By Adam Pagnucco.

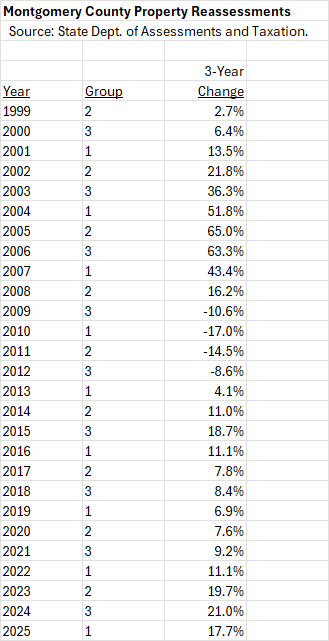

The State Department of Assessments and Taxation (SDAT), which assesses real property values in all Maryland counties, has released its new assessments for 2025. And in the part of Montgomery County that it has reassessed, property assessments have increased by 17.7% since they were last measured three years ago. That’s similar to the statewide increase of 20.1%.

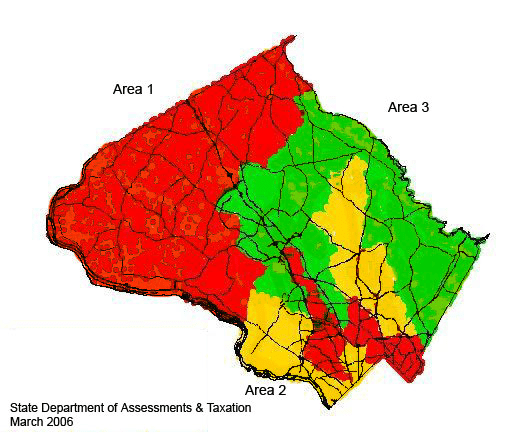

SDAT does not reassess all properties annually. Instead, it divides each county into three geographic groups and reassesses properties in each area every three years. In 2025, SDAT reassessed properties in Group 1, which includes Downtown Silver Spring, Takoma Park, Kensington, parts of Bethesda and Rockville and much of Upcounty. See the map below.

The new data is not yet published on SDAT’s website. But Frederick News-Post reporter Cameron Adams, who previously reported on reassessments in Frederick County, graciously forwarded it to me. The documents can be downloaded at the end of this column.

The table below compares Montgomery County’s 2025 reassessment to all others since 1999 using SDAT’s archive. Note that each of the three property groups is reassessed in different years as stated above.

Over the last four years, reassessments have gone up faster than at any time since before the Great Recession. That said, they come nowhere close to the pre-recession boom of the aughts.

Montgomery County and most of its municipalities cap increases in principal residence tax bills at 10% each year, so homeowners won’t get hit with the entire tax bill increase immediately. However, unless assessments fall, homeowners will eventually be responsible for big tax bills as taxable assessments accumulate annually.

Even with the 10% cap for homeowners, these increases will be a windfall for Montgomery County government because of how its charter limit on property taxes works. Under the charter limit established in 1990, a super-majority of the county council was required to approve changes in tax rates that would result in the volume of property tax collections increasing faster than the rate of inflation. (That limit had exemptions, such as new construction.) The number of council members required to go over the limit was originally 7 of 9, but the requirement was changed to 9 in 2008 and a unanimous vote of current members in 2018.

In 2020, voters approved a different charter limit on property taxes which required a unanimous vote of all current council members to change the tax rate. The volume of collections was no longer tied to inflation, allowing it to increase faster. As I explained in a column that year, the new limit should allow higher tax collections over time. That’s why a coalition of progressive groups supported it.

With soaring assessments, a huge MCPS budget request and a tax-friendly county executive, 2025 may not be gentle on the wallets of MoCo property owners.

The state’s press release and data by county appear below.