By Adam Pagnucco.

The first of multiple tax hikes that will likely be implemented in coming weeks is now on deck. But this one did not originate with either the county executive or the county council. Instead, it is set to take effect automatically due to a provision in county law.

The tax at hand is the county’s impact tax, which is applied to new development projects and used to fund the capital budget. There are two impact taxes: one for transportation and one for schools. The council sets impact tax rates by resolution, but according to the county code, they are adjusted in the interim by the county’s finance director. The language for the transportation impact tax states:

The Director of Finance, after advertising and holding a public hearing as required by Section 52-17(c), must adjust the tax rates set in or under this Section on July 1 of each odd-numbered year by the annual average increase or decrease in a published construction cost index specified by regulation for the two most recent calendar years. The Director must calculate the adjustment to the nearest multiple of 5 cents for rates per square foot of gross floor area or one dollar for rates per dwelling unit. The Director must publish the amount of this adjustment not later than May 1 of each odd-numbered year.

The language for the school impact tax states:

The Director of Finance, after advertising and holding a public hearing as required by Section 52-17(c), must adjust the tax rates set in or under this Section effective on July 1 of each odd-numbered year in accordance with the update to the Growth and Infrastructure Policy using the latest student generation rates and school construction cost data. The Director must calculate the adjustment to the nearest multiple of one dollar. The Director must publish the amount of this adjustment not later than May 1 of each odd-numbered year.

While the finance director is empowered to make these adjustments under law, in practice, the planning staff makes calculations for school impact tax adjustments with input from MCPS.

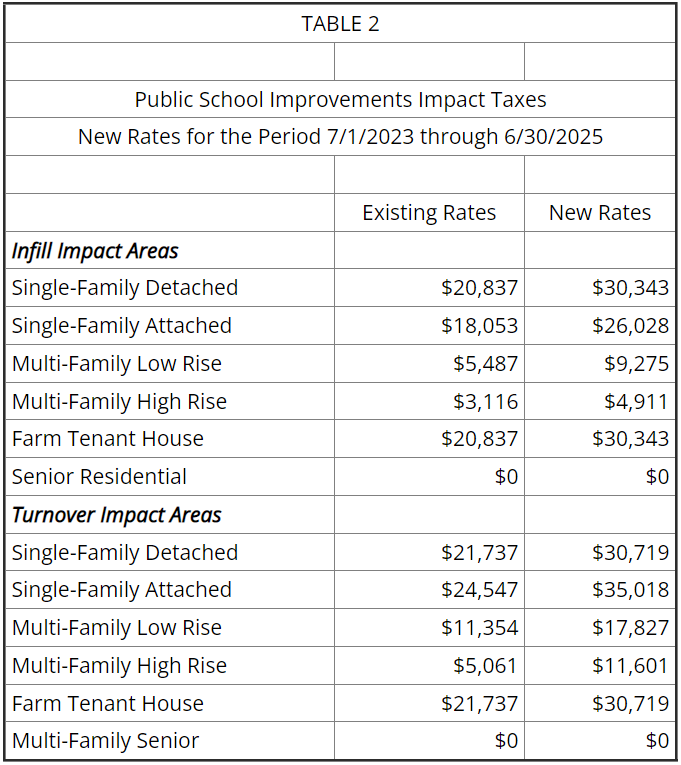

On May 1, the updated rates were published in the county register. Transportation rates are due to increase by 9.47 percent because of construction cost inflation. However, the school rates are set to rise much more, with many rates increasing by 40-70 percent. The table below shows the changes to school impact tax rates.

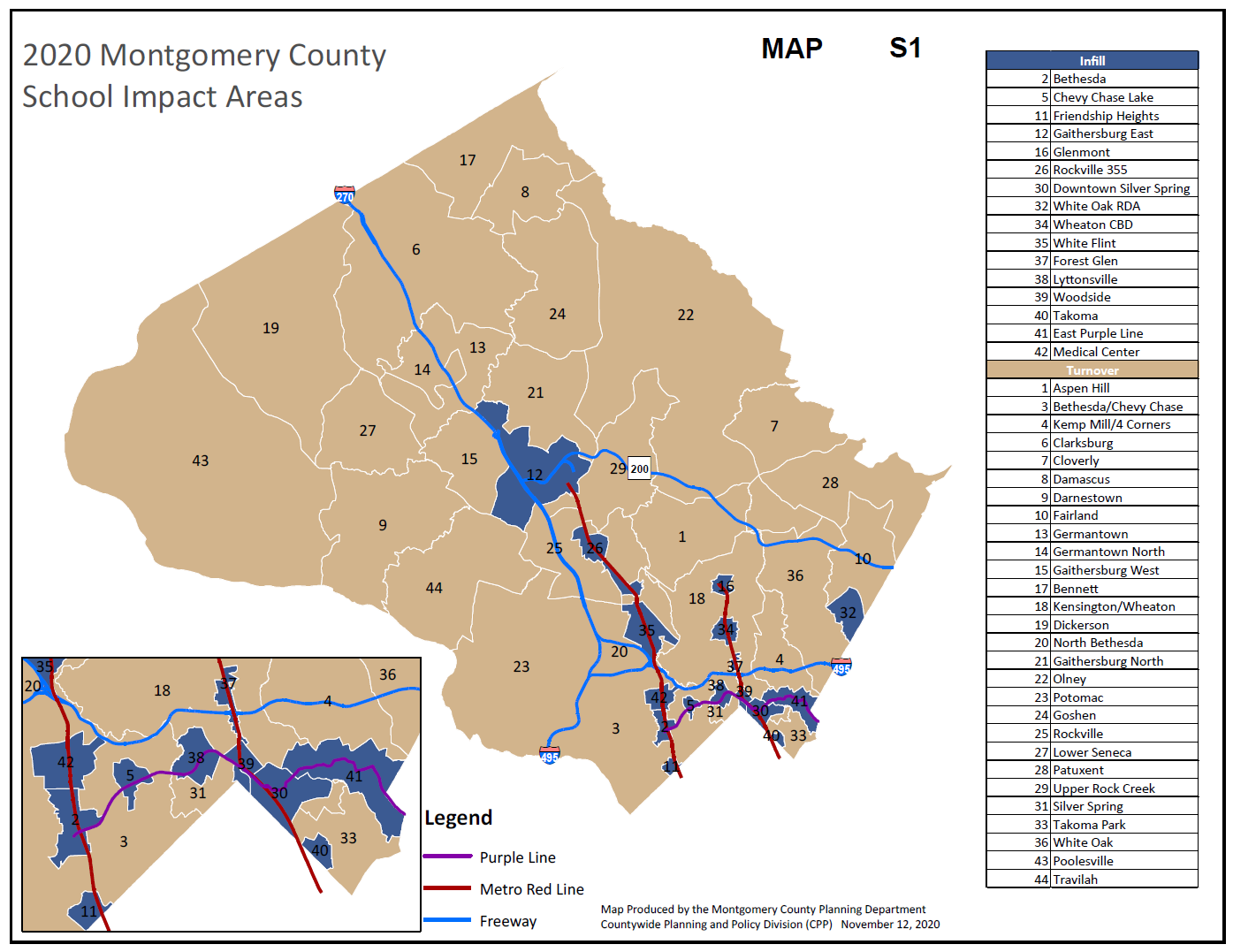

The map below shows the location of the areas referred to by the above rates.

These new rates will add many thousands of dollars in cost to new housing. They may even affect the decisions of some developers to proceed with projects, particularly when they are facing cost increases of their own. And their combination with potential increases in recordation and property taxes could make the county’s housing market even more challenging than it already is.

I asked the planning staff to explain the new rates. Following is a statement by Jason Sartori, the chief of the planning department’s Countywide Planning & Policy Division.

*****

Impact Tax Statement 05.03.2023

Development impact tax rates are updated every two years, taking effect on July 1 of odd-numbered years. School impact tax rates are recalculated by the Planning Department on behalf of the Department of Finance based on the latest school enrollment data (from MCPS), housing inventory data (from SDAT) and school construction costs (from MCPS). Montgomery Planning has no discretion in how the tax rates are calculated.

School impact taxes are calculated for four housing types in two context-based geographies called school impact areas, as described in the Council-adopted Growth and Infrastructure Policy. For the new rates effective July 1, most of the impact taxes will increase between 40% and 70%, but the Turnover Impact Area Multifamily High-Rise rates will increase by 129%, from $5,061 to $11,601 per unit.

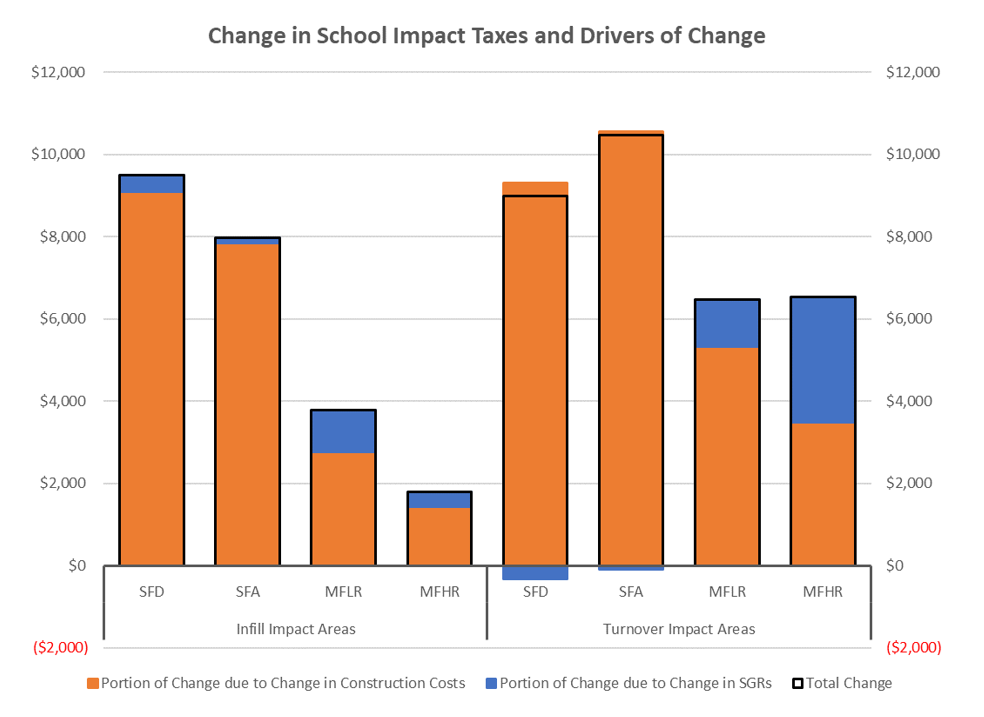

The main driver for these rate increases is the increase in school construction cost per student. Compared to the construction costs provided by MCPS two years ago, the current cost to construct an elementary school is 34% higher; the cost to build a middle school is 44% higher; and the cost to build a high school is 53% higher per MCPS.

Student generation rates (SGRs) capture the average number of public school students living in a housing type and geography combination. Montgomery Planning calculates SGRs for the same eight combinations of housing types and school impact areas using the current school year’s official and complete enrollment and a corresponding housing dataset. (For the purposes of calculating school impact taxes and estimated enrollment impacts of new development, the multifamily SGRs are calculated using only units built since 1990. Units in older multifamily structures yield students at higher rates that are inconsistent with the number of students coming from new multifamily development.) While current school year enrollments are up from the last time SGRs were calculated using pandemic-depressed 2020-21 enrollments, the enrollment increase is not uniformly distributed across housing types. Countywide, single-family detached and single-family attached SGRs fell 1.3% and 0.6%, respectively. Meanwhile, the multifamily SGRs increased 19.1% for units in low-rise structures (four stories or less) and 14.3% for units in high-rise structures (five stories or more).

As a result, the increase in student generation rates played a larger role in increasing multifamily impact taxes. For example, 47% of the increase in the Turnover Impact Area Multifamily High-Rise impact tax was due to increased enrollment from those units. The graph below demonstrates the increase in each of the eight school impact tax rates and the portions of each increase that can be attributed to increased school construction costs (in orange) and the change in student generation rates (in blue).

We think the increase in multifamily student generation rates is indicative of the current housing market. Since 2019, the average sold price has increased by 32% for detached homes, and 18% for attached homes. Families are being priced out of single-family units and are opting instead to live in less expensive multifamily units (or live in them longer). Multifamily structures still see substantially fewer students on a per unit basis than single-family units. However, compared to enrollment data from two years ago when the impact tax rates were last updated, there are currently more students living in multifamily units.