By Adam Pagnucco.

Last week, I published a post titled They Were Warned explaining how the county council was told by their own staff a year ago that the executive’s recommended budget was unsustainable. The council mostly ignored their staff and added both spending and positions to that budget. Now the staff is back with new warnings about this year’s budget. Will the council learn the lesson of last year?

In a memo to be considered at the council tomorrow, the staff once again lays out the fiscal dangers lurking in County Executive Marc Elrich’s recommended budget. They begin with this statement:

*****

Council staff has concerns about the Executive’s proposed use of one-time resources for ongoing expenditures, sustainability of spending growth given projected resources, and a potential structural deficit as early as FY25:

- The Executive’s proposed budget is not consistent with the Council’s adopted fiscal policies on use of one-time reserves.

- The Executive’s budget would result in a 16.8% increase in tax supported expenditures from FY22-FY24, the largest two-year spending increase since prior to the Great Recession.

- The Executive’s budget commits the County to future funding increases for MCPS under the Maintenance of Effort law.

- The Executive’s recommended budget creates an estimated structural deficit of approximately $145 million in FY25.

*****

Let’s dig into some of these issues and others.

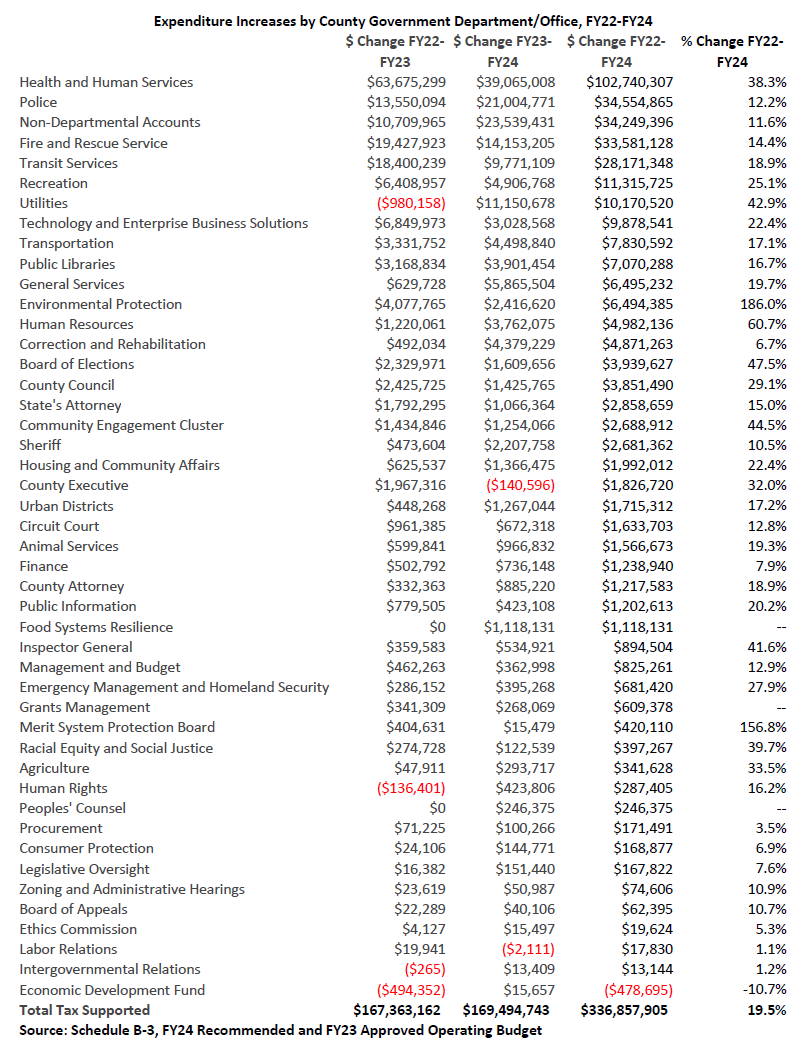

The two-year increase received by many county departments is astronomical.

In my post titled The Central Fiction of Elrich’s Budget, I laid out how many county departments and agencies were receiving large increases this year other than just MCPS. The staff added up the two year increase for many of these departments and agencies combining last year’s approved budget and this year’s recommended budget. They then printed the table below.

This is the county executive who promised over and over again to save money by streamlining government instead of resorting to tax hikes. Instead, he is seeking to push through what is the biggest expansion of county government since before the Great Recession financed by one of the biggest property tax hikes in county history.

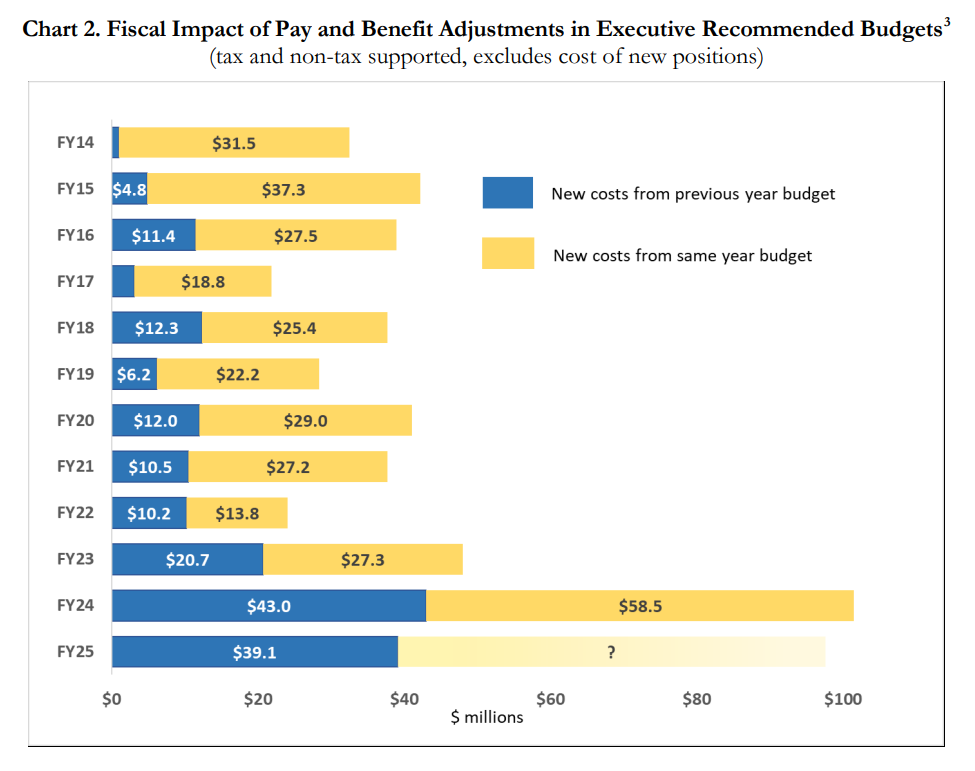

The executive’s compensation increases will be difficult if not impossible to sustain.

MCPS has not concluded negotiations with its unions so school employee compensation packages are not yet known. However, the executive has concluded agreements with the three county government unions – MCGEO, the police and the fire fighters – and their members will receive raises ranging from 6.0% to 13.4%. Those raises plus benefit adjustments have an annualized cost of $100 million.

The staff printed the table below showing how the cost of raises this year compares to prior years.

The staff writes:

The Executive recommends a 7.9% increase in FY24 compensation costs for Montgomery County Government (with employee turnover savings incorporated into that total). Excluding revenue from the tax increase, since that can only be used for MCPS, this increase is nearly three times the projected FY24-FY29 average annual revenue growth rate of 2.8%.

Translation: Under current projected revenues, the executive’s compensation increases are unsustainable.

The executive’s budget heavily relies on one-time revenue sources.

The staff writes:

The Executive’s proposed budget is not consistent with the Council’s adopted fiscal policies on use of one-time reserves. The Executive uses $159.3 million in reserves in FY24, mostly to fund ongoing expenditure. This action is not consistent with the Council’s fiscal policies which requires that one-time revenues, such as excess reserves, only be used for one-time expenditures. The budget also uses over $30 million in additional one-time resources from a recapture of Income Tax Offset Credit revenues and an increase in assumed “lapse” savings from vacant positions in County Government.

The problem with using one-time revenue sources is that they must be replaced if they are used for ongoing spending. That leads to:

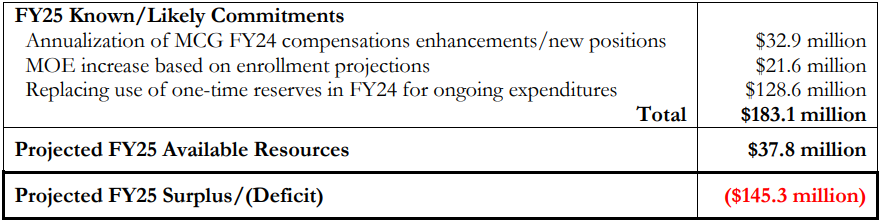

The executive’s budget contains a structural deficit of $145 million.

The staff writes:

The Executive’s recommended budget creates an estimated structural deficit of approximately $145 million in FY25. Even with continuing revenue from the proposed 10-cent tax increase, the Executive’s recommended Fiscal Plan estimates that $37.8 million of additional tax supported resources will be available for agency uses in FY25, representing a 0.7% increase from the recommended FY24 uses. However, the Executive’s budget includes known, or likely, FY25 tax supported expenditure increases totaling $183.1 million as detailed below. Absent any changes, addressing this gap may require spending reductions or revenue increases in FY25.

Since each penny of the property tax raises roughly $22 million, this creates the possibility of a 7% property tax hike next year. That would come on top of this year’s 10% property tax hike plus rising tax bills due to increased assessments.

Here is the bottom line: if the council approves anything resembling the county executive’s recommended budget, it will cause a cascading chain of consequences with escalating liabilities and repeated tax hikes. That’s assuming there is no recession in the next few years. Council, the time to take a stand is now.