By Adam Pagnucco.

Here is how the U.S. Bureau of Economic Analysis defines personal income.

Income received by persons from all sources. It includes income received from participation in production as well as from government and business transfer payments. It is the sum of compensation of employees (received), supplements to wages and salaries, proprietors’ income with inventory valuation adjustment (IVA) and capital consumption adjustment (CCAdj), rental income of persons with CCAdj, personal income receipts on assets, and personal current transfer receipts, less contributions for government social insurance.

Trends in this measure should approximate the base for the county’s income tax, which is the county government’s second largest revenue source (behind property taxes). Rising levels of personal income should be very helpful for the county’s budget.

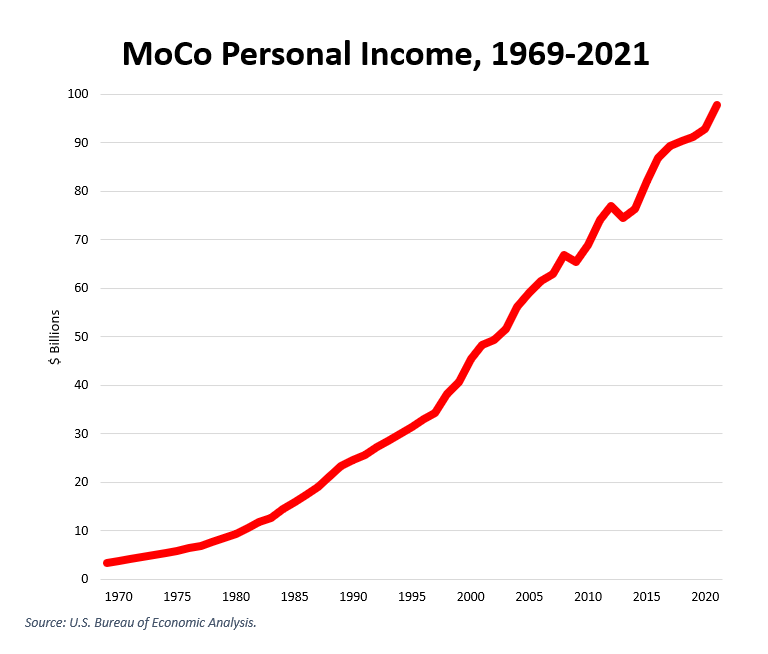

The chart below shows the county’s personal income from the U.S. Bureau of Economic Analysis from 1969 through 2021.

This looks great, right? But let’s remember – this reflects population growth and inflation as well as real gains in per capita personal income. The county has had a lot of growth in both population and prices since 1969.

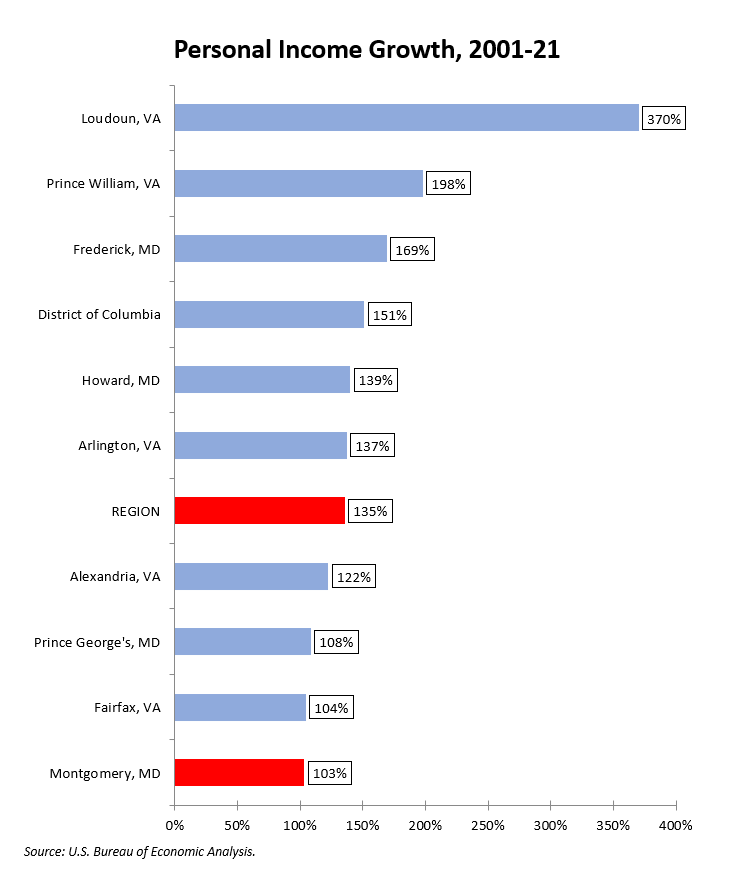

Now let’s compare our growth in personal income to the other big players in the region over the last 20 years.

This is not so great. We grew, yes, but all of the other big players saw more growth on this measure.

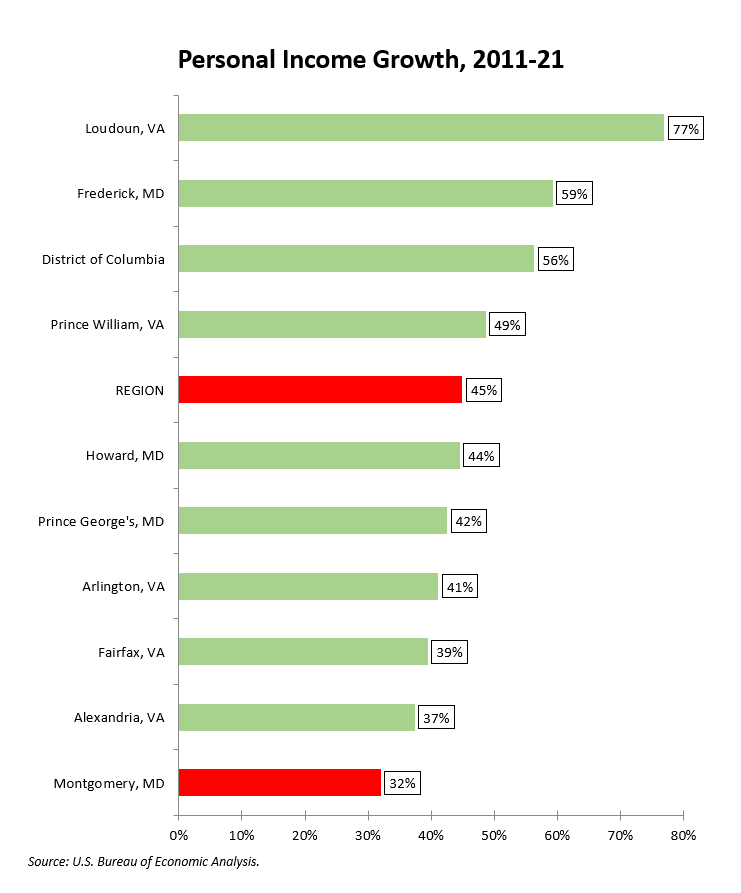

Here is personal income growth in the last decade.

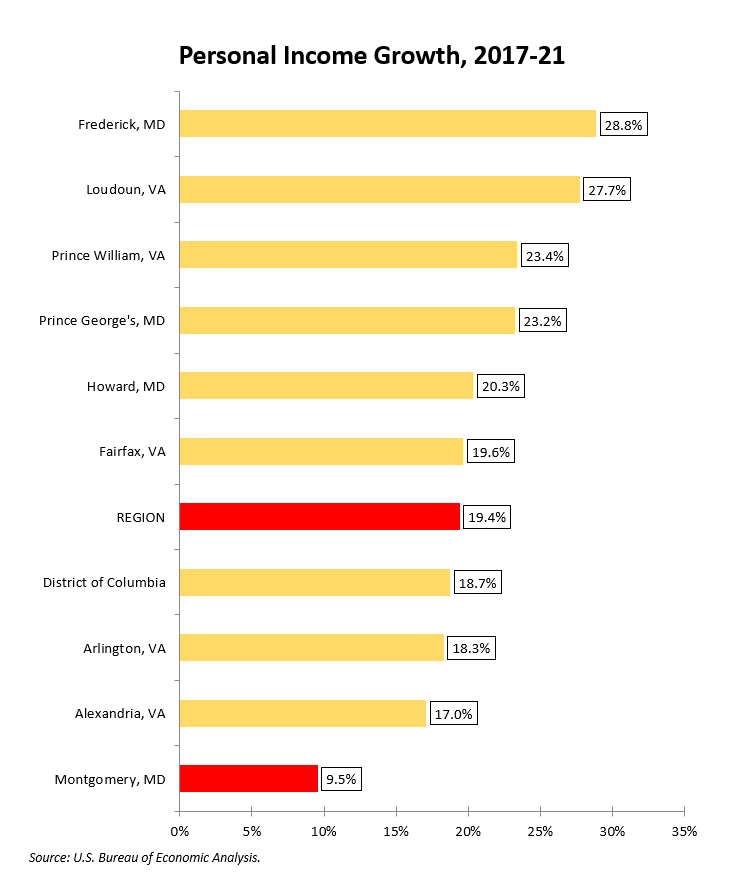

Again, we lag. Finally, here is growth from 2017 (our peak year of real gross domestic product) through 2021.

Last again. Let’s remember that some politicians would like to raise our income taxes. If they do so, they may get less revenue than they believe.

Let’s put this in perspective. We are not going to be the worst on every economic measure we examine in this series. And I would not say that we have the weakest economy in the region overall. But personal income is not just important for government budgets – it’s our income that supports our quality of life. The government should be helping us figure out how to make more money, not simply how much more to tax it.

Up next: wage and salary employment.