By Adam Pagnucco.

Regular gains in revenues. Surging reserves. Easy money. There may be chaos in MCPS and acrimony between the county executive and the county council (what’s new?), but from a monetary perspective, this county government has been strolling down the Golden Brick Road for a while now. How much longer will it last?

Maybe not long, according to the county’s newest six-year fiscal plan.

First, a brief note. During the Great Recession, when the county almost lost its bond rating, the county established a policy that its reserves should equal 10% of adjusted governmental revenues and began issuing a series of six-year fiscal plans with a path to get there. (Here’s an early version from all the way back in 2010.) These plans list revenues, non-agency uses (like debt service, reserve contributions and cash for the capital budget), money available for agency use and changes in reserve levels in the current fiscal year with projections of up to six years out. These plans are updated in December, March (when the executive’s budget is issued) and June (after the council approves a new budget).

Anyone with experience in economic forecasting understands that it’s challenging, and the estimates get more uncertain the farther out they are. With a six-year time horizon, each revenue estimate could be updated up to 18 times before the money goes into the coffers. As a result, those estimates change – sometimes by a lot.

Tracking individual revenue sources across each fiscal plan reveals how volatile they can be. Property taxes, usually the largest single county revenue source, are a lumbering leviathan. They tend to turn around slowly. The county’s initial estimate of property tax receipts in a given fiscal year is usually within 6% of the final estimate. Income taxes are more volatile, with county estimates being as much as 7-9% off. And forget about transfer and recordation taxes, which are all over the place. The county’s first estimate of FY24 transfer and recordation taxes, made in 2018, was $189 million. The current estimate, made with just a month to go in the fiscal year, is $133 million, a 30% drop. (This is a topic to which I will someday return.)

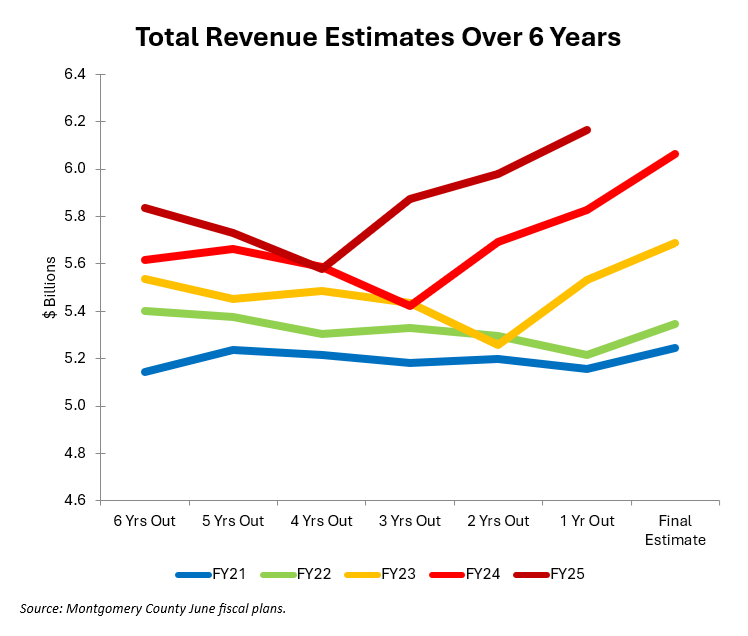

In the past, county projections have sometimes turned out to be too high and sometimes too low. Once in a while, they are close to target. Recently, the county’s revenue estimates have been too low. Consider the chart below, which shows six years of estimates for the last five years of total revenues. Each line represents one fiscal year. The estimate on the far left is six years out. The estimate on the far right is the last estimate in the fiscal plan and is presumably close to the actual.

Let’s look at the dark blue line first. That’s total revenues in FY21. The initial estimate ($5.14 billion) turned out to be 2.0% less than the final estimate ($5.25 billion). That’s decent forecasting. The green line is FY22. The final estimate ($5.35 billion) was 1.0% less than the initial forecast ($5.40 billion). Again, the projection turned out to be pretty close to the truth.

Now look at the other three lines – orange (FY23), red (FY24) and dark red (FY25). Do you see the sharp dips in them? Those declines in projections were made during the COVID years of 2020 and 2021. Back then, the county government believed that the pandemic would slash county revenues. But that never happened – county revenues continued to climb during COVID. The result was that FY24 revenues came in at 7.9% above original projections. And right now, FY25 revenues in the approved budget are 5.6% higher than the original estimate.

This revenue underestimation is still an issue in our budgets. Both the FY24 and FY25 recommended budgets assume a “mild recession.” A recession did not happen in FY24 (which is ending on June 30) and most economists are not forecasting a recession over the next year. I guess it’s better to forecast low than high, but this is impacting our budgets.

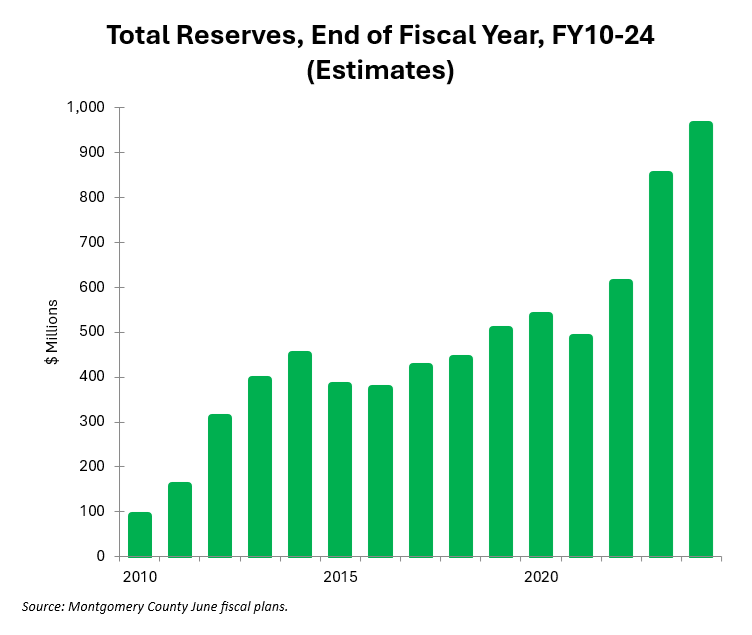

Because county revenues are coming in higher than forecast, the county is now racking up big-time reserves. The chart below shows estimated ending reserves from FY10 through FY24.

Look at that big spike in FY23-24. Ending reserves are estimated to be $960 million at the end of FY24. The county’s reserve target is 10% of revenues, but in FY24, reserves are supposed to be 14.9% of revenues – and 16.1% if all agencies are included. And here is the kicker – that is despite the county spending a net $74 million out of reserves, the biggest withdrawal in nearly a decade. The approved FY25 budget assumes a net $253 million decline in reserves, an astronomical amount that exceeds what the county withdrew during the Great Recession.

County leaders have gotten used to lowball revenue estimates creating big reserves, which they then spend through special and supplemental appropriations. Consider the $20 million the council just authorized for corporate welfare. Or the combined $26 million in supplemental appropriations for snow removal, transportation, general services and correction on tomorrow’s council agenda. (The teachers union wants $10 million more for MCPS but that’s not on the agenda.)

I would have loved to have worked at the council with that kind of money flying around! Instead, I worked there in 2010-14, when my council members were cleaning up after the Great Recession and the budget was tighter than Scrooge’s wallet.

So why might the days of easy money be coming to an end?

First, a general observation from writing about or working on government budgets over the last couple decades: today’s circumstances are not tomorrow’s. Bad budgets don’t last and neither do good ones because of the business cycle.

Second, the county’s forecasters constantly adjust their projections. They have certainly noticed the county’s epic decline in transfer and recordation taxes despite huge rate hikes. Declining sale values of commercial properties will also eventually hit property assessments.

Third, Scrooge could have written the county’s FY26 forecast. The county is now projecting a 2.9% increase in revenues in FY26, a fairly mundane number. But because the forecast no longer assumes goosing revenues with huge reserve withdrawals, it only anticipates a 0.1% increase in money available for county agencies. The last time that county agencies received a collective increase that small was during the darkest days of the Great Recession.

It’s definitely possible that the forecasters are lowballing projections again. But if I were still at the council, that 0.1% increase would have my full attention. If the estimates are correct, the party could be over – and that’s even if there is no recession. From the halls of Park and Planning to the bowels of MCPS, let the sharpening of pencils begin.