By Adam Pagnucco.

Recently, I broke two stories on potential charter amendment drives. First, long-time charter amendment advocate Robin Ficker told me that he is gathering signatures for a charter amendment that would “limit property tax increases to the rate of inflation. Not a cut, just a modest increase.” Second, Reardon “Sully” Sullivan, who passed a term limits charter amendment last year, formed a ballot issue committee for a charter amendment that would limit county government spending increases.

Now, Ficker has told me that he is teaming up with Sully to gather signatures for the charter amendment on spending. Ficker sent me the following email:

*****

Adam, this is the one charter amendment Sully AND I are supporting and will collect sufficient signatures for.

With increased assessments, a county executive who is the only person in US history who has been term limited twice for property tax increases and a governor who knows how to grow Maryland’s gross domestic product ONLY by raising taxes and giving away NFL teams, it is important to have a push somewhere from the voters to make Montgomery County affordable. That is why our limit spending ? will pass. Robin. Sully and I wrote this question together with the National Legal Research Group. When my property tax limit ? Passed in 2008, Peter Sep, now President of the National Taxpayers Union said at the Union’s national Conference, which I attended, “your victory is a national record to pass a taxpayer protection measure at the local level against such difficult odds”

*****

When I asked Ficker whether he was also working on a separate charter amendment, he replied, “My prior statement was an interpretation (or possible misinterpretation) of the amendment I just sent you. There is only ONE ?. We have our official rollout in the middle of April’s nice weather. The amendment I just sent you, written by Sully and I is the ONLY amendment. I’m collecting signatures for only the amendment I just sent you. Robin”

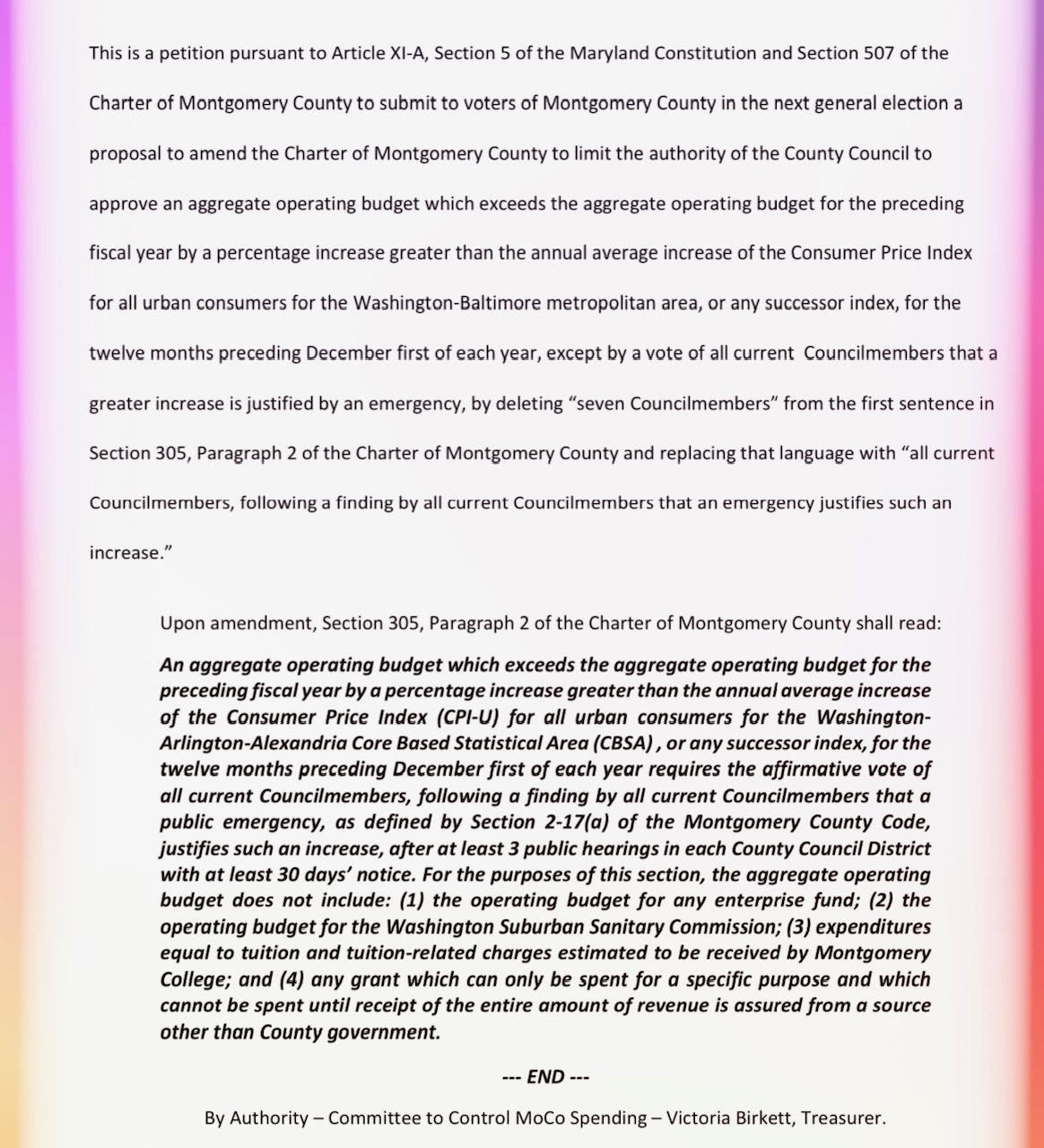

Ficker also sent this graphic showing the text of the charter amendment he is working on with Sully.

And so this amendment would limit aggregate operating budget increases to the rate of inflation. A unanimous vote by council members could exceed this limit if they determine that the county faces “a public emergency.”

What constitutes a public emergency? The language refers to Sec. 2-17A of the county code, which states, “The County adopts the Maryland Emergency Management Assistance Compact codified in § 14- 803 of the Public Safety Article of the Maryland Code.” That provision of state law does not define an emergency but discusses “emergency management mutual assistance between the jurisdictions entering into this Compact.” Covered services include “fire services, law enforcement, emergency medical services, transportation, communications, public works and engineering, building inspection, planning and information assistance, mass care, resource support, health and medical services, and search and rescue.” Sec. 501 of the county’s charter defines an emergency as caused by “a disaster or enemy attack.”

How does this amendment interface with the tax loophole in state law for education spending? That’s a question for lawyers, but let’s note that the relevant state law language refers to county charter limits on property taxes, not entire county aggregate operating budgets.

In any event, with the county executive recommending a property tax increase and a gigantic fee hike along with the General Assembly’s imminent passage of a tax hike package, the issues of taxes and spending are now on the table. Ficker and Sully are both experienced signature gatherers who have had success in passing charter amendments. We shall see how their newest effort proceeds.