one penny raises roughly $20 million, this tax hike could yield close to $200 million, making it one of the largest tax hikes in county history.

This is the least surprising development I have seen in my 17 years in county politics.

I will have more on the nature of the tax hike and particularly how it interacts with the voter-approved charter limit. But let’s understand the broader picture first. Elrich has a long history of supporting tax hikes. When he was on the county council, he voted for four of them, including:

A 13% property tax hike in 2008.

A near doubling of the energy tax in 2010. The increase was supposed to sunset in two years but roughly three-quarters of it was subsequently made permanent.

An increase to recordation taxes in 2016.

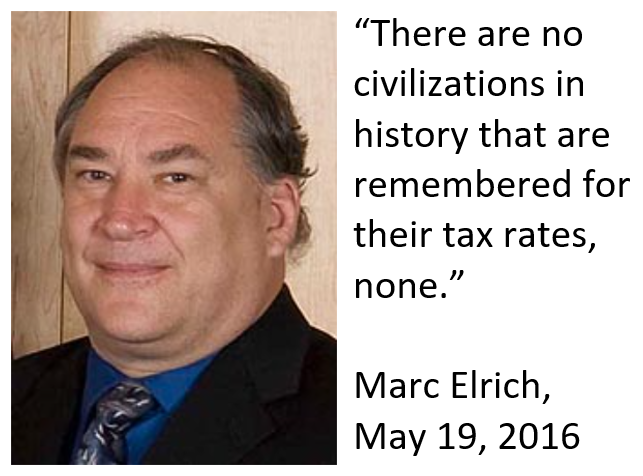

An 8.7% property tax hike in 2016. In voting for this increase, Elrich uttered one of his most notorious quotes in a political career full of them: “There are no civilizations in history that are remembered for their tax rates, none.”

By the time that he ran for executive in 2018, Elrich had a different message about taxes: he intended to restructure government to eliminate positions, thereby saving money, so a tax hike would not be necessary. Elrich told WAMU that a tax hike was “out of the question” and he wrote the following in a Washington Post op-ed:

Far from saddling taxpayers with higher bills, I will streamline county government. Unions and their members, our county’s workforce, know and trust me. That is why we announced our plan to restructure county government together. Our county is facing difficult financial times; without thoughtful changes, employees will face across-the-board cuts.

It took Elrich less than a year and a half to break his promise on taxes. In March 2020, he proposed a $66 million property tax hike which the council promptly rejected. He also proposed a hidden property tax hike involving recalculation of the charter limit which the council also scrapped. As if that were not enough, he proposed a charter amendment to make tax hikes easier. Again, the council said no.

Elrich backed off taxes for a time but he embarked on an aggressive expansion of government, adding more than 2,000 positions across county agencies during his first term. This time, the council went along. Elrich’s promised restructuring plan never happened as his task force recommended eliminating just 9 positions in the whole government. Elrich could get away with this temporarily because the county budget was juiced with federal money but now that is drying up. By January, I could see where this was headed and I wrote, “Can the county control its spending to offset likely declines in federal money?”

Now we know the answer.

Look folks, there are no surprises here. Responsible elected officials make hard choices in budgets. They give increases to departments in great need that match their policy agendas and pay for them by restraining spending growth in other departments. Tax hikes might be necessary in downturns, like the Great Recession, but otherwise well-governed polities spend carefully and try to live within their means.

Elrich takes credit for not raising taxes on his 2022 campaign website.

That is not the way of Elrich, who won last year’s Democratic primary by a bare 32 votes. If he had admitted that he planned a 10 percent property tax hike immediately after reelection, would he still be in office?

So much for campaign promises. Always remember:

Elections have consequences.